When we listen to many financial advisors and Wall Street firms, they all repeat the same old stories decade after decade. Common mantras like: “Buy and hold, the market always comes back,” “You haven’t lost until you sell,” or “Invest as much money as you can in the stock market as soon as you can.” These are just a few examples of what you hear from the financial industry, experts who are consistently promoting the services they sell to you. Is this really the right way to invest? Let’s dive deeper into these mantras and make sure the decisions you make are best for you, not the financial industry.

The third example I mentioned above is probably the biggest reason the average investor around the world hardly ever achieves their financial goals. Wall Street pushes everyone to invest their money into the stock market and do it as fast and often as you can. This is such a focus for everyone, and sophisticated pricing and projection models show you how beneficial it is to do this and how dangerous it is not to, which is why everyone takes the Wall Street advice and does it.

There is a reason the influence is so strong; let me explain. Have you ever seen David Copperfield live? I have and he’s really good. Like any good magician, he gets you to focus on what is happening with his left hand so you don’t even think about what’s going on with the right hand. Like the magician, Wall Street pushes everyone so hard to put so much money into the stock market and as soon as you can so that you won’t ever think to focus on one simple, yet critical, decision which leads to one simple question: PRICE? When was the last time your financial advisor said: “Let’s wait to invest your hard earned money into the market until the market declines and is cheaper,” or “Let’s hold off until the market falls to wholesale levels so we can try and get you real strong returns.” Wall Street would never talk about this because it would disrupt the easy money machine they run that has them buying at wholesale and selling to you, the average investor at retail prices. Wall Street’s key focus for their own investments is price. Price determines exactly when they buy and sell in the market. This is why they achieve record profits each year and you don’t. Why isn’t it your focus also?

This is not to say that every financial advisor doesn’t care about your money, there are plenty that do and I know a couple. My point is to get you to simply start asking the question about price. Don’t you question price with everything else you buy in life? Why in the world would you not focus on it with your investments that ultimately determine what you can and can’t do with your life.

I’ll begin with a simple question: Would you invest in a vehicle where your savings are subject to losses and with just a 2% annualized rate of return?

Think about that for a minute. You have the risk of potentially losing money compounded with the fact that this vehicle, over the last decade and a half has produced an annualized return of just 2.0%. Would you put your hard earned savings into a plan that works like this? Let’s take a look.

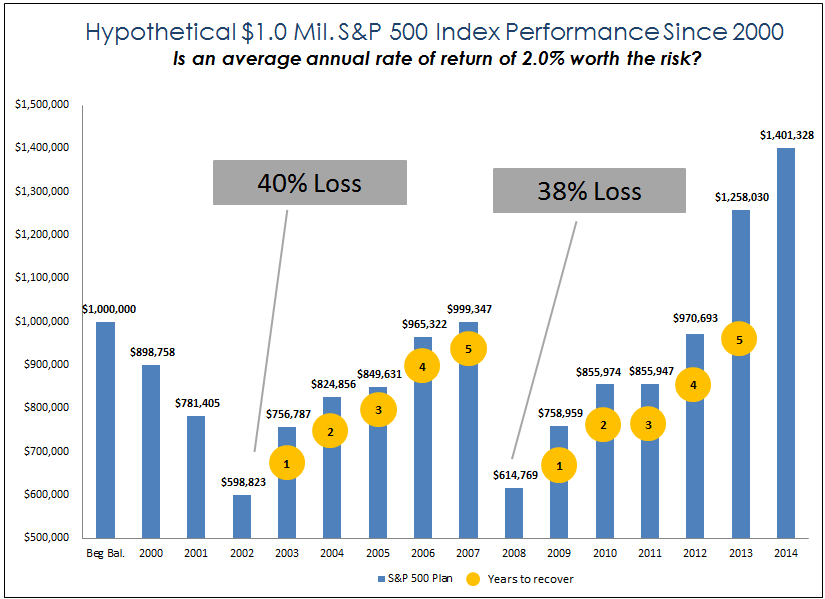

The chart we’re looking at is a hypothetical $1 million investment in the S&P 500 Index and that investment’s performance since 2000. Now granted, not all of your money may have been in the stock market… but let’s just go with it for example purposes. In 2000, if you had a starting balance of $1 million in your portfolio you would have taken a substantial hit due to the multi-year market decline. From 2000 to 2002, your investment dropped from $1 million to around $600,000, approximately a 40% loss. If you had the courage to stay in the market, you spent the next five years crawling back to nearly breakeven in 2007. Think about it for a minute, seven years have gone by and you haven’t made a dime in the markets.

Then the financial crisis of 2008 hit and your portfolio drops 38%, down to roughly $615,000. Again, it takes about five years to get back to our original $1 million. That’s another five years wasted playing catch up. Take a good look at the chart, how much have you earned from 2000 to 2008 with a “buy and hold strategy”? Nothing…

If you’ve been in the market since 2000, the profits have only been made the last couple of years and that really depends on when your money went into the market. In this example, our $1.0 million beginning balance grew to $1.4 million at the end of 2014. That’s an average annual rate of return on an IRR basis of 2.0%. Is an investment return at par with long term CD rates worth the risk? Did the buy-and-hold strategy really work over this period of time? These approaches are being promoted by Wall Street, mutual fund companies, and other financial institutions every day. What they may not be telling you is that every time you lose money in the markets you create a drag on your account where your portfolio is constantly working to get back on track with the performance you need to achieve the goals that originally enticed you to make that investment. As you can see, this drag can stay with you for 5, 10 plus years. This is why you almost never see the average investor achieve the financial goals that would allow them to live the life they choose to live. Is this the best that Wall Street and other financial institutions have to offer and, more importantly, is it working for you even now? Is this really the right approach for investing or is there a better way?

The problem with “buy and hold” is that investors never hear the full title of that strategy, which may be why people don’t understand the major flaw until it’s too late, when the money is gone and the years are wasted. The full title of the strategy is “Buy at Any Price in the Market and Hold with No Plan for Risk or Profit”. Does this make any sense to you? Do you think this is the strategy financial institutions use for their capital? Now I know I am not making any friends on Wall Street writing articles like this but I feel it’s my responsibility to expose the truth. Furthermore, the problem is not the big banks and financial institutions, it’s you. They aren’t doing anything wrong, the average investor is simply because of a lack of understanding. To really change your financial trajectory, there is only one answer in my opinion: Stop thinking and acting like an average investor and start thinking and acting like the big banks and financial institutions. A simple first step is to focus on “price”, just like Wall Street does.

I started on the financial institution side of the business and trust me, the actions of the average investor and Wall Street are nearly polar opposite. This is why one group typically achieves record breaking profits much of the time and the other hardly ever comes close to achieving their financial goals. What if we start thinking and investing like Wall Street and other financial institutions? If you bought and sold in the markets based on “price” like Wall Street instead of “time” like the average investor, the results would look very different.

The next time you make a key financial decision, make sure you’re asking yourself this simple question: Is this decision benefiting you, or Wall Street? I’ll keep writing articles that help you focus on putting more money in your pocket and keeping more of what you make. Whether you take action is up to you.

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD holds firm near 1.1850 amid USD weakness

EUR/USD remains strongly bid around 1.1850 in European trading on Monday. The USD/JPY slide-led broad US Dollar weakness helps the pair build on Friday's recovery ahead of the Eurozone Sentix Investor Confidence data for February.

USD/JPY keeps the red below 157.00 on intervention risks

The Japanese Yen sticks to its modest intraday recovery gains against a broadly weaker US Dollar on the back of speculations that authorities will step in to stem weakness in the domestic currency. In fact, Japanese officials stepped up intervention warnings and confirmed close coordination with the US against disorderly FX moves. This, in turn, triggered an intraday USD/JPY turnaround from the 157.65 region, or a two-week top, touched in reaction to Prime Minister Sanae Takaichi's landslide win in Sunday's election.

Gold remains supported by China's buying and USD weakness as traders eye US data

Gold struggles to capitalize on its intraday move up and remains below the $5,100 mark heading into the European session amid mixed cues. Data released over the weekend showed that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Fed expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

Cardano steadies as whale selling caps recovery

Cardano (ADA) steadies at $0.27 at the time of writing on Monday after slipping more than 5% in the previous week. On-chain data indicate a bearish trend, with certain whales offloading ADA. However, the technical outlook suggests bearish momentum is weakening, raising the possibility of a short-term relief rebound if buying interest picks up.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.