Many of us have traded an AUD currency pair, left the position overnight and then came back to see an “inexplicable” large move. There was no Australian data, no data for the other currency in the pair and no speaker for either of the currency pairs. That move was in fact a result of a large miss or beat for key Chinese data. But why does AUD move when Chinese data is released?

China is the largest trading partner of Australia, with China consuming around 33% of Australia’s exports such as iron ore, coal, copper, gold and other commodities. Strong performance of China’s economy usually suggests that Chinese demand for Australian commodities will increase, and vice versa for when the Chinese economy performs poorly. During my time as a professional Market Analyst, we would often see a positive correlation between the Chinese stock markets and copper when stocks were higher for the day. This is because speculators assume that when companies are doing well they will seek to expand, and while doing so will purchase raw materials, such as copper, in order to build infrastructure; thus increasing demand and price for the metal.

So, when we see a high volatility Chinese data release, we can expect a reaction in the AUD. A worse-than-expected value indicates poor performance for China, and will lead to a weaker AUD due to the assumption that demand from the Chinese for Australian commodities will fall. We see the opposite reaction for AUD when a better-than-expected value is released. As explained, a negative data release from China affects AUD, and in the long term will affect the growth of Australia, due to the decreasing demand for Australian commodities. The Australian economy relies on exports to drive aggregate demand as the export of goods accounts for around 20% of the nation’s GDP.

The data that has the greatest effect on AUD and the Australian economy I sChinese CPI. To simplify, Chinese CPI has an indirect effect on Australian CPI. If the former falls, the latter is likely to follow, and in turn leads to the RBA using lower rates to stimulate the economy. When Chinese CPI is trending either higher or lower, we then know that there is a high probability that Australian CPI will soon follow that same trend.

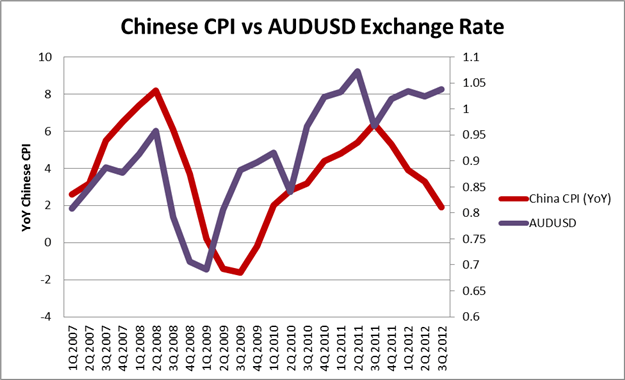

(source: Trading Economics)

The chart above shows the relationship between Chinese CPI and the AUD/USD exchange from 2007-2012. As We can see, AUD/USD lags behind Chinese CPI. We can also see some divergence in the latter part of the chart as Chinese CPI continued lower to near 3-year lows, however the general relationship has since resumed. When trading, it is important to keep an eye on Chinese CPI projections as well as the current trend, in order to construct detailed fundamental analysis.

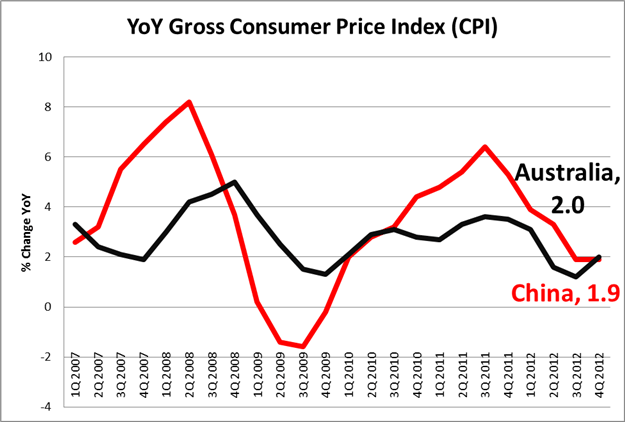

(source: Trading Economics)

The chart above shows the relationship between CPI Y/Y for both Australia (black) and China (red). Once again, some correlation can be seen, with Australia lagging behind.

To conclude, it is now clear to see why China has a large effect on the Australian economy and currency. With this knowledge, we can have an edge in the market as we have a deeper understanding of the fundamentals that influence these two trade partners.

Risk Warning: This is the SBForex view of the market and is not trading/investment advice. Foreign Exchange and CFD trading carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose.

Editors’ Picks

AUD/USD: Some profit-taking should not be ruled out

AUD/USD has quickly faded Wednesday’s strong advance despite climbing to new multi-year highs around 0.7150 earlier on Thursday. The pair’s decline comes amid a marginal uptick in the US Dollar, while investors gear up for US CPI data and relevant Chinese releases on Friday.

EUR/USD faces next resistance near 1.1930

EUR/USD has surrendered its earlier intraday advance on Thursday and is now hovering uncomfortably around the 1.1860 region amid modest gains in the US Dolla. Moving forward, markets are exoected to closely follow Friday’s release of US CPI data.

Gold plunges on sudden US Dollar demand

Gold drops markedly on Thursday, challenging the $4,900 mark per troy ounce following a firm bounce in the US Dollar and amid a steep sell-off on Wall Street, with losses led by the tech and housing sectors.

Ripple collaborates with Aviva Investors to tokenize funds as XRP interest declines

Ripple (XRP) exhibits subtle recovery signs, trading slightly above $1.40 at the time of writing on Thursday, as crypto prices broadly edge higher. Despite the metered uptick, risk-off sentiment remains a concern across the crypto market, as retail and institutional interest dwindle.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.