People seem to think that since they hear that so few people are successful in trading, that there must be a complicated process to complete in order to make money. The truth is, that the simpler we make trading, the more profitable it seems to be. Many traders and investors often seek out complicated indicators, so this week I decided to discuss a simple technique that is often overlooked when traders are reading charts, specifically candle charts. We are all too quick to look at the squiggly lines we call indicators and oscillators and dismiss the simplest signal available to us, PRICE!

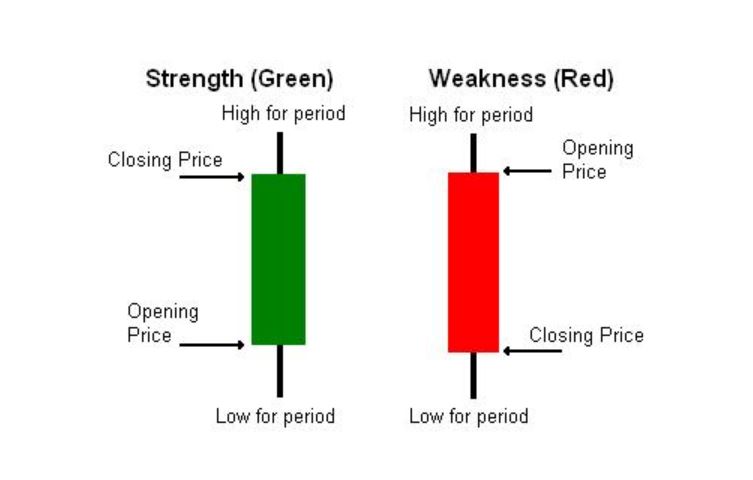

The most common way that price is displayed for most traders is through candle charts. If you are not familiar with the construction of a candlestick, I have included the quick reference below. There are two parts to candles. The body of the candle is the colored portion and indicates the opening price and the closing price of the candle. The lines sticking out from the top and or bottom of the candle’s body are known interchangeably as tails, shadows, or wicks.

A green candle usually indicates strength in price and is formed due to price closing higher than it opened during that period. The bottom of the body is the opening and top is the closing. Conversely, the red candle indicates weakness due to the closing price being lower than the open for that period. The top of the body of a red candle is the opening price and the bottom of the body is the closing.

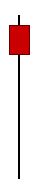

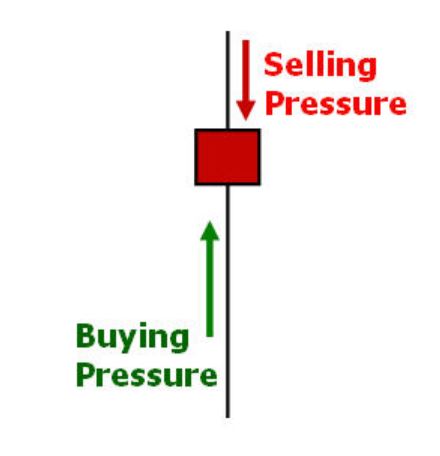

The problem is that many traders end their candle analysis there. You must look to see what the tails (wicks, shadows or whatever else you wish to call them) are telling you. These tails mark the highs and lows of the period. If I asked you what the candle below signifies, you may tell me weakness since it is red.

However, with further examination, you will see that there is a long tail to the downside. This means, that even though the bears pushed the price lower, there was enough bullish pressure to move price higher before the close of that period. This is a bullish candle! Let’s look at the candle chart to see where it was in the whole trend.

This red candle indicated that we were ready to bounce off demand with a lot of bullish pressure. You must listen to the tale the tails are telling you. Any candle tail that is above the real body (colored portion of candle) tells that the bulls were not able to hold price up and the bearish pressure moved prices downward. Any tail below the body indicates buying pressure.

This becomes especially important when price is nearing a level of demand and/or supply. By seeing which force is winning (bulls or bears) we can anticipate a bounce or break of that price level and take appropriate action.

Supply and demand are economic forces that determine price. This is especially true when looking at the financial markets. We can use the same tools for reading supply and demand as the professionals do. We just must refer to the candle charts instead of incoming orders from clients. Remember that price gives us clues as to the immediate direction the stock will go. We just must be open to viewing it and listen to the tale of the tails!

This is one key factor for my trading success. There are several others that we teach in the Professional Trader course. Be sure to stop by your local Online Trading Academy office to see one of our many superstar traders/instructors for an educational experience you won’t ever forget!

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

GBP/USD holds above 1.3600 after UK data dump

\GBP/USD moves little while holding above 1.3600 in the European session on Thursday, following the release of the UK Q4 preliminary GDP, which showed a 0.1% growth against a 0.2% increase expected. The UK industrial sector activity deteriorated in Decembert, keeping the downward pressure intact on the Pound Sterling.

EUR/USD stays defensive below 1.1900 as USD recovers

EUR/USD trades in negative territory for the third consecutive day, below 1.1900 in the European session on Thursday. A modest rebound in the US Dollar is weighing on the pair, despite an upbeat market mood. Traders keep an eye on the US weekly Initial Jobless Claims data for further trading impetus.

Gold sticks to modest intraday losses as reduced March Fed rate cut bets underpin USD

Gold languishes near the lower end of its daily range heading into the European session on Thursday. The precious metal, however, lacks follow-through selling amid mixed cues and currently trades above the $5,050 level, well within striking distance of a nearly two-week low touched the previous day.

Cardano eyes short-term rebound as derivatives sentiment improves

Cardano (ADA) is trading at $0.257 at the time of writing on Thursday, after slipping more than 4% so far this week. Derivatives sentiment improves as ADA’s funding rates turn positive alongside rising long bets among traders.

The market trades the path not the past

The payroll number did not just beat. It reset the tone. 130,000 vs. 65,000 expected, with a 35,000 whisper. 79 of 80 economists leaning the wrong way. Unemployment and underemployment are edging lower. For all the statistical fog around birth-death adjustments and seasonal quirks, the core message was unmistakable. The labour market is not cracking.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.