Ella, a soon to be senior in high school was on a cruise with her family over the summer break. She was a smart and curious girl who loved to travel and cruise with her family each summer. During this vacation, given her age and with college around the corner, Ella was really thinking about life, her future and creating the life she wanted to live. She wanted a family of her own but also wanted a career that would allow her to really live life on her terms. Doing what she wanted when she wanted to do it was very important to her.

One night on the ship as they were in the middle of the Pacific, Ella couldn’t sleep as she was deep in thought, excited for her future and wanting to capture all this in her journal. Not wanting to wake her family, she took her laptop and headed out onto the deck of the ship to find a quiet place under the stars to sit and journal her future…

The waters were rough that night, but that didn’t stop Ella. She found a seat on the deck near the back of the ship next to some life boats. Just as she was about to sit, a huge wave smashed into the ship, knocking Ella off her feet. Without thinking, she reached out and grabbed onto a life boat and just like that, her, the life boat and laptop fell into the sea. With the fall, she hit her head on the life boat and was knocked unconscious. Two days later, her boat hit something and woke her up with a sore head and quite a bit of confusion. Ella had floated to a deserted and somewhat unusual island.

It was just her, her laptop and more mangos and bananas than she could ever eat. Strangely, she wasn’t afraid… The incident almost felt like it was meant to be. She figured she would be rescued at some point in the coming days so she decided to be as productive as she could be. Once again, she began thinking about her future, to design it exactly as she wanted it with freedom of choice and time. She turned on her computer and to her surprise, nothing looked the same. All that was on the computer was a trading/investing platform with charts and live data. For some mysterious reason, her market data was live but she had no access to the internet or media noise that leads many traders off track. Also, she had no idea what trading or investing was or how markets work other than the basic market talk in high school.

With nothing but time on her hands, no trading or investing experience and no access to the outside world, she decided to try and figure out what everything on her screen was and meant, and how she could make some money.

With no resources available, she asked herself some very simple questions and figured out the answers:

- How do you make money buying and selling in markets?

Buy low and sell high or vise versa

- Where is “low” and where is high?

At market turning points. Low is where price stops falling and turns higher. High is where price stops rallying and turns lower.

- How do I find market turning points?

Price always turns at price levels where supply and demand are out of balance. So, I need to find those areas on the price chart. I need to buy at price levels where demand exceeds supply and sell at price levels where supply exceeds demand, that’s all.

Ella looked at her charts for a while to see why price was turning where it did and what that picture looked like…

- What does supply and demand look like on a price chart?

When price spends little time at a level and rallies in strong fashion, demand exceeds supply. When price spends little time at a level and declines in strong fashion, supply exceeds demand. She started to mark all these areas off on the chart and saw that the same thing happened every time.

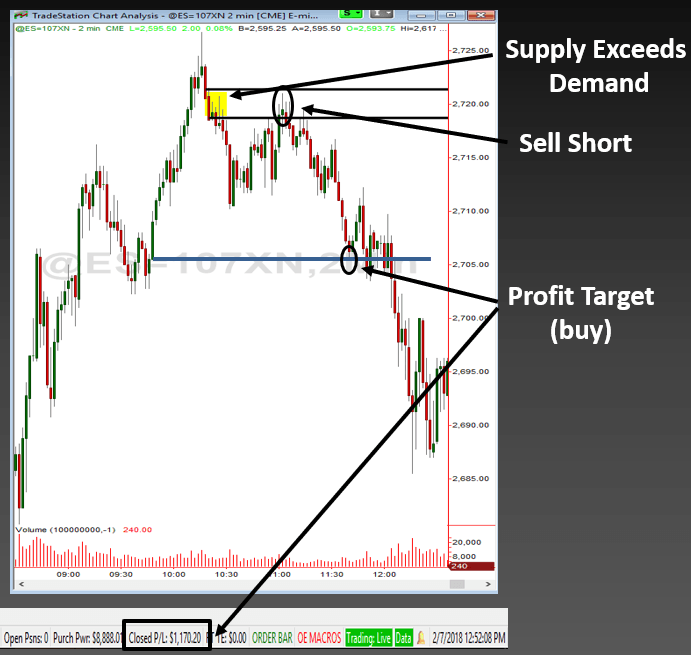

S&P Trade – 2/7/18

After thinking and some self-reflective Q&A, she found a supply level in the S&P and sold short. She profited when price fell and made about $1,100.00 in about 30 minutes. She didn’t know anything about technical or fundamental analysis. She had no idea how to value a stock or company. The lack of any information period forced her to think in simple terms, which led to simple questions with simple answers. Did she really need anything else?

The older we get and the more access to information we have, the more we tend to over complicate everything. Like anything in life, proper trading and investing isn’t just about mastering the basics, it’s about mastering the right basics. Had Ella had the resources like the internet, books, teachers and so on, she likely would never have arrived at the simplicity of markets and how you profit from them. In turn, she, like most people, would never get to live the life she chose to live. Instead, like so many who don’t make the right financial decisions and have a faulty money belief system, key life choices are unfortunately made for them.

As for Ella and how life is now going for her, stay tuned. I plan on speaking with her next week and will let you know. I have a feeling she has an amazing life story to tell with her new skill set.

Live the life you choose.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD remains cautious near 1.1760 ahead of US data

EUR/USD trades marginally on the defensive at the end of the week, hovering around the 1.1770-1.1760 band against the backdrop of an equally humble advance in the US Dollar. Meanwhile, investors gear up for the release of key US data later in the day, including PCE and GDP figures.

GBP/USD looks slightly bid near 1.3480, focus on US docket

The British Pound gathers some fresh steam on Friday, prompting GBP/USD to reverse four consecutive days of losses and revisit the 1.3480 zone. Cable’s decent bounce comes on the back of modest gains in the Greenback prior to the release of significant US data.

Gold extends the recovery past $5,000/oz, looks at US data

Gold prices advance for the third straight day on Friday, reaching new multi-day highs just north of the key $5,000 mark per troy ounce. The continuation of the precious metal’s uptick follows steady geopolitical effervescence in the Middle East, while traders eagerly await key US data releases.

US GDP growth expected to slow down significantly in Q4 after stellar Q3

The United States Bureau of Economic Analysis will publish the first preliminary estimate of the fourth-quarter Gross Domestic Product at 13:30 GMT. Analysts forecast the US economy to have expanded at a 3% annualized rate, slowing down from the 4.4% growth posted in the previous quarter.

Week ahead – Markets brace for heightened volatility as event risk dominates

Dollar strength dominates markets as risk appetite remains subdued. A Supreme Court ruling, geopolitics and Fed developments are in focus. Pivotal Nvidia earnings on Wednesday as investors question tech sector weakness.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.