One of the first things that new traders to the FX markets learn is that many currencies are correlated with other markets. For instance, the close relationship between oil and the Canadian dollar or certain metals and the Australian dollar are intuitive given the importance of exporting those commodities for the Canadian and Australian economies.

One strong, but less obvious, correlation is the tight connection between AUD/JPY and global stock markets. In this case, the factor linking the two seemingly-disparate markets is investors’ risk appetite. When market participants are feeling optimistic about global economic growth, they tend to buy stocks at the expense of more conservative investments such as bonds.

A similar dynamic takes place in the FX market, where upbeat traders will buy higher-yielding currencies with underlying economies leveraged to global economic growth (e.g. the Australian and New Zealand dollars) and sell lower-yielding currencies with relatively stable economies (e.g. the Japanese yen and Swiss franc). Conversely, when traders are apprehensive about the potential for global economic growth, they tend to unwind those trades by selling the higher-yielding currencies and buying perceived safe havens. This is the essence of the so-called “carry trade,” a major short- and long-term driver of FX movements.

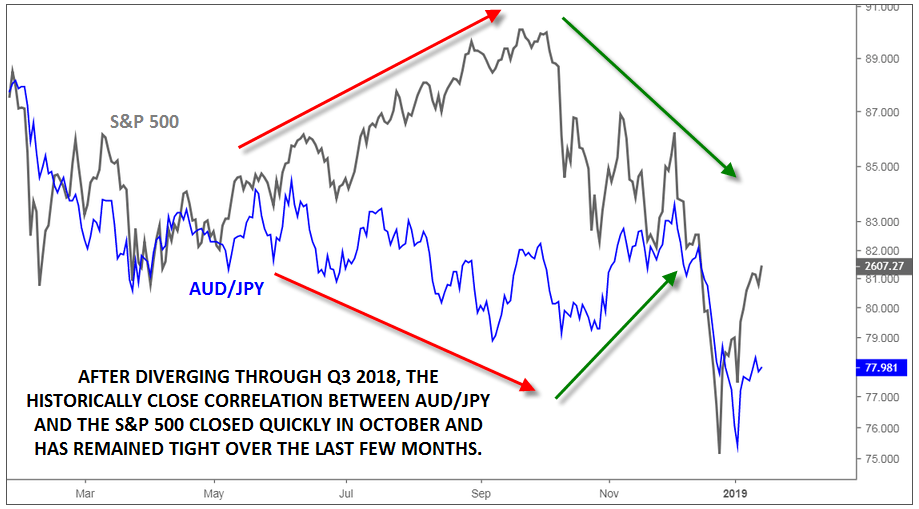

This strong correlation offers traders several actionable insights. Most straightforwardly, if a trader feels strongly that the broad stock market is due to fall or rise, he/she could use AUD/JPY to express that view in a highly liquid, 24-hour market that offers the potential for leverage. Alternatively, traders can watch for divergences between the S&P 500 and AUD/JPY as a sign that one (or both) of the markets is vulnerable to a reversal.

We saw that exact scenario in Q3 2018, when the S&P 500 rallied to new highs, while AUD/JPY continued to languish. The divergence indicated that stock traders should be more skeptical toward the rally in the S&P 500, and sure enough, the index came unwound months’ worth of a gains in a couple of weeks in October. Such divergences can emerge over longer time horizons given the upward tendency of stock investments, they can still provide valuable signals to short-term and swing traders.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Editors’ Picks

USD/JPY rebounds above 153.00 ahead of US inflation data

USD/JPY stages a comeback and regains 153.00 in the Asian session, snapping a four-day losing streak amid some repositioning ahead of the US CPI report. However, expectations that Japan's PM Sanae Takaichi could be more fiscally responsible, along with bets that the BoJ will stick to its policy normalization path and the risk-off mood, could support the safe-haven Japanese Yen, capping the pair's upside.

Gold: Will US CPI data trigger a range breakout?

Gold retakes $5,000 early Friday amid a turnaround from weekly lows as US CPI data loom. The US Dollar consolidates weekly losses as AI concerns-driven risk-off mood stalls downside. Technically, Gold appears primed for a big range breakout, with risks skewed toward a bullish break.

AUD/USD consolidates below 0.7100 as traders await US CPI report

AUD/USD consolidates the previous day's retracement slide from the vicinity of mid-0.7100s, or a three-year high, holding below 0.7100 as traders move to the sidelines ahead of Friday's release of the US consumer inflation figures. In the meantime, the divergent RBA-Fed outlooks might continue to support spot prices amid subdued US Dollar demand, though the risk-off impulse could act as a headwind for the Aussie.

Bitcoin, Ethereum and Ripple stay weak as bearish momentum persists

Bitcoin, Ethereum and Ripple remain under pressure, extending losses of over 5%, 6% and 4%, respectively, so far this week. BTC trades below $67,000 while ETH and XRP correct after facing rejection around key levels. With bearish momentum persisting and prices staying weak, the top three cryptocurrencies continue to show no clear signs of a sustained recovery.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.