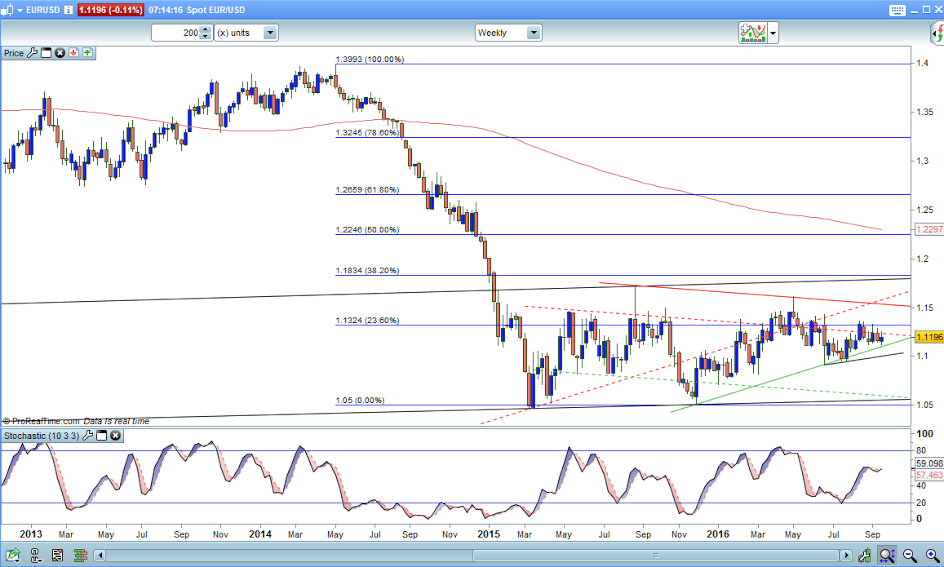

SUPPORT: 1.1180 1.1145 1.1110/00 1.1070/60 1.1038....1.0998

RESISTANCE: 1.1208 1.1248/50 1.1284 1.1320/25 1.1367/70 1.1422/25*

I have showing you a weekly chart of the Eur/Usd because I think we are at quite a critical time in its life...Now for all of 2014 the Euro was trending....we stopped in 2015....Take a close look at this weekly chart...we looked like we was making a continuation pattern....Now after reaching 10470 we rallied to 1.17...came down again in Nov 2015 to 10525....At that point the continuation pattern looked as though we were taking out the lows of 10470 and on our way to parity...However....it didn't...it stopped and rallied...Now in the world of charts and TA a base pattern will always take longer to form than a continuation pattern.....So....where am I leading....I am leading onto the fact that although we did not reach the 10470 area we did in fact make a Double Base....and for 2016 we have moved in a sideways to slightly higher way....I believe this confirms the base pattern which has taken nearly 2 years to form....I believe that this little market is about due to break to the topside....Why I hear you fundamentalists ask...Europe is in the doldrums....Europe will not hike rates....etc etc etc....As a pure technical trader these things do not concern me.....I believe short term weakness in the Euro gives opportunities to buy it....I believe....that this base pattern is coming to its conclusion and that the next big move we see will be to the topside....Now we have quite a bit of work to do before we can say...hey we have broken.....However....at the point where the Euro was being slaughtered by the markets, there was no reason on this planet why it would stop just short of 10470...No reason whatsoever.....So we did stop....why.....Because there were people out there with far greater fundamental knowledge than myself ( who has none ) but also technically...which is what I spied....Now even if we trade to the top of the pattern which is at 1.1785, that is still a long way off from where we are now....so you can see the potential for a greater move higher...The interesting part comes if we break this pattern....Patterns that take 2 years to form are a force to be reckoned with....So even if you are a scalper in Euros...Please be aware that the mood is changing...and has been for 2 years.....we break 1.1850 we clear this pattern and are on our way to 1.2250.....Now intra day this is not going to help you...Options I hear you ask...Yes...if your broker is good enough you can buy calls....timescale....well..I usually say that the length of time it takes to make the base pattern you halve it for the first target to be reached....Now the measured target off this base is 1.3000......I can hear the screams now resounding as you read this....In my 34 years of doing this and being an active trader nothing surprises me anymore about the markets....be they FX...Bonds....Precious metals or Stock indecies.....So why cant we go to 1.3000......I love being told a fundamental reason why we cant and yet 9 to 12 months later we are sitting there quite happily with markets at their long term projected targets and yet the world has not ended.....It is food for thought....and I strongly believe that now we are at the cusp from now until year end where the Euro will gradually gain in strength....and in 2016 you should see a break and the market trade higher....Day traders reading this.....we are buying down to 1.1100....and we are holding.....and only below 1.09 would I hold my hands up and say hey..I was wrong....so please , be aware that the market is changing.....we buy weakness.....we look at what our historical charts tell us....and we listen.....our first weekly target is 1.1540.....take care with shorts except in the short term.

The research provided by Charmer Charts is provided solely to enable clients to make their own investment decisions and does not constitute personal investment recommendations. No recommendations are made directly or indirectly by Technicalanalysisreports.com or Charmer Charts as to the merits or suitability of any investment decision or transaction that may result directly or indirectly from having viewed the technical analysis investment research. Customers are therefore urged to seek independent financial advice if they are in any doubt. The value of investments and the income derived from them can go down as well as up, and you may not get back the full amount you originally invested. Derivatives and foreign exchange trading are particularly high-risk, high-reward investment instruments and an investor may lose some or all of his or her original investment. Also, if you decide to acquire any investment denominated in a different currency you should note that changes in foreign exchange rates may have an adverse effect on the value, price and income of the investment in your own currency. Technicalanalysisreports.com or Charmer Charts shall not be liable for any direct or indirect, incidental or consequential loss or damage (including loss of profits, revenue or goodwill) arising from the use, inability to use, interruption or non-availability of the technical analysis investment research or any part of the research materials published or otherwise any loss of data on transmission, howsoever caused. Whilst the research material published is believed to be reliable and accurate, it is not independently verified. Accordingly, no representation or warranty is made or given by Technicalanalysisreports.com or Charmer Charts, its officers, agents or employees as to the accuracy or completeness of the same and no such person shall have liability for any inaccuracy in, or omission from, such materials.

Editors’ Picks

EUR/USD makes a U-turn, focus on 1.1900

EUR/USD’s recovery picks up further pace, prompting the pair to retarget the key 1.1900 barrier amid further loss of momentum in the US Dollar on Wednesday. Moving forward, investors are expected to remain focused on upcoming labour market figures and the always relevant US CPI prints on Thursday and Friday, respectively.

GBP/USD sticks to the bullish tone near 1.3660

GBP/USD maintains its solid performance on Wednesday, hovering around the 1.3660 zone as the Greenback surrenders its post-NFP bounce. Cable, in the meantime, should now shift its attention to key UK data due on Thursday, including preliminary GDP gauges.

Gold holds on to higher ground ahead of the next catalyst

Gold keeps the bid tone well in place on Wednesday, retargeting the $5,100 zone per troy ounce on the back of modest losses in the US Dollar and despite firm US Treasury yields across the curve. Moving forward, the yellow metal’s next test will come from the release of US CPI figures on Friday.

Ripple Price Forecast: XRP sell-side pressure intensifies despite surge in addresses transacting on-chain

Ripple (XRP) is edging lower around $1.36 at the time of writing on Wednesday, weighed down by low retail interest and macroeconomic uncertainty, which is accelerating risk-off sentiment.

US jobs data surprises to the upside, boosts stocks but pushes back Fed rate cut expectations

This was an unusual payrolls report for two reasons. Firstly, because it was released on Wednesday, and secondly, because it included the 2025 revisions alongside the January NFP figure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.