In today’s fast-moving financial world, success isn’t just about spotting opportunities—it’s about acting on them with speed, precision, and adaptability.

Financial markets in 2025 move faster than ever. Prices shift in milliseconds. News breaks globally and is digested in real time by algorithms. Retail sentiment can swing based on a single tweet, while central bank language is analyzed by AI tools before human readers can blink.

For traders and investors, this means the edge no longer lies solely in what you know, but in how fast and accurately you respond.

That’s where AI agents come in.

In simple terms, an AI agent is a machine that doesn’t just observe or analyze—it acts.

AI agent

-

Continuously monitors multiple streams of information.

-

Identifies meaningful patterns.

-

Makes autonomous decisions.

To achieve a goal—like maximizing returns or minimizing risk.

It’s not a static trading bot or a set of fixed rules.

AI agent is a dynamic market participant—a digital decision-maker that:

- Evolves

- Adapts and

- Learns

What exactly is an AI agent?

At its core, an AI agent is an intelligent system that helps you:

-

Cut through noise.

-

Spot real signals.

-

React quickly.

-

Protect against blind spots.

Think AI agent as:

-

A fusion of macro analyst

-

Quant trader

-

Risk manager and

-

Strategist

All in one machine that operates 24/7 without emotional interference.

AI agent doesn’t just react:

-

It plans

-

Adjusts and

-

Even rethinks its course.

Based on the incoming flow of market, sentiment, and behavioral data.

AI agent can it give traders and investors a competitive edge.

Because AI agents:

-

Don’t get tired,

-

Don’t panic, and

-

Don’t fall into biases

AI agent:

-

Process data in real time.

-

Adjust to changing market conditions.

-

Learn from past trades.

-

Integrate sentiment, volatility, and news.

- Manage risk dynamically.

In today’s environment, that’s more than a nice-to-have. It’s a strategic necessity.

What is an AI agent?

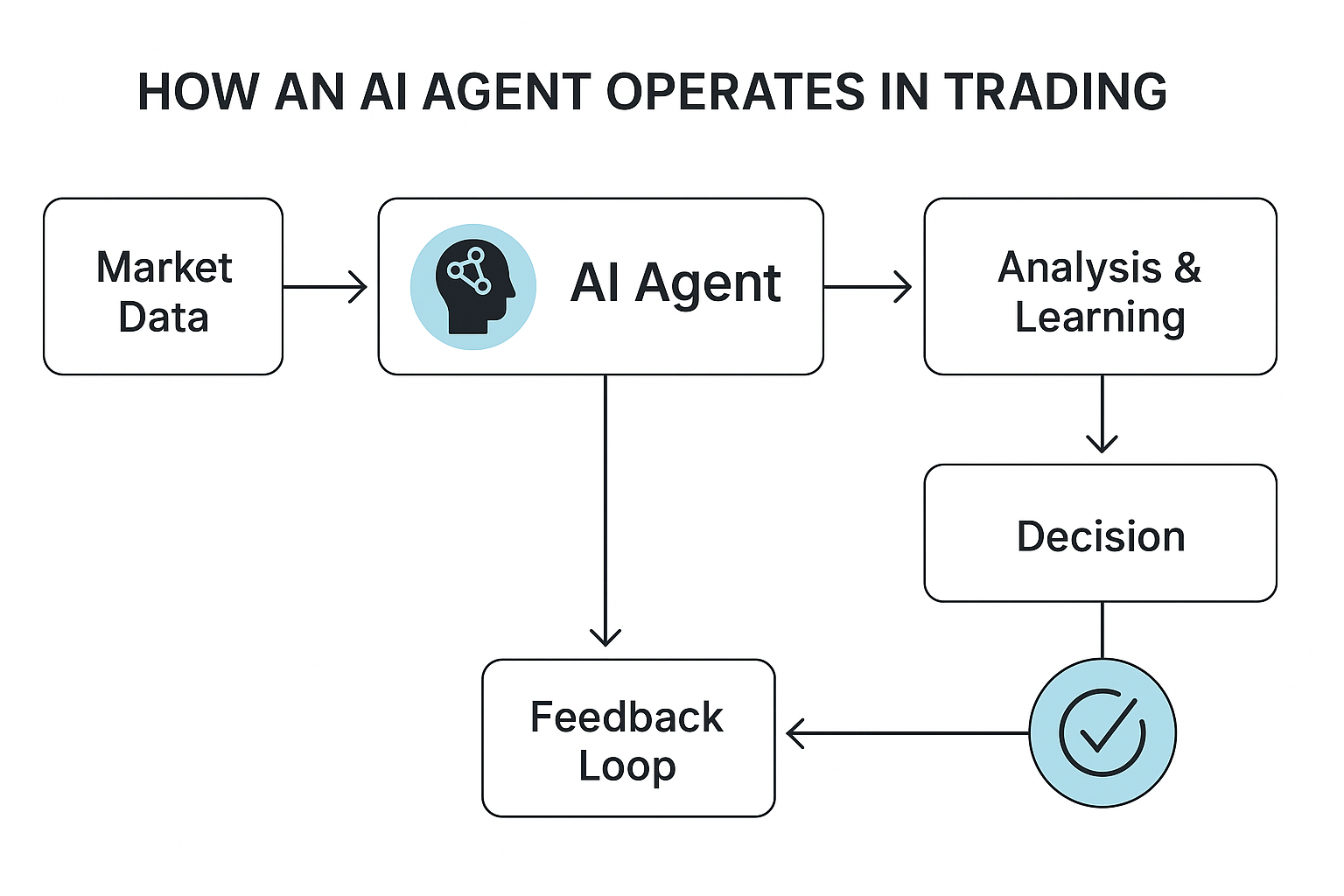

We often hear terms like “machine learning,” “algorithms,” or “AI tools” in financial commentary. But an AI agent is something more specific—and more powerful.

At its core, an AI agent is a software-based decision-maker that perceives, analyzes, learns, and acts in real time.

Unlike traditional trading bots or static algorithms, AI agents:

-

Evolve continuously

-

Adapting their behavior based on new data

-

Emerging risks, and

-

Shifting market narratives

AI agents:

-

Monitor diverse market inputs (price, news, sentiment, on-chain data).

-

Recognize patterns using historical and real-time learning.

-

Make decisions based on probabilities and defined goals.

-

Take action or provide live recommendations.

-

Self-adjust based on outcome feedback.

You can think of an AI agent as your market co-pilot—data-driven, emotionless, and fast.

The basic definition

An AI agent is a type of software entity designed to:

-

Perceive its environment (in this case, financial markets),

-

Analyze incoming information,

-

Decide what action to take, and

-

Act toward achieving a defined objective (like maximizing profit, minimizing drawdown, or optimizing risk/reward).

It doesn’t simply follow a script. It learns from feedback and evolves.

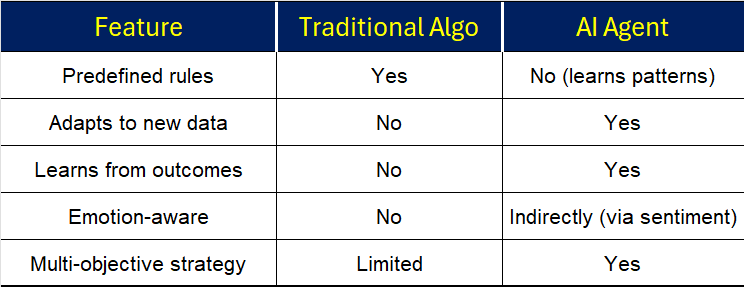

What makes it different from traditional algorithms?

Traditional trading systems are like rigid machines:

-

If X happens, do Y.

-

They work well in stable, predictable conditions.

But financial markets are anything but stable. They are nonlinear, chaotic, and deeply influenced by human behavior.

Here’s where AI agents stand apart:

An AI agent is:

-

Adaptive,

-

Context-sensitive, and

-

Goal-driven

and that changes everything.

Core capabilities of an AI agent in finance

Let’s look at how AI agents operate in real trading and investment settings.

A well-designed AI agent:

Ingests multi-source data:

-

Real-time price feeds.

-

Macroeconomic indicators.

- Sentiment scores.

-

Blockchain data, even

-

Reddit and twitter signals

Finds patterns and relationships:

-

Using deep learning.

-

Reinforcement learning, or natural language processing (NLP).

-

Identifies correlations humans may miss.

Builds scenarios and simulations

The agent doesn’t just react—it projects:

-

It simulates market moves

-

Assigns probabilities, and

-

Chooses the most favorable path

Executes or advises

Based on its risk profile and objectives:

-

It places trades or

-

Recommends actions

Learns and adjusts

Every action is evaluated:

-

If a trade was successful, the logic is reinforced

-

If not, the model recalibrates

The mental model

Think of an AI agent like a live strategist—not just automating tasks, but making strategic decisions in context.

-

It’s watching hundreds of instruments

-

It’s calculating risk exposures across multiple asset classes.

-

It’s detecting sentiment reversals before they hit the charts.

-

It’s weighing past outcomes to shape future behavior.

And it’s doing all of this continuously and without fatigue.

Why are ai agents valuable for traders and investors?

In financial markets, timing isn’t everything—timing with clarity is.

Markets are increasingly complex, data-saturated, and emotionally charged. Even experienced traders can be overwhelmed by conflicting signals, sentiment noise, and volatility traps.

AI agents help cut through that chaos—not by replacing human intuition, but by enhancing it.

Here’s how:

Speed without emotion

AI agents:

-

Absorb real-time data across dozens of assets.

-

React within milliseconds to new events.

-

Never second-guess, panic, or hesitate.

While a human is still absorbing the implications of an inflation surprise or geopolitical headline, an AI agent has already:

-

Repriced probabilities.

-

Adjusted portfolio exposure.

-

Triggered stop-loss refinements.

-

Simulated alternate outcomes.

In markets where milliseconds matter, emotionless execution is an edge.

Integrated multidimensional analysis

Modern financial decisions aren’t driven by price alone. They depend on:

-

Macroeconomic regimes (e.g. rate cycles, trade policy).

-

Sentiment dynamics (fear vs greed).

-

On-chain data (in crypto markets).

-

Microstructure signals (order book imbalances, liquidity gaps).

AI agents analyze all of these simultaneously—faster and more thoroughly than any individual or team.

For example:

A human trader may see a bullish chart.

An AI agent might see: a bearish funding skew, whale outflows, neutral sentiment divergence, and suggest a fade instead.

Adaptability in real time

Markets are fluid. What works today may fail tomorrow.

Traditional systems rely on static rules: “Buy the breakout, sell the breakdown.”

But when volatility compresses or macro sentiment flips, those rules break down.

AI agents adapt dynamically:

-

They reweight inputs as volatility changes.

-

They shift strategies as market regimes evolve.

-

They “forget” failing signals and promote new ones.

This adaptability isn’t theoretical. It happens live—during trades, during macro shocks, during narrative shifts.

Strategic risk management

Great trades aren’t just about entry and exit—they’re about managing the space between them.

AI agents help by:

-

Sizing positions intelligently based on volatility and confidence.

-

Setting stop-losses contextually, not mechanically.

-

Using options to hedge directional bias.

-

Monitoring tail-risk events via NLP alerts.

They treat risk management not as an afterthought—but as a core function of trading strategy.

Scalability and consistency

An AI agent:

-

Can trade 50+ assets across markets and time zones.

-

Never needs rest.

-

Never gets overconfident or distracted.

-

Learns from every trade – whether it wins or loses.

This means:

-

Scalable coverage across FX, crypto, commodities, and indices

-

Consistent execution under pressure

-

Repeatable logic, constantly refined through feedback

Summary table: Why AI agents are transformative

From theory to practice

Understanding what an AI agent is and why it matters is essential. But to truly grasp its power, we need to see it in action—navigating real market conditions, making decisions, managing risk, and delivering results.

Example: A real-world AI trading scenario in Bitcoin: How an AI Agent helped navigate a volatile EUR/USD trade.

Let’s imagine a scenario that many traders will recognize:

It’s early morning in Europe, and the EUR/USD pair is trading at 1.0865. Markets are nervous ahead of a surprise ECB press conference. Most traders are unsure whether to take a position or wait it out.

Now, here’s how an AI agent steps in:

Step 1: Market awareness

The AI agent picks up signals across its data feeds:

-

Spikes in social media sentiment related to the ECB.

-

Option volatility around the 1.0800–1.0900 range.

-

News headlines flagged for urgency in real time.

Step 2: Pattern recognition

The agent recalls similar situations in past ECB events:

“When ECB officials used dovish language in unscheduled statements, EUR/USD dropped by 40–70 pips within the first hour.”

Step 3: Action

The AI agent simulates potential scenarios. If it’s allowed to auto-trade, it places:

-

A short position at 1.0860.

-

A stop-loss at 1.0895.

-

A take-profit at 1.0805, aiming for a risk/reward ratio above 2:1.

Step 4: Real-time adjustment

Minutes after the ECB begins speaking, EUR/USD starts dropping fast.

The AI agent recognizes accelerating momentum and dynamically:

-

Tightens the stop-loss to protect profits.

-

Closes half the position at 1.0820.

-

Lets the rest ride to the take-profit level.

Result:

-

Total return: +55 pips.

-

Risk exposure capped within defined rules.

-

Zero emotional involvement.

-

Strategy recorded and improved for next time.

Takeaway:

In this example, the AI agent wasn’t just executing a mechanical trade. It:

-

Scanned global signals,

-

Recalled historical patterns,

-

Managed risk dynamically, and

-

Adapted in real time—without fear or hesitation.

This is what makes AI agents so powerful: They transform overwhelming information into clear, structured action.

Advanced real-world example: AI Agent navigating a Bitcoin macro-sentiment arbitrage play.

So, let’s walk, imagining a possibly realistic, multi-layered Bitcoin trade—one that could take place in 2025, when BTC could be trading near $103,883.

This could be more than a simple long/short bet. It could be a strategic, AI-driven scenario that brought together macro signals, technical structure, sentiment analysis, on-chain behavior, and volatility pricing—executed through a two-leg portfolio that dynamically adapted as the market evolved.

Date: Mid 2025

Market context: Bitcoin is trading at $103,883, having broken out from a consolidation pattern near $100K. The catalyst?

-

Softer U.S. inflation data.

-

Rising expectations of Fed rate cuts.

-

Improving crypto regulation sentiment in Europe.

-

Coinbase’s inclusion in the S&P 500 index.

But this time, the AI agent isn't just chasing momentum. It's running a multi-layered macro-sentiment arbitrage strategy.

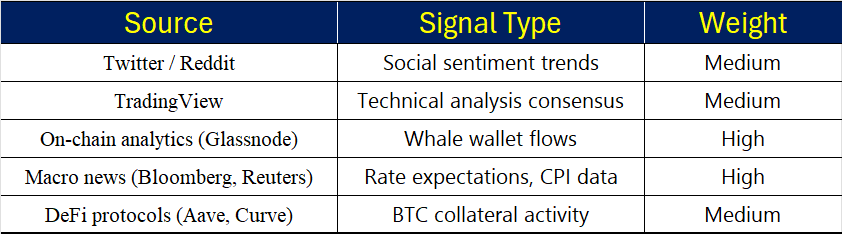

Step 1: Multi-source signal ingestion

The AI agent continuously gathers and weights data from:

It detects divergent sentiment:

-

Bullish flow in U.S. macro media.

-

Neutral/uncertain in crypto-native Twitter.

-

Whale BTC movements signal distribution, not accumulation.

-

Open interest in BTC futures rising with negative funding rates.

Conclusion: Potential for short-term pullback before further upside.

Step 2: Strategic trade setup – Two-leg approach

The AI agent builds a hedged directional position:

Leg 1 – Spot BTC short

-

Entry: $103,800.

-

Stop-Loss: $105,200.

-

Target: $98,000.

-

Rationale: On-chain + sentiment divergence.

Leg 2 – Call options (Protective upside)

-

BTC Call Options @ $110,000 strike, 10 days to expiry

-

Small premium paid (~0.6% of notional)

-

Rationale: Cover for breakout if upside continues

Step 3: Live position management with dynamic inputs

Every 30 minutes, the agent:

-

Reruns its risk-reward model based on price volatility and funding rates.

-

Tracks liquidation levels via order book depth.

-

Monitors AI-derived “Narrative Shift Index” (an NLP sentiment model from news and Twitter).

-

Adjusts position size dynamically based on convexity of expected move.

If downside momentum accelerates and BTC breaches $100,000, the agent:

-

Closes half of the short for realized gains.

-

Rolls protective calls into lower delta out-of-the-money puts.

-

Prepares to reverse position if the liquidation cascade completes.

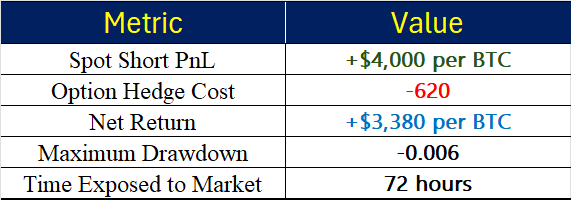

Result (3 days later)

The AI agent outperformed manual strategies, not by being aggressive—but by being:

-

Multidimensional.

-

Probability-driven.

-

Emotionless in execution.

-

Adaptive to live feedback.

Final insight:

This advanced use of an AI agent shows its ability not only to act, but to navigate complex, conflicting signals—balancing sentiment, macroeconomics, and technical setups while dynamically adjusting risk.

Key tools the agent used:

-

Real-time natural language processing (NLP) for sentiment scoring.

-

Volatility clustering detection via GARCH-like models.

-

Options pricing models to measure convexity.

-

Automated narrative tracking and scenario simulations.

Takeaway for traders:

In 2025, the edge isn’t just speed—it’s synthesis.

AI agents can combine macro thinking, market microstructure, and narrative intelligence—all in real time. That’s something very few human traders can do consistently.

How can you create an AI agent?

You’ve seen what AI agents can do—but how do you actually build one or start using one in real life?

The good news is: you don’t need to be a programmer or a tech expert to understand the building blocks. Let’s break it down step by step.

Step 1: Define what you want the agent to do

Before you build or use an AI agent, you need to decide:

-

What do you want it to help with?

-

Is it for identifying trade setups, managing risk, tracking sentiment, or building a portfolio?

Example: “I want an agent that warns me when BTC shows high volatility and helps me decide whether to buy or stay out.”

Step 2: Feed it the right information

An AI agent is only as smart as the information you give it.

It needs data such as:

-

Market prices (like EUR/USD, BTC, or gold).

-

News headlines (especially central bank or geopolitical events).

-

Social media sentiment (Reddit, Twitter).

-

On-chain activity (for crypto traders—like large wallet movements).

This data can be collected using tools or services like:

-

Market data platforms (e.g., TradingView, Binance, MetaTrader)

-

News APIs or RSS feeds

-

Free websites that monitor crypto wallets or funding rates

You don’t need to build this from scratch—many tools already combine these inputs.

Step 3: Let the agent think

This is the brain of the operation. The AI agent takes all this information and:

-

Searches for patterns.

-

Estimates probabilities (like “There’s a 75% chance of BTC dropping if X happens”).

-

Compares current events to similar events in the past.

-

Generates recommendations or alerts.

Some platforms use tools like ChatGPT, machine learning models, or sentiment analysis engines to do this thinking.

For example, GPT could summarize breaking news and explain what it might mean for EUR/USD.

Step 4: Choose how the agent will act

You get to decide how much control the agent has:

-

Only send alerts and suggestions?

-

Place trades automatically based on your rules?

-

Manage risk by adjusting your position size?

Many traders start with alerts and evolve into automation as they trust the agent more.

Important: The agent should always follow your risk rules. You stay in control.

Step 5: Let it learn over time

The most powerful AI agents don’t just repeat—they learn from experience.

If a trade went well, the agent strengthens that strategy. If it failed, it adjusts next time. This process is called a feedback loop.

You can even give it feedback yourself:

-

“That was a good call.”

-

“Avoid trades like that in the future.”

Over time, your agent becomes more aligned with your goals, style, and strategy.

Can I build one myself?

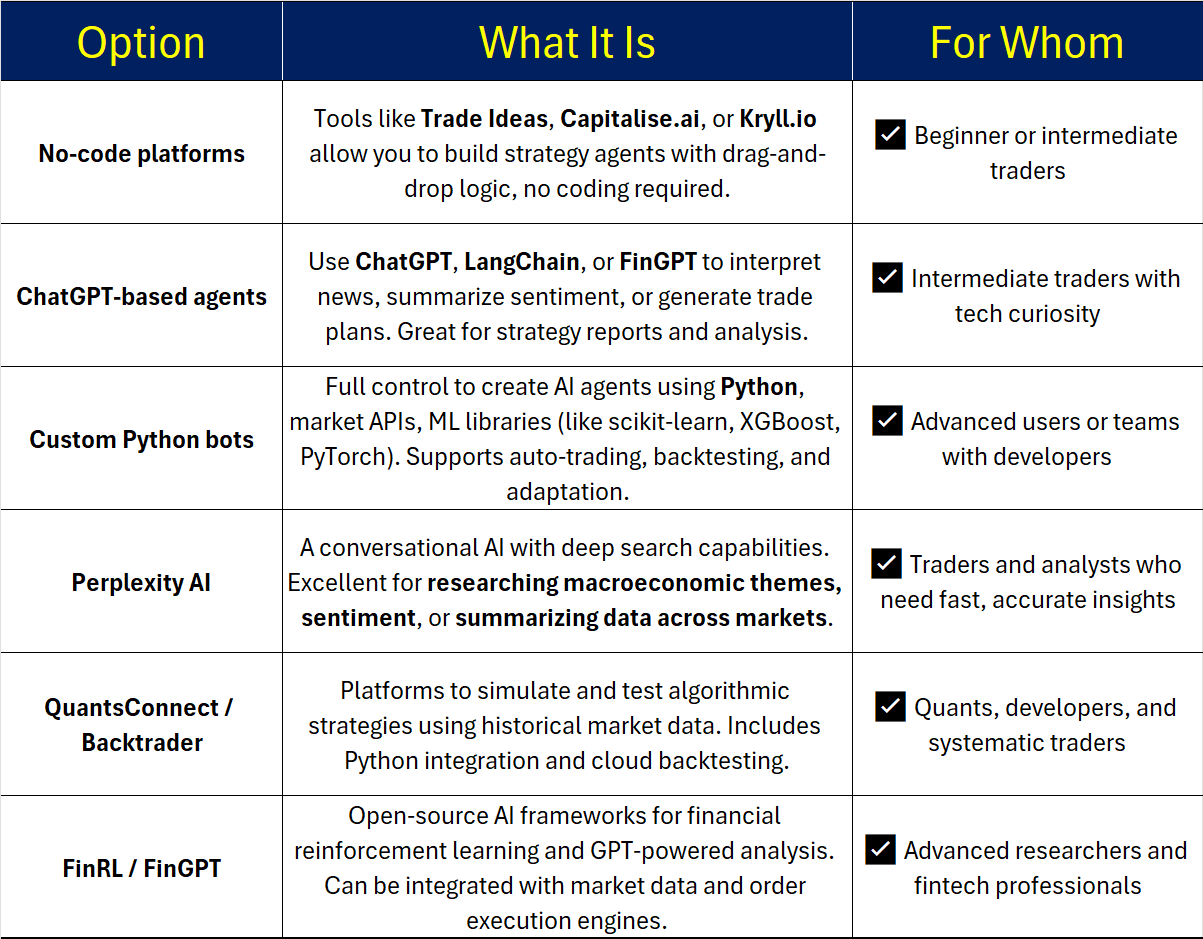

Absolutely! You don’t need to be a professional coder to start using or even building your own AI agent. It all depends on how much control you want, and how deep you want to go.

Here are four different paths you can take:

What you need to create an AI agent

-

A trading idea or strategy.

-

Data feeds (price, news, sentiment, etc.).

-

An engine to process the data (AI model or logic).

-

Rules for risk and action.

-

A way to review and improve over time.

Final thought

You don’t need to compete against AI.

You can work with it—by creating or using an AI agent that:

-

Fits your strategy.

- Respects your risk, and

-

Learns with you

In the next few years, successful traders won’t be the fastest or loudest.

They’ll be the ones with the smartest partners.

And for many, that partner will be an AI agent —developed by experienced and insightful traders.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The Article/Information available on this website is for informational purposes only, you should not construe any such information or other material as investment advice or any other research recommendation. Nothing contained on this Article/ Information in this website constitutes a solicitation, recommendation, endorsement, or offer by LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu are not liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the website, but investors themselves assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Article/ Information on the website before making any decisions based on such information or other Article.

Editors’ Picks

EUR/USD Price Annual Forecast: Growth to displace central banks from the limelight in 2026 Premium

What a year! Donald Trump’s return to the United States (US) Presidency was no doubt what led financial markets throughout 2025. His not-always-unexpected or surprising decisions shaped investors’ sentiment, or better said, unprecedented uncertainty.

Gold Price Annual Forecast: 2026 could see new record-highs but a 2025-like rally is unlikely Premium

Gold hit multiple new record highs throughout 2025. Trade-war fears, geopolitical instability and monetary easing in major economies were the main drivers behind Gold’s rally.

GBP/USD Price Annual Forecast: Will 2026 be another bullish year for Pound Sterling? Premium

Having wrapped up 2025 on a positive note, the Pound Sterling (GBP) eyes another meaningful and upbeat year against the US Dollar (USD) at the start of 2026.

US Dollar Price Annual Forecast: 2026 set to be a year of transition, not capitulation Premium

The US Dollar (USD) enters the new year at a crossroads. After several years of sustained strength driven by US growth outperformance, aggressive Federal Reserve (Fed) tightening, and recurrent episodes of global risk aversion, the conditions that underpinned broad-based USD appreciation are beginning to erode, but not collapse.

Bitcoin Price Annual Forecast: BTC holds long-term bullish structure heading into 2026

Bitcoin (BTC) is wrapping up 2025 as one of its most eventful years, defined by unprecedented institutional participation, major regulatory developments, and extreme price volatility.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.