With the next Bitcoin halving expected to happen under a month (May 12, 2020), a significant number of users believe that this will create a bullish run for BTC as halving decreases its inflation. In this article, we’ll use historical data to explore how to trade halvings from an events arbitrage perspective.

Looking at historical data

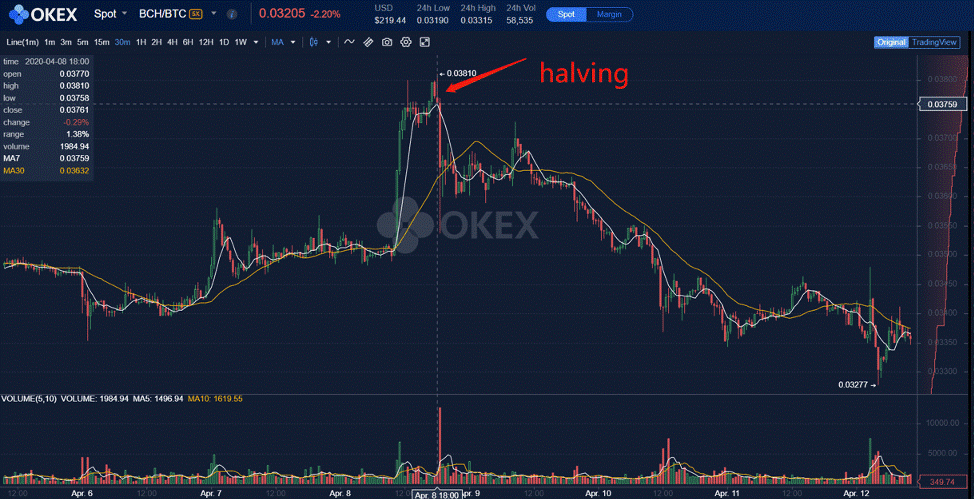

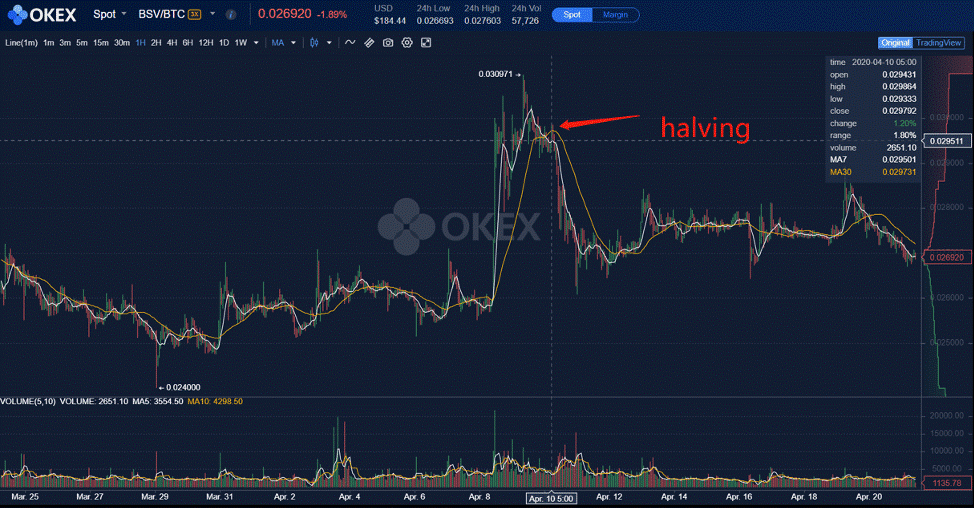

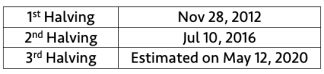

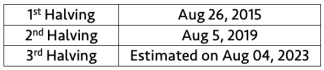

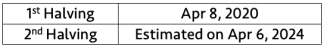

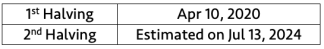

In April 2020, we experienced halvings for both Bitcoin Cash (BCH) and Bitcoin SV (BSV) on Apr 8 and Apr 10 respectively. Let’s look at their price graphs against BTC only so as to remove the noise created by market movements:

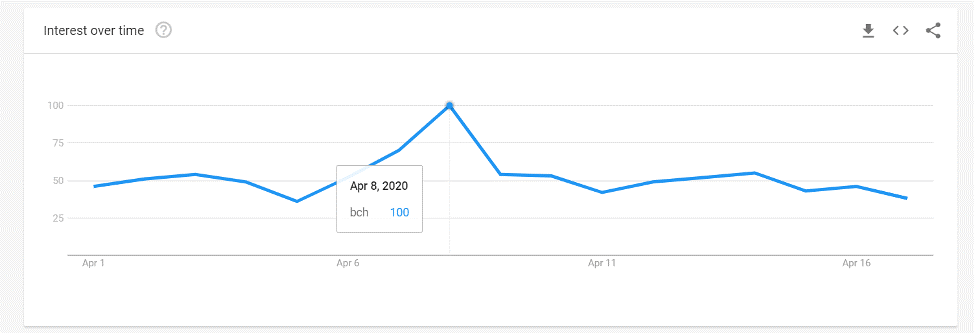

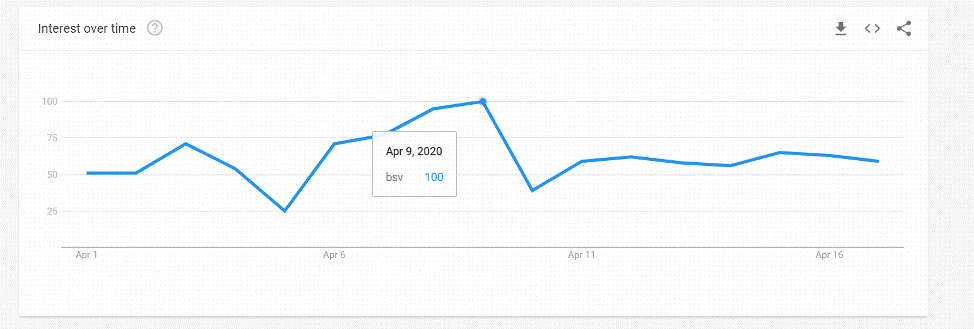

We can observe that the price peaks on the halving date. As a quantitative trader, I believe the price of assets in the short-term is driven by supply and demand. The fundamental aspect of decreased inflation that causes price increase can be ignored in the short-term. We can imagine that the price is at the highest point when the market is sentiment is high due to all the news surrounding the halving. Take a look at the Google Trend screenshots below. It shows that the search for BCH and BSV peaked right at the time of halving, meaning demand is at its highest. Therefore, in theory, we can buy the rumor and sell the news.

Backtesting the Long Short Strategy

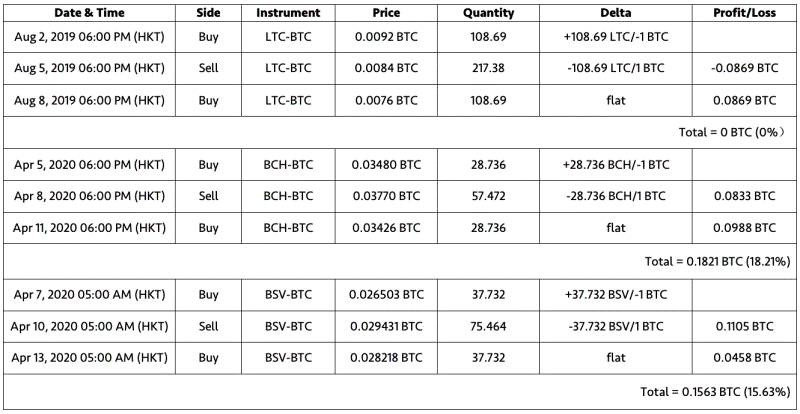

We can see that the Google Trend usually begins to rise about 3 days before halving, peaks on the halving date, and then goes down after halving. Using the past halving data of LTC (halved on Aug 5, 2019), BCH and BSV, we can propose a simple trade to long before halving, short on the halving date, and unwind the final position 3 days after halving.

We can perform 3 trades against the BTC quote pair to remove noise from the market: Buy ~1 BTC of the halving coin 3 days prior to halving, short ~1 BTC on the halving date, then unwind 3 days after halving to net a total of 33.84% return, with an average 11.28% return on each trade.

Example:

The total return will be around 0.3384 BTC (33.84%), with an average return of 11.28%.

How to trade the upcoming BTC halving

This simple back test shows that there is alpha when you “buy rumor, sell news” for small-cap coins. However, applying this to trade BTC is different and there is no easy way to hedge the market. In the examples above, we are essentially delta flat as we are constantly buying or selling BTC against the halving coin. But for a similar BTC trade, we need to either take delta by trading it against USD or USDT with OKEx Margin Lending or USDT swap; or alternatively hedge it with ETH. It will be up to traders themselves to determine which is the best cause of action.

Conclusion

Today we looked at an event arbitrage trading strategy to long a halving coin before halving and then short it right after halving. To summarize, the theory behind is that due to the heated discussion and news on halving, the demand for that coin will increase prior to the event; but as the news die down after it halves, the buying pressure is gone and the coin price would drop. We’ve backtested the strategy on 3 coins against BTC to remain delta neutral. It is now up to traders to decide whether we apply this trading logic to the upcoming BTC halving in May.

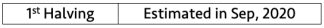

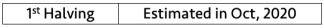

Halving dates for different coins:

This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involves significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

Editors’ Picks

EUR/USD weakens to near 1.1900 as traders eye US data

The EUR/USD pair loses ground to around 1.1905, snapping the two-day winning streak during the early European trading hours on Tuesday. Markets might turn cautious ahead of the release of key US economic data, including US employment and inflation reports that were pushed back slightly due to the recently ended four-day government shutdown.

GBP/USD edges lower below 1.3700 on UK political risks, BoE rate cut bets

The GBP/USD pair trades on a weaker note around 1.3685 during the European session on Tuesday. The Pound Sterling edges lower against the US Dollar amid political risk in the United Kingdom and rising expectations of near-term Bank of England rate cuts.

Gold drifts lower as positive risk tone tempers safe-haven demand; downside seems limited

Gold drifts lower during the Asian session on Tuesday and snaps a two-day winning streak, though it lacks strong follow-through selling and shows some resilience below the $5,000 psychological mark amid mixed cues. The outcome of Japan's snap election on Sunday removes political uncertainty, which, along with signs of easing tensions in the Middle East, remains supportive of the upbeat market mood.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Follow the money, what USD/JPY in Tokyo is really telling you

Over the past two Tokyo sessions, this has not been a rate story. Not even close. Interest rate differentials have been spectators, not drivers. What has moved USD/JPY in local hours has been flow and flow alone.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.