Do you like the idea of trading intraday, but you're worried it gets too fast? Are you concerned you'll suffer wild swings in profits but also losses as a consequence?

Listen: I'm not fast thinking. And I'm not someone who can problem-solve quickly. So, how do I trade rapid price moves? You'll see how with examples shortly.

Three transferrable skills to enable you to trade rapid price movement

First: The playing field

Think of a playing field in sports. When the price is within the field of play, you can trade; out-of-bounds is when you don't. And determining the playing field "dimensions" makes up the lion's share of your trading 'game plan'.

Imagine for a moment you are watching the live market trading. At times, it appears like a wild roller coaster of movements up and down in price, right? But the playing field brings order to the chaos. It tells you, "hey don't trade between these prices," or "If you are in a long trade, and the price reaches XYZ, exit the trade".

Your playing field tells you the price ranges you can trade (within the playing field) and the ranges you can't trade (out of bounds). Not only does this framework bring order and structure to your trading day, it massively reduces the mental overload of trying to keep focused on every "wiggle" in price as if hanging on every word of a compelling speech.

Second: The specialist's catalyst

Markets don't move because you identified a "pattern" or "set-up". Price responds to events like employment data, retail sales, central bank announcements etc. These are examples of catalysts for moves in price.

In the days of the trading pits, specialists were traders focusing on a single instrument. It's still the common practice amongst professional traders in today's screen-based trading.

You can liken a specialist to reading each chapter in a novel. As you read through a book, you are "getting to know" each character. In the same way, this happens with specializing. Because you know the background story, you see the story unfolding as you had intuitively expected. When you hear or read professional traders talking about trading using "feel" or "intuition", they are referring to this.

In the example coming shortly, the "feel" for the market moving down is the observation and subsequent documentation two days earlier.

Third: The playbook

A playbook is a catalogue of trades that:

-

Have a proven edge - i.e. they produce positive results (without harsh drawdowns) over any meaningful sample size.

-

They are based on multiple evidence characteristics, making them unique and easily distinguishable. A feature of the playbook trades I share with clients is the tiny movement in price to suggest the trade is not working, and therefore a paper-cut loss or scratch trade is the extent of the worst-case outcome.

Time for the example

The brief video is from live trading mentoring featuring the concepts in a practical setting so clients can replicate what I'm doing.

You'll notice that at one point, the fast movement reaches a pace I can't compete in.

But isn't the point here to demonstrate rapid trading moves?!!

Have you ever driven your car at 200 miles or kilometres per hour? 140km an hour is the fastest I have driven for any reasonable period. Any quicker, I was sure I couldn't control the car. Yet 140 is still fast, right? And it's the same with trading - there is fast, and there is faster! But the skills above make it obvious when you stand aside.

PS: I mentioned knowing where to 'no longer hold a long trade' based on the playing field. The different 'boundaries' align with where professionals and market makers trade/don't trade. Remember the playing field from the video?

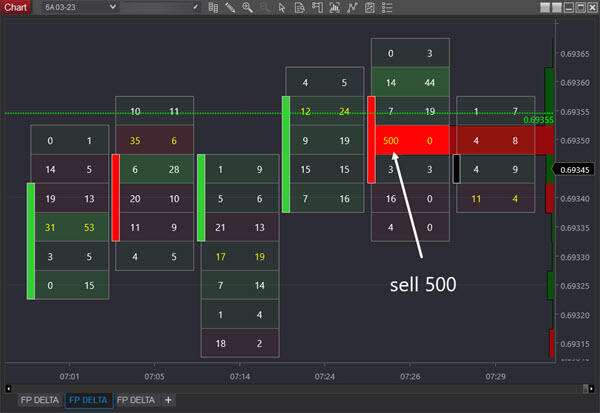

Below are screenshots featuring the same playing field levels 17 hours after the trade was recorded. Colour-coded boundaries notify you of the differing approach to exiting a position. In this instance, "green" signals the weakest of the boundaries. They can be pushed "out" a little further.

See the professional trader who tested this out? A 500-lot trade (50 million face value) is exited only after waiting to see if the market can push the boundaries. When it's clear it won't, the professional sells the position.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD clings to humble gains around 1.1780

EUR/USD manages to reverse Tuesday’s pullback, sticking to daily gains around 1.1780 following an earlier bull run past 1.1800 the figure. The pair’s slight advance comes on the back of the equally marginal uptick in the US Dollar, as investors continue to closely follow developments on the trade front and news from the White House.

GBP/USD clings to small gains above 1.3500

GBP/USD is posting moderate gains above 1.3500 on Wednesday. The pair edges higher as the US Dollar meets fresh supply amid a modest improvement seen in risk sentiment following US President Donald Trump’s first State of the Union address.

Gold rises toward $5,200, supported by geopolitics and trade jitters

Gold buyers are back in the game, eyeing $5,200 and beyonf on Wednesday after seeing a correction from monthly highs on Tuesday. The US Dollar slips after Trump’s SOTU fails to impress and as AI-driven worries ease. Dovish Fed bets also weigh. Gold looks north so long as the key 61.8% Fibo resistance at $5,142 holds on the daily chart.

Bitcoin, Ethereum and Ripple post cautious recovery amid downside risks

Bitcoin, Ethereum, and Ripple are posting a cautious recovery on Wednesday following a market correction earlier this week. BTC is approaching a key breakdown level, while ETH and XRP are rebounding from crucial support levels.

Nvidia remains at the heart of the AI boom

Nvidia remains at the heart of the AI boom, with Q4 revenue projected near $65.6–66.1 billion, nearly 70% higher year-over-year. But investors are watching cash flow, leverage, and broader AI adoption. Growth is strong, but the AI stress isn’t over.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.