Every trader faces tilt—even the most seasoned ones.

It's a common reality.

I'll clarify in a minute. But before diving in:

Ever felt that sensation? Like when you drive without buckling up? After years of habitually wearing your seatbelt driving without it feels odd.

You notice the absence of the belt even when it slips your mind to fasten it. Right?

So even if you drive without fastening your belt, it's only a short time before you buckle up because it's too unfamiliar and uncomfortable not to. True? Keep that in mind.

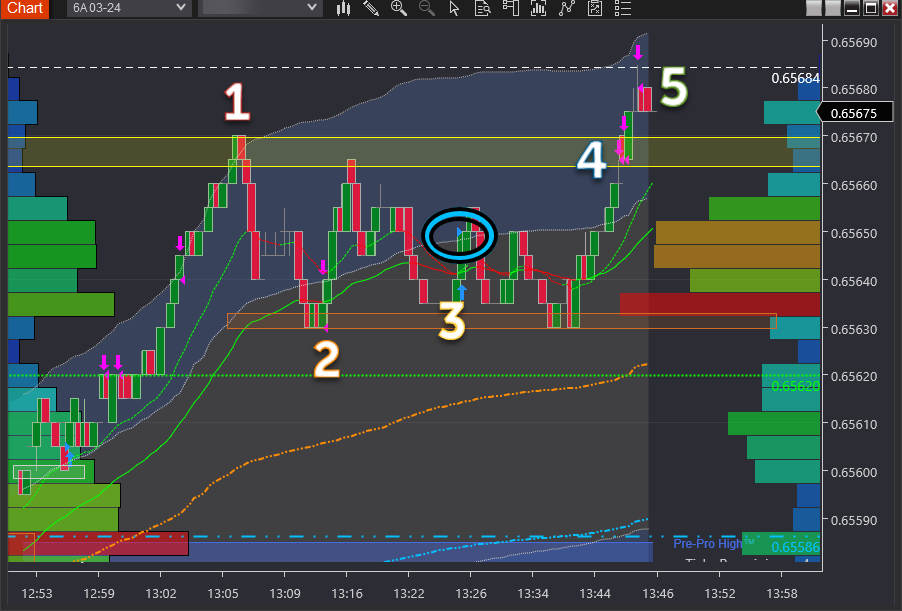

See anything wrong with the trade where I entered long (bought) at number 3 and sold at numbers 4 & 5?

(Blue arrows are buys pink arrows are profit takes.)

Actually, the blue circle marks where I experienced tilt. Let me show you how.

In the preceding long trade—involving numerous buys and sells (you can't see the buys in this chart)—the final profit was taken at number 2.

It happened after the market approached my resting sell order—positioned where you see number 1.

But the price failed to reach my sell order by one tick—not due to bad luck—but because I was too slow to adjust the order according to the latest details I monitored.

Experiencing frustration and annoyance

My frustration stemmed not from 'missing out' but realising that I 'dropped the ball' mid-game.

I acted out of an emotional response known in trading as tilt prompting me to buy at number 3. Although not obviously apparent, this entry deviates from a few of the protective layers in my trading process.

However, it's not a catastrophic blowout, Is it?

You'll see those protective layers in a minute. But first— returning to a driving analogy:

Imagine your tyres are airtight. Even if you encounter a puncture, the slow leak allows you to reach your destination safely. Correct?

Likewise, top traders rely on an airtight trading process with many protective layers. Even if you skip a few the ramifications are a slow leak. Not a catastrophic blowout, resulting in devastating losses and a blow to your self-confidence.

How so?

When your process becomes ingrained—straying from it feels uncomfortable—much like driving without your seatbelt.

It doesn't take long before you buckle up and revert to your process. It's as if you're incomplete until you do. Make sense?

For instance:

Driving through a parking lot at 10 km/h without wearing a seatbelt presents some risk—it pales in comparison to the danger of driving on the freeway at 80-100 km/h without buckling up. See the analogy?

But how does it become so deeply ingrained?

Imagine spending the better part of a year receiving daily support to adhere to an airtight trading process.

It's your experience whether trading at a professional firm, as I can attest to, or working with someone who supports and guides you in the same manner.

Neither willpower nor self-discipline.

When you consistently follow a trading process for hundreds of trading days—any deviation suddenly feels uncomfortable.

You feel compelled to return to it even if you momentarily stray. While you may skip a few layers of your process—the bulk of it remains intact—protecting you. Make sense?

Side note

When you start trading it's common to fixate on making profits. Yet—once you've experienced real trading—you understand preserving your self-confidence and account stability is the true challenge. Agree?

Here is where an airtight trading process truly shines—it safeguards against these pitfalls—fostering a truly transformative experience.

There's a great sense of pride in witnessing client transformations as they develop deep confidence in navigating the market, armed with a protective process that shields them from potential harm.

Examining the protective layers

Can you see the short trade and accompanying profit-taking in the chart below?

During the trading above, professional traders rely on a process that includes game-planning, playbook trades, and multiple points of evidence to protect themselves from common pitfalls like tilt.

These practices aren't exclusive to special individuals; rather, they result from receiving the right guidance and support to develop essential skills and knowledge.

To better understand their application, you can watch a live recording of the trade sequence above in real life.

Watch the video footage below to discover exclusive insights into an airtight trading process.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

Gold extends rally to new record-high above $4,420

Gold extends its rally in the American session on Monday and trades at a new all-time-high above $4,420, gaining nearly 2% on a daily basis. The potential for a re-escalation of the tensions in the Middle East on news of Israel planning to attack Iran allows Gold to capitalize on safe-haven flows.

EUR/USD gathers recovery momentum, trades near 1.1750

Following the correction seen in the second half of the previous week, EUR/USD gathers bullish momentum and trades in positive territory near 1.1750. The US Dollar (USD) struggles to attract buyers and supports the pair as investors await Tuesday's GDP data ahead of the Christmas holiday.

GBP/USD rises toward 1.3450 on renewed USD weakness

GBP/USD turns north on Monday and avances to the 1.3450 region. The US Dollar (USD) stays on the back foot to begin the new week as investors adjust their positions before tomorrow's third-quarter growth data, helping the pair stretch higher.

Top 10 crypto predictions for 2026: Institutional demand and big banks could lift Bitcoin

Bitcoin could hit record highs in 2026, according to Grayscale and top crypto asset managers. Institutional demand and digital-asset treasury companies set to catalyze gains in Bitcoin.

Ten questions that matter going into 2026

2026 may be less about a neat “base case” and more about a regime shift—the market can reprice what matters most (growth, inflation, fiscal, geopolitics, concentration). The biggest trap is false comfort: the same trades can look defensive… right up until they become crowded.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.