Markus is a self-made multi-millionaire who was born in Germany. He came to the US in 2002 with $30,000 in his pocket and a dream to become a successful trader.

Over the past 20 years, he traded and invested his way to success in the stock and real estate market, making millions of dollars in the process.

Markus has written three best-selling books about trading and investing that have been translated into multiple languages. His youtube channel with over 4 million views is dedicated to his favorite topic — which is trading stocks and options.

Markus has connected with over 300,000 traders in more than 200 countries across the globe.

He lives in Austin, TX where he enjoys spending time on the lake watching his kids racing their sailboats.

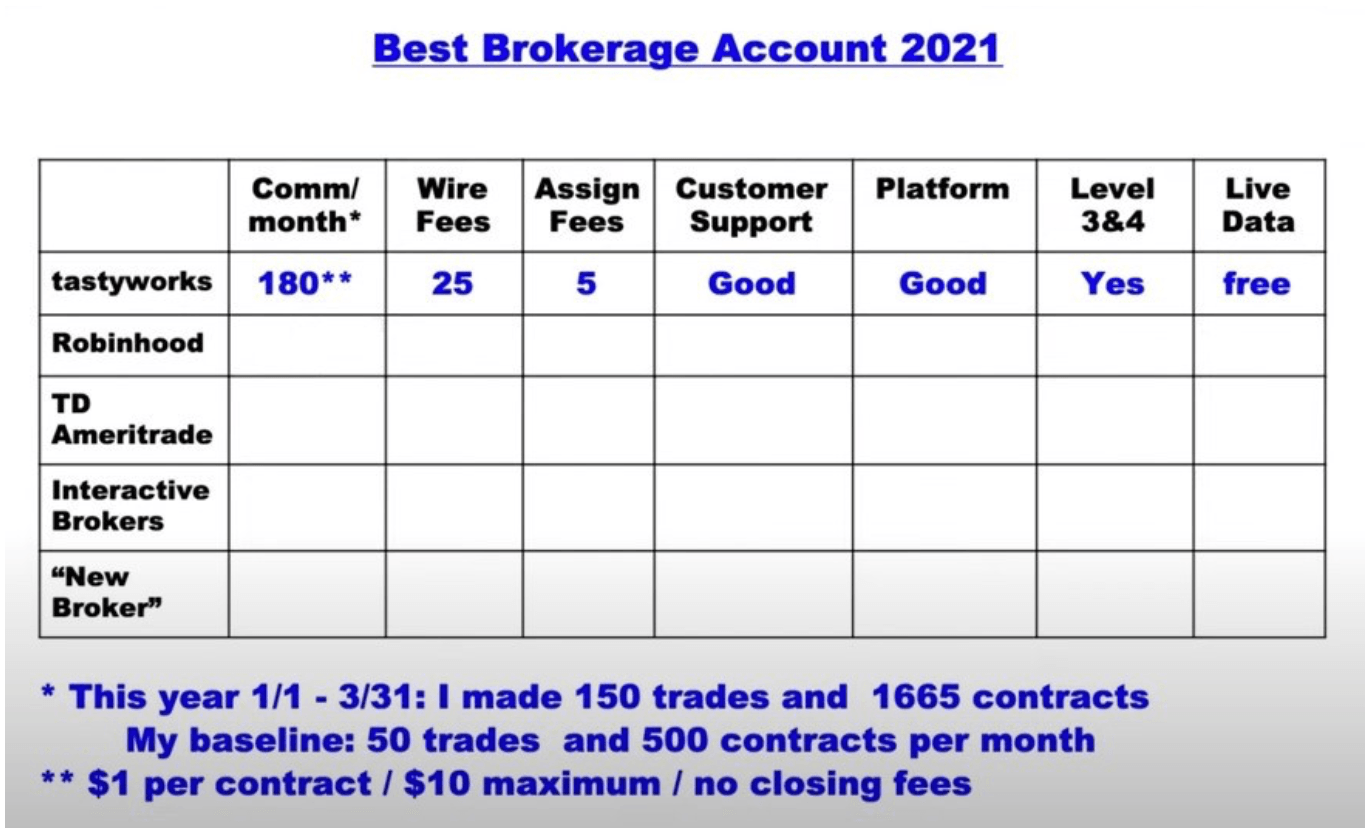

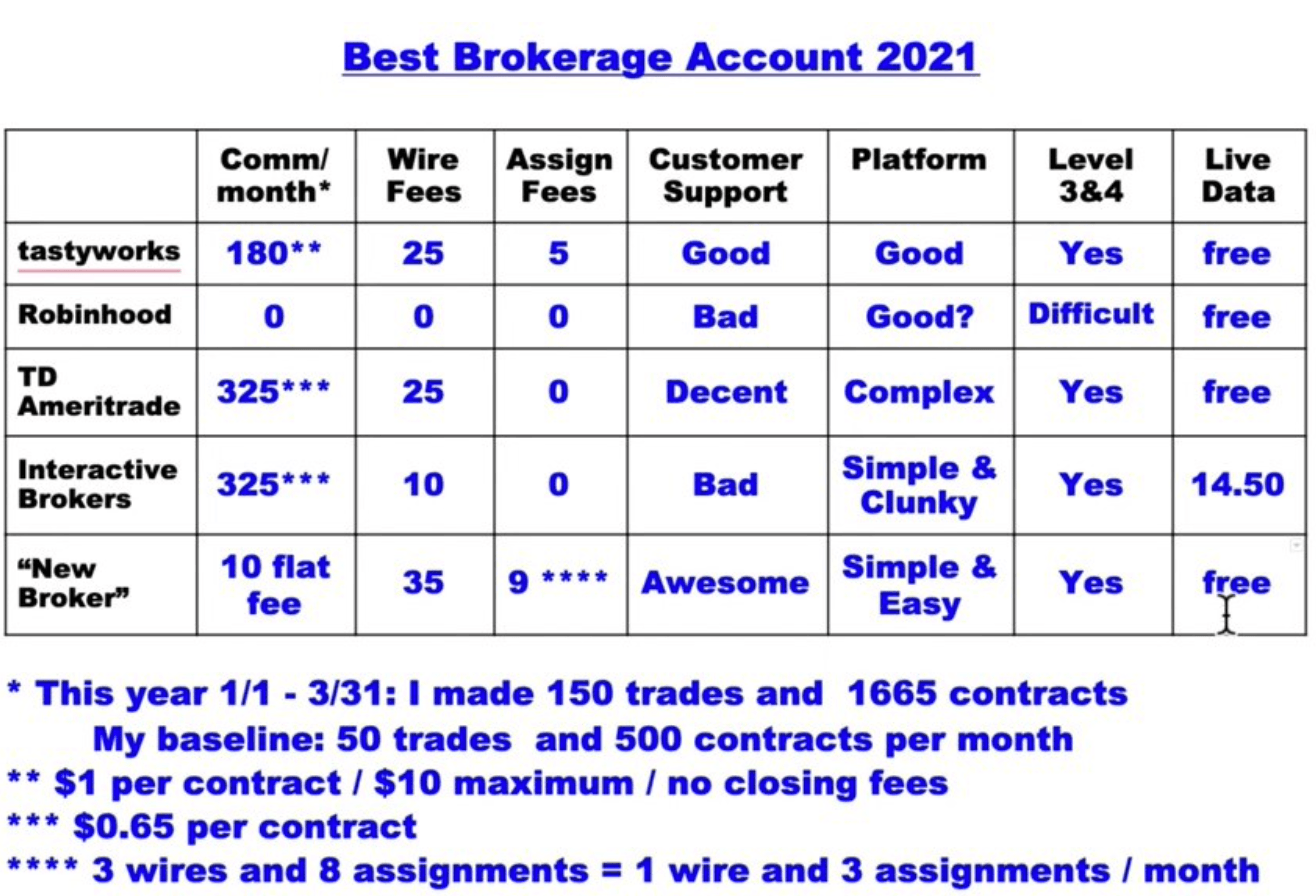

Let’s talk about the best brokerage account, and in order to do this, I want to compare five different brokers for you. I’ll be comparing tastyworks, the current broker that I’m currently trading with, Robinhood because many traders are using it, TD Ameritrade because it’s wildly popular, Interactive Brokers because it’s great for international traders, and we will talk about a new broker that I’ve been using for the past couple of months, so I have an account with them.

I want to talk about this and compare them to the others and tell you why I really like this new broker and why I’m in the process of switching over all my accounts.

The first thing to keep in mind when you’re comparing different brokers, you have to pick criteria that fit your needs. These are my criteria and they might be great for you, or your criteria may be different. So what I’m looking for when finding the best broker.

My Criteria For Selecting A Broker

So the first thing that I would like to know is how much do I have to pay in commissions per month? I use a certain baseline for this. With my current broker, tastyworks, I looked back over the past three months and I wanted to see how much I spent. From 1/1 through 3/31 I made 150 trades and traded 1,665 contracts.

So I use this as my baseline in order to compare these different brokers. I took to see what if I make 150 trades, or 50 trades per month and 500 contracts that I’m trading per month. Again, for you, it might be different, but we need to have somehow a baseline, especially when we are comparing the commissions per month that I’m spending right now, that I would be spending on Robinhood, TD Ameritrade, interactive brokers, and this new broker that I’m trading with.

Now, every single broker has some other fees, and you need to see which of these fees are important to you. Here are the ones that are important to me. I want to know if there any wire fees and if so, how much are they?

Also, are there any assignment fees? Assignment fees are important to me because I’m trading The Wheel Strategy, and part of this strategy is getting assigned shares, so I want to know how much this will be.

Information about their customer support is also important to me. What happens if I need help and I need to call or e-mail them? Do they have an online chat feature? So this is important for me.

What about the platform? Every single broker offers a platform for you, so which one best fits your needs?

This is where we get a little bit more technical because I want to talk about levels three and four. What does this mean? Well, it means that, especially when you are selling options which you do with The Wheel Strategy, you need certain option trading permissions, so you want to know how easily can you get level three and four if this is important to you.

Now, last but not least, I love having live data. I don’t know about you, but I want to make sure that live data available with these brokerages. I also want to know how much it costs if anything. So let’s get started and let’s talk about the first broker here, tastyworks.

tastyworks

I am currently using tastyworks, and I know exactly how much money I spent on tastyworks. On this particular account, I spent $550 dollars in commissions.

For the baseline of 50 trades and 500 contracts per month, I spent around $180 in commissions. Now for tastyworks, how much are wire fees? When I wire money out, which is once a month, it costs me $25.

What about the assignment fees? The assignment fees for tastyworks are $5. I want to explain to you exactly how they are charging. So with tastyworks, they charge $1 per contract and they do have a $10 maximum. So you’re never paying more than $10. Even if you’re trading 50 contracts, you will only pay $10.

They also have no closing fees and this applies to options trading. For stock trading, these days, trading stocks is free pretty much everywhere. So we want to worry about options here because that’s what I’m mainly trading.

What about customer support? I must say their support is good. The experiences that I have had thus far when I contact them by chat are very quick. When contacting them through chat, they usually only have me on hold for three to ten minutes.

Now, what I do not like about tastyworks? You cannot call them, and sometimes I would rather speak with someone on the phone, so this is why I’m not labeling it “very good,” I’m just labeling it as “good” because you can’t call them.

As for their platform, I think it is pretty good. However, I’m just using a fraction of the platform, so for me, the most important function is actually placing trades. I’m not using any of the complicated curves that you can have and all of the analysis tools, but again, if this is important to you, then you need to make sure that this platform meets all of your needs. For me, it does what I need it to do, which is entering trades.

Now level three and four is actually something that is quite easy to obtain with tastyworks. So no problems there, and live data is actually free.

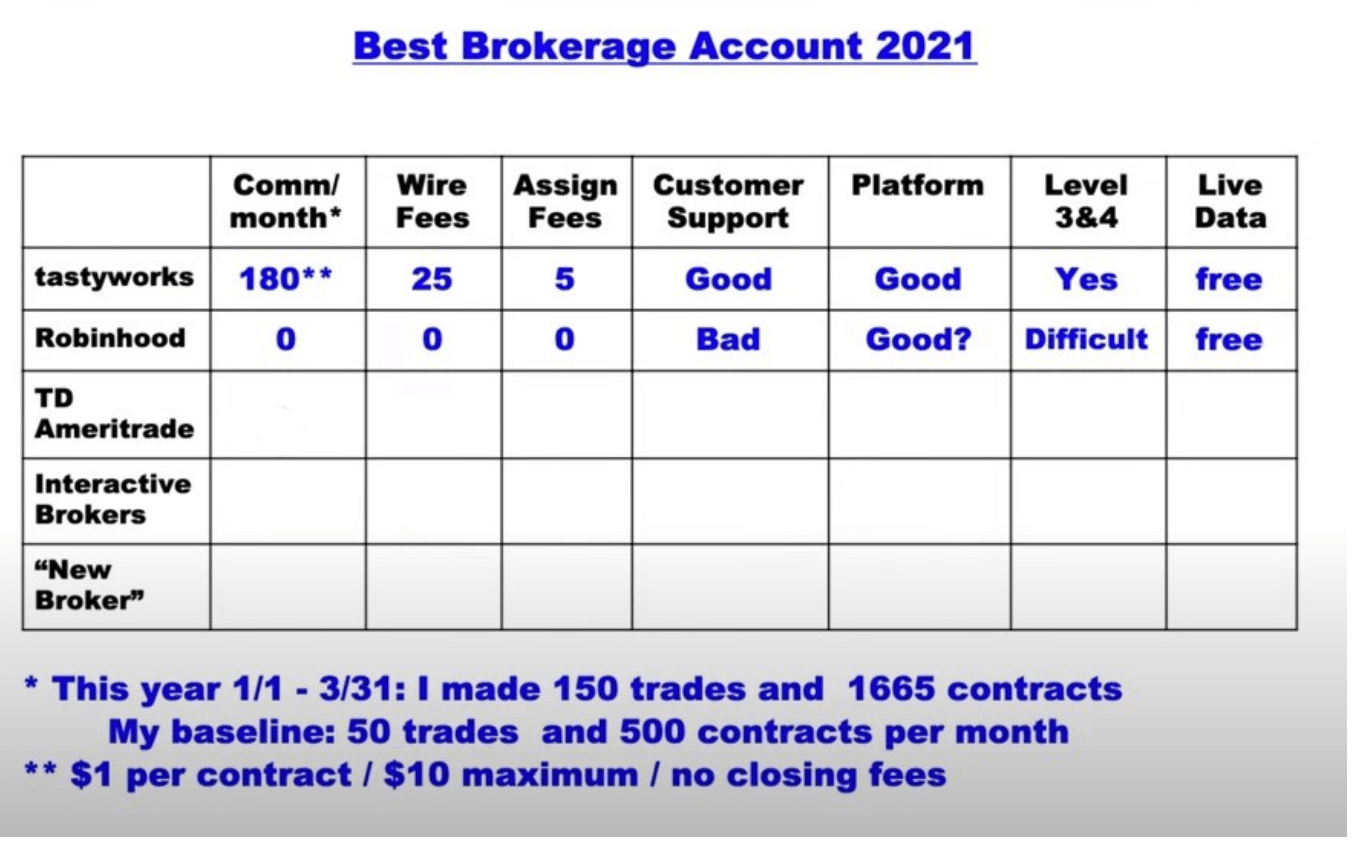

Robinhood

As for Robinhood, how much would you pay in commissions per month? Well, Robinhood has always advertised you pay zero commissions, and that is true. For options trading, you also pay zero dollars, which is actually pretty cool.

Wire fees are a whopping zero dollars with assignment fees being zero dollars. So thus far Robinhood is really good in terms of commissions, right?

Well, what about customer support? Now, full disclosure, I do not have an account with Robinhood, so I’ve never contacted them, but based on what I have heard, it is pretty bad.

What about based on what I’ve seen? I don’t know if you’ve been following the news, but back when we had the GME craziness, Robinhood restricted trading for several days. I don’t think that was fair. I don’t think that they should have done that, but they did.

This makes it seem to me they don’t have their customers in mind. Now, again, full disclosure, I don’t have an account with them and never contacted them. I’ve just heard that customer support is pretty bad.

What about the platform? I don’t know first hand, but I’ve heard it’s good. Again, this is where I go from hearsay because I don’t have an account with Robinhood, never had one, & don’t want one.

In terms of levels three and four, I heard from traders who have an account with them say it is fairly difficult to obtain levels three and four. If you’re trading The Wheel Strategy, this is super important. As for their live data, it’s free.

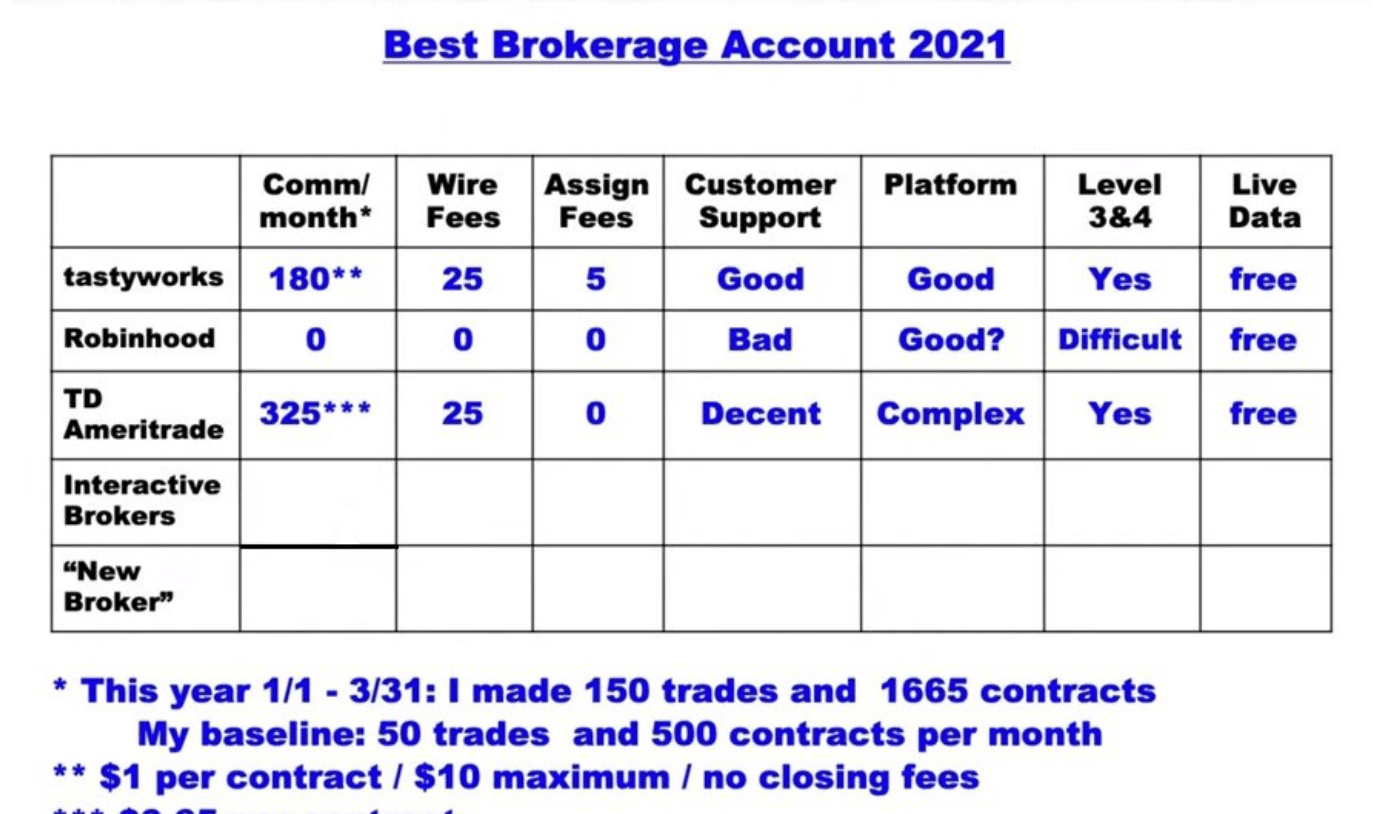

TD Ameritrade

Now on to TD Ameritrade. How much would you spend with TD Ameritrade based on my baseline? You would pay 65 cents per the contract that you trade. So if you’re trading like me, 500 contracts per month, times 65 cents, that comes to $325.

What about the wire fee? The wire fees here are also $25, the same as with tastyworks, but assignment fees are zero.

Now, what about customer support? Customer support used to be good. Right now I would say it is decent. There was a time when you could call them they would pick right up. These days you are probably on hold for anywhere between 15 minutes and 2 hours because they got bought by Charles Schwab. There seems to be a lot of consolidation going on and because of this, and because of this, it seems that customer support is suffering.

What about the platform? ThinkOrSwim is probably one of the most powerful trading platforms out there, and it is fairly complex. For me, I just need to enter simple orders such as buy and sell orders. So for me personally, it is too complex.

It took me a long time to learn it. For those of you who have ThinkOrSwim, you either love it or you hate it. Either way, it is so complex, so you probably had to spend hours and hours learning it.

Levels three and four are fairly simple to acquire, and also live data here is free.

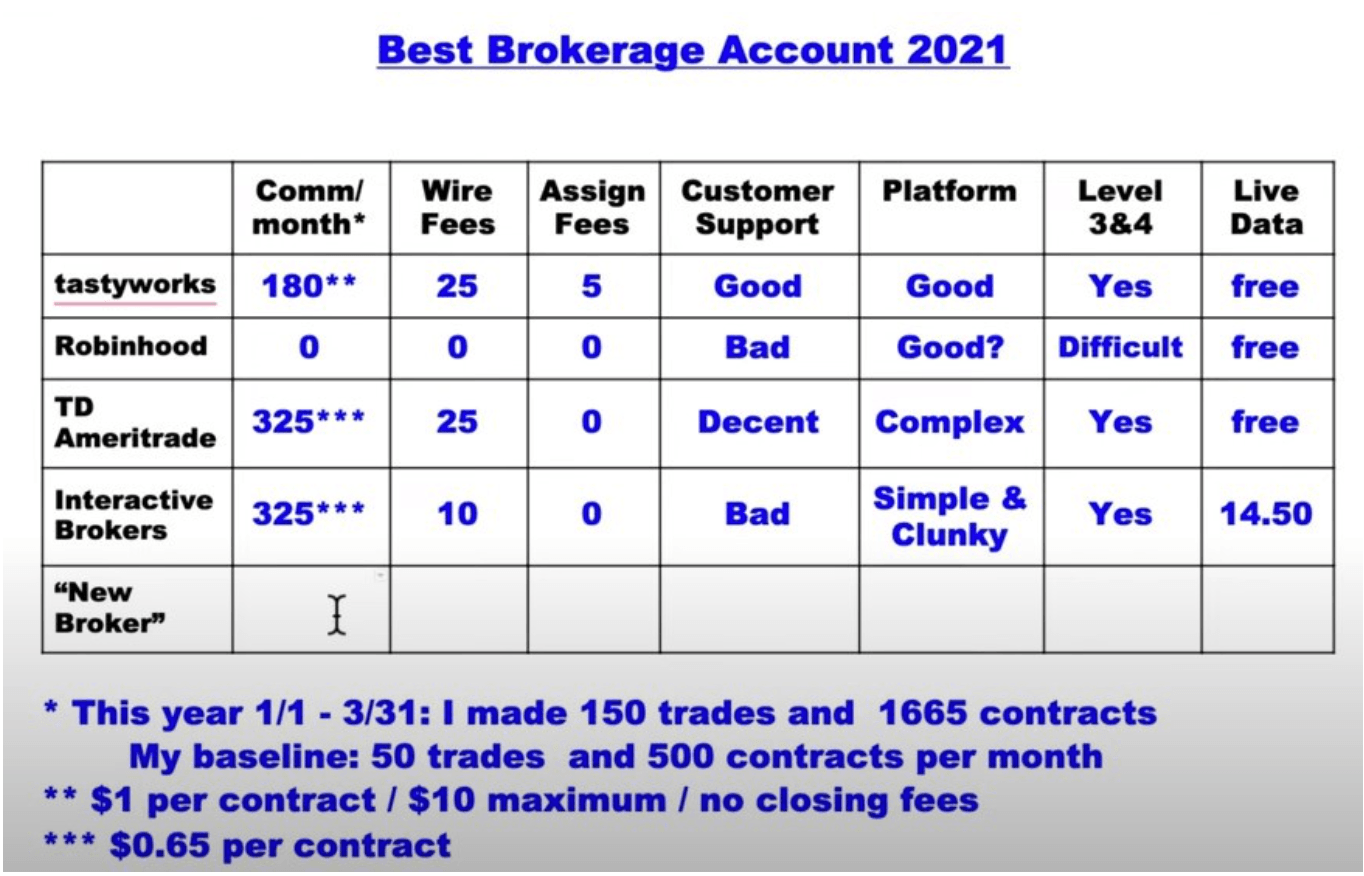

Interactive Brokers

Now with Interactive Brokers, I personally do have three accounts. I’ve been using them since 1999. They’re a great choice for international traders. However, Interactive Brokers charges 65 cents per contract. So very similar here to TD Ameritrade. If I would trade on Interactive Brokers I would actually spend $325.

The wire fee here is a little bit cheaper, $10. The assignment fees, if you get assigned, are zero. Now their customer support, based on my experience is pretty bad. I’ve tried contacting them by chat, by phone, by email, and if you’re trying to contact them by chat, you will most likely be on hold for at least 20 minutes. If you try to contact them by phone it is not unusual to wait 30 to 60 minutes until you get connected.

Their platform here is actually simple to use, but I find it’s pretty clunky. So just if you want my opinion and again, this is just my opinion. You on the other hand might find this platform blazing fast and think it’s the best trading platform there is.

Now, in terms of levels three and four, yes, it is fairly easy to obtain, but they charge you $14.50 for live data, so just keep this in mind. This is a monthly fee so you just need to know what you need.

So with the new broker, and I’ll tell you in a moment who that is, but when I saw all this mess going on in February where several brokers restricted trading, I said, “you know what, this is not fair.” When I heard from some of you say, “My broker suddenly raised the margin requirements and I didn’t have a margin problem before and now I have a margin call,” or that you’re on hold forever before you get any customer support, I set out to find a great broker, and here is the new broker that I’m currently using.

Tradier

The new broker that I’m using is Tradier. I will move all of my accounts over to them because of what they’re offering. The commission per month, it’s a $10 flat fee. $10 no matter how many options you trade. This is a special rate for those of you reading these articles, and following me on YouTube.

So I think it is an absolutely cool model because it is a flat fee no matter how many contracts you trade. Now, this, of course, is great if you are trading a lot of contracts like me. You have seen it, 500 contracts per month, with 150 trades, so I’m a very, very active trader.

I think it is absolutely cool that instead of paying $180 per month, all I’m paying right now is a $10 flat fee. That is pretty cool.

Now the wire fees are a little bit more expensive. The wire fees are $35, but again, I’m using it once a month. So, therefore, if I’m adding this up, all right, and I say, well, that is $205 per month versus $45 a month, and for me, that adds up. Right. It’s only a $10 difference from tastyworks, and I’m not wiring money in and out like crazy. I’m just wiring it out once a month and that is okay.

So the assignment fee here is a little bit higher, at $9 as of right now. So over the past three months, I had 3 wires and I had 8 assignments. This is for the year. This means that per month I have 1 wire and approximately 3 assignments.

So as you can see, this is why the assignment costs here for me are not that important. Again, these are my numbers, your numbers might be completely different, and that is fine. This is where the cool thing is you have probably your brokerage account statement, so you can take a look at that, and then you know exactly how much you’re paying right now.

So the customer support, I must say based on my experience, over the past two months that I’ve been using them, is awesome. What do I mean by awesome? By awesome I mean that I can pick up the phone right now. I can call them, and within two to three rings, somebody picks up. The customer support team is in North Carolina, so I’m not going overseas, they are here in the United States.

They have been super responsive by email and by phone. I don’t even know if they offer a chat on the website because I was just so happy that I can finally talk to somebody. Again, I’m coming from tastyworks, and on tastyworks, I’ve never, ever been able to talk to somebody because their business model is that they’re all doing it by chat, so I love this.

What about their platform? Their platform is simple, and in my opinion, it is super easy to learn. So you can learn this platform in literally 10 minutes because that’s what they do. They just say, hey, if you want to enter trades, which I want to do, it’s fine.

They don’t have all of the bells and whistles that the other platforms have. So I would say it’s more comparable to Robinhood instead of a platform like TD Ameritrade because with Robinhood you just enter the trade and it is good. So it’s simple and easy, does the trick for me.

Levels three and four are super easy to get. And live data is free. So this is what this new broker is all about.

For our members, we have created in our private community a special discussion group, and in this discussion group, we are here to help you, support you, with this particular brokerage. Which again is called Tradier.

So, for example, people have been asking if they open an account for business, an LLC for example? And the answer is yes. So you can ask us if you want to, of course, you can contact them. So this is what we have here. We have a Tradier discussion group.

We do have tutorials for you such as videos on how to open an account, how to set up a paper trading account, and that reminds me, they offer paper trading. As you know, I highly recommend that you trade on a paper trading account first.

There are also videos on how to fund your Tradier account, how to place a stock entry order for the PowerX Strategy, how to place options order for the PowerX Strategy, entering orders for The Wheel Strategy, how to check your positions.

Summary

OK. So, again, my promise is to show you the best broker and this is the best broker for my needs. Now, for your needs, it might be different, but I thought that I compare here that the top five brokers that most traders are using right now.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

AUD/USD struggles to reconquer the 0.6700 mark

The AUD/USD pair trades just below 0.6700 in the Asian session on Tuesday, trying to regain some ground after falling at the beginning of the week. The US Dollar benefited from a dismal mood, with a sell-off in tech shares leading an otherwise slow session.

USD/JPY stalls as Yentervention risk weighs

USD/JPY reversed course to open the final week of the trading year, falling back to the 156.00 region and paring off last week’s late burst of bullish momentum. General volatility is expected to widen during the last trading week of 2025, and follow into early 2026 as holiday-thinned market volumes wreak havoc on general market trends.

Gold holds above $4,300 after setting yet another record high

Spot Gold traded as high as $4,550 a troy ounce on Monday, fueled by persistent US Dollar weakness and a dismal mood. The XAU/USD pair was hit sharply by profit-taking during US trading hours and retreated towards $4,300, where buyers reappeared.

Ethereum: BitMine continues accumulation, begins staking ETH holdings

Ethereum treasury firm BitMine Immersion continued its ETH buying spree despite the seasonal holiday market slowdown. The company acquired 44,463 ETH last week, pushing its total holdings to 4.11 million ETH or 3.41% of Ethereum's circulating supply, according to a statement on Monday. That figure is over 50% lower than the amount it purchased the previous week.

Bitcoin Price Annual Forecast: BTC holds long-term bullish structure heading into 2026

Bitcoin (BTC) is wrapping up 2025 as one of its most eventful years, defined by unprecedented institutional participation, major regulatory developments, and extreme price volatility.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.