An Option Profit/Loss Graph is the primary tool for option traders to calculate the potential profit or loss on an option position. We need to do this to decide whether the potential profit on an option trade is worth the risk.

Using the profit/loss graph is easy when you understand it, so here, I’ll show how to build one from scratch if there wasn’t a computer to do it for us. I’ll demonstrate how it was done in the covered wagon days, on a sheet of graph paper. This will make it easy to grasp how it works. (Note to millennials: paper is a substance with two flat surfaces and four straight edges, on which people used to make symbols with writing instruments called pencils, before the invention of screens).

Calculating Profit/Loss on Options

Let’s say, for the sake of example, that SPY closed today at $332 per share and I believe that it will go up further in the next few weeks (not a recommendation, just a for-instance).

I see that there are call options at the $330 strike price that expire in fourteen days. One of these call options gives me the right to buy SPY at $330 at any time within the two weeks. The options can be purchased for $3.00 per share today.

If I buy the calls today for $3.00, how much money can I make if SPY goes up by, say, $4.00 per share? Or any other amount?

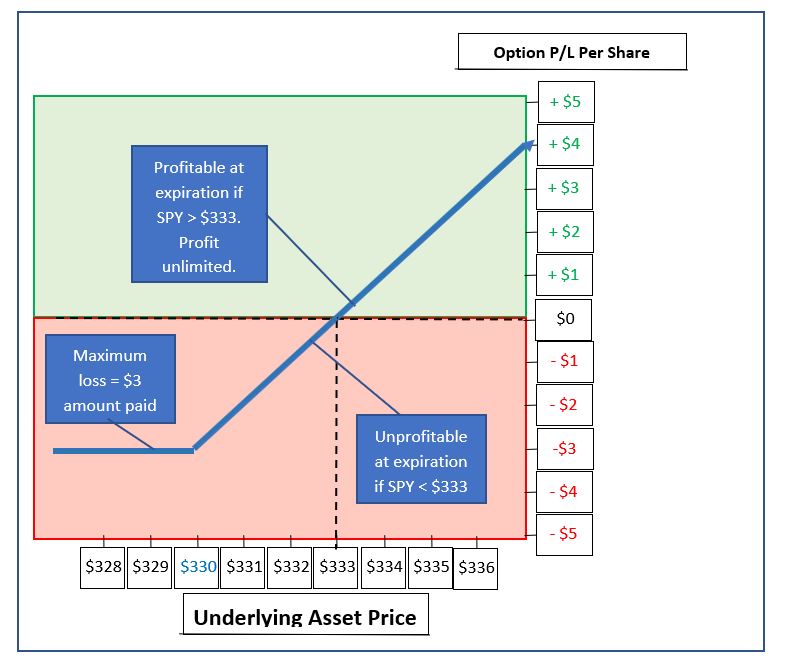

Here’s an example with images of how to manually create an option profit/loss graph to calculate whether or not an option trade has viable profit potential:

Creating the Option Profit/Loss Graph (the old-fashioned way):

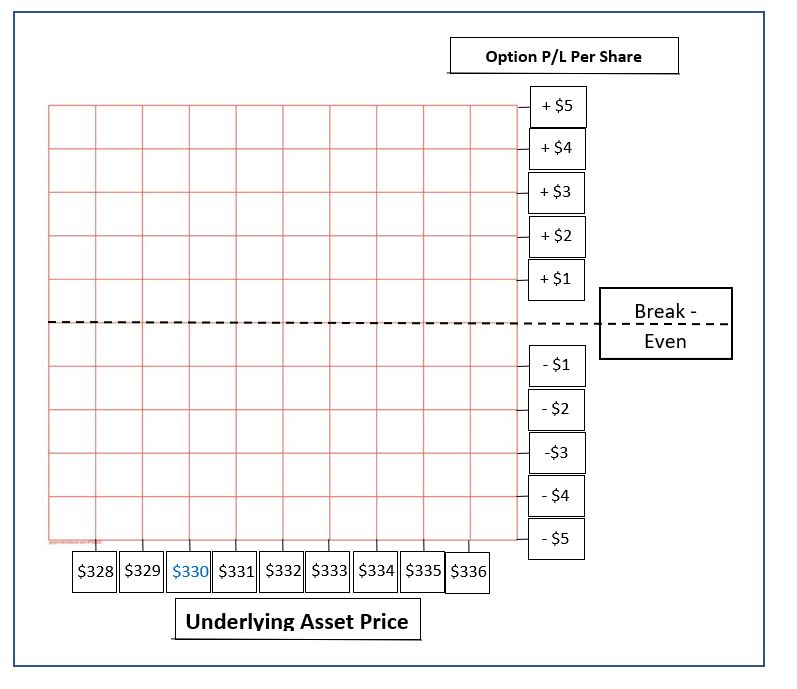

1. Laying Out the Option Profit/Loss Graph

-

Take out a sheet of graph paper

-

Label the horizontal axis Underlying Asset Price.

-

Label the vertical axis Option Profit/Loss per Share

-

Draw a horizontal line across the middle of the sheet, label it Break-Even

-

Across the bottom of the page, label grid squares with numbers representing the SPY per-share price, with the $332 current price in the center, looking left to right.

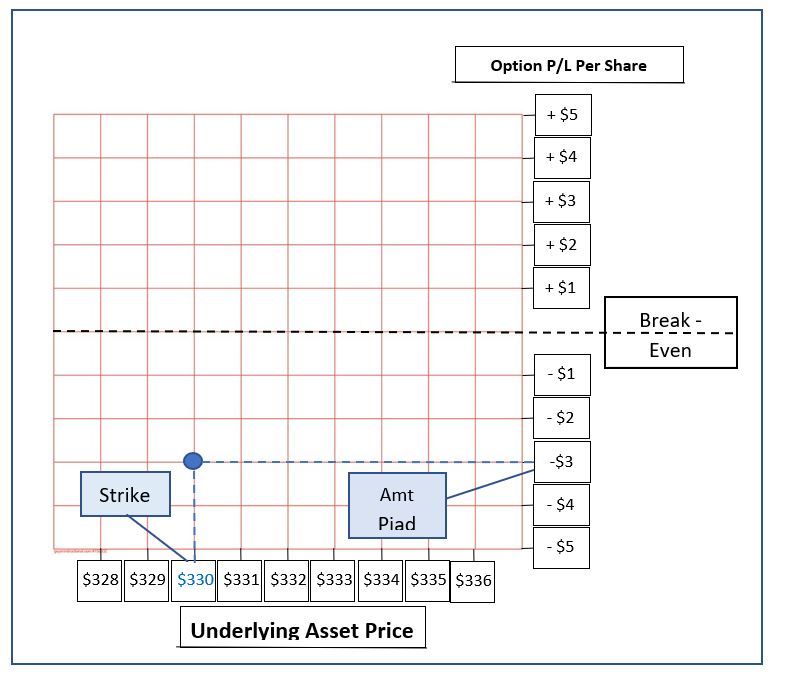

2. Plotting the Proposed Option Trade Entry

On the graph, place a dot where the strike price ($330) and the amount paid for the option (-$3.00) intersect.

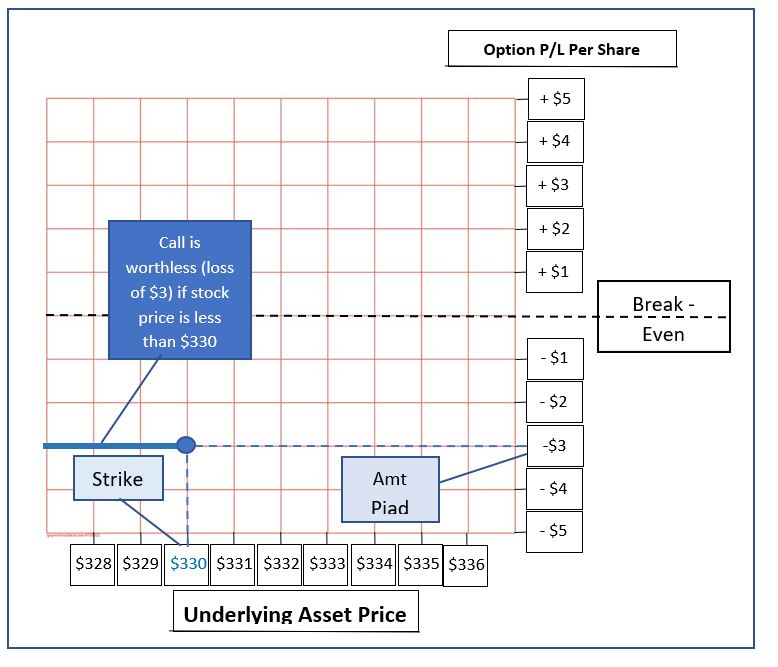

3. Determining Loss if Price Is Below Strike Price at Expiration

Since this option trade example is a call, we will extend a line horizontally from the dot to the left edge of the chart. This shows that, upon expiration the loss would be equal to the amount paid for the option ($3), if at expiration the price was less than the $330 strike price by any amount ($0 – $330).If this trade were a put, the line would extend to the right edge of the chart to show that, upon expiration the loss would be equal to the amount paid for the option, if at expiration the price was more than the strike price by any amount.

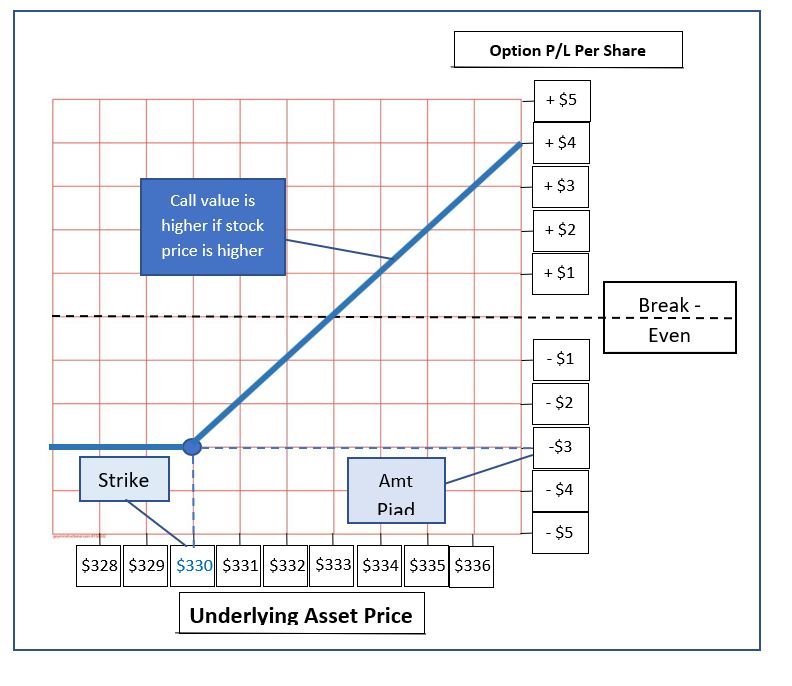

4. Determining Potential Profit/Loss at Expiration

For this call example, we will draw a line from the dot diagonally upward to the right. This line should run straight through the intersections in the grid lines, as shown. This shows that if the stock price is higher than the call strike at expiration, the call’s value will be equal to the amount by which the stock price exceeds the strike.If we had used a put, this line would be drawn diagonally upward to the left in the same fashion to determine the potential profit/loss.

5. Reading the Option Profit/Loss Graph

The finished graph above shows the following:

-

The maximum loss on any option purchase is the amount paid, and this maximum loss occurs on an option held until expiration if the stock price then is such that the option is worthless. This is conveyed by the horizontal line at -$3 P/L stretching from stock prices of $330 across to zero (although prices below $328 are not shown on the graph in this example).

-

This is a bullish trade – one that rewards an upward move in the stock price. This is conveyed by the upward slope of the diagonal line. Higher stock prices (farther to the right) equal higher profit potential, as indicated by the increase in price as the diagonal line moves upward.

-

Profit/loss can be determined by doing the following:

-

Draw a vertical line upward from the horizontal axis at any underlying asset price (price of SPY) at which you want to evaluate the trade’s profitability, say $333. This horizontal reference line you just drew is called a price slice. In practice, computers draw them for us.

-

From the point where the price slice intersects the blue diagonal line, draw a new horizontal line to the right, all the way to the vertical axis.

-

The value at which your newly-drawn horizontal line intersects with the vertical axis shows the profit or loss per share on the option trade, if the stock were to be at the price indicated at expiration.

-

Starting from an underlying asset price of $333, this process gives a value of $0 per share P/L. This indicates that if SPY is at $333 at expiration, the trade will break-even. A line drawn upward from $335 would intersect the P/L line at a P/L axis value of +$2.00, indicating a $2.00 profit, and so on.

-

-

Using the same logic, it is now easy to see that if the stock is at any price below $330 at expiration, the maximum loss of -$3.00 per share will be the result.

-

And, if the stock is between $330 and $333, there will be a loss on the trade of from $0 to -$3.00.

-

Finally, if the stock were to be at any price higher than $333, then there will be a profit on the trade, equal to the amount by which the stock exceeds $333, with no limit on profit.

The construction of these graphs is elementary, but very useful. This is just the beginning of what an option profit/loss graph can tell us. I hope that this step-by-step description makes learning how to use an option profit/loss graph easier.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD flatlines below 1.1800 ahead of Fed Minutes

EUR/USD struggles to find direction and continues to move sideways below 1.1800 for the second consecutive day on Tuesday as markets remain in holiday mood. Later in the American session, the Federal Reserve will publish the minutes of the December policy meeting.

GBP/USD retreats to 1.3500 area following earlier climb

GBP/USD loses its traction and trades flat on the day near 1.3500 after rising to the 1.3530 area early Tuesday. Trading conditions remain thin ahead of the New Year holiday, limiting the pair's volatility. The Fed will publish December meeting minutes in the late American session.

Gold rebounds toward $4,400 following sharp correction

Gold gathers recovery momentum and advances toward $4,400 on Tuesday after losing more than 4% on Monday. Increased margin requirements on gold and silver futures by the Chicago Mercantile Exchange Group, one of the world’s largest trading floors for commodities, prompted widespread profit-taking and portfolio rebalancing.

Tron steadies as Justin Sun invests $18 million in Tron Inc.

Tron (TRX) trades above $0.2800 at press time on Monday, hovering below the 50-day Exponential Moving Average (EMA) at $0.2859.

Bitcoin Price Annual Forecast: BTC holds long-term bullish structure heading into 2026

Bitcoin (BTC) is wrapping up 2025 as one of its most eventful years, defined by unprecedented institutional participation, major regulatory developments, and extreme price volatility.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.