New traders will often hear of Banks & institutions in the markets, active at certain levels, and indeed will often see the huge moves created by their activity, but alas are sadly unable to gauge where these players are entering the market, and even less able to gauge how to benefit from these constant streams of liquidity.

We at Littlefish have developed an indicator which tracks the flow and volume of Banks & institutions in the markets and generates signals offering the opportunity to align with these directional flows. As with all great indicators, the indicator is most profitable when used as part of a solid trading strategy that seeks to identify potential market entries and then uses the Order Flow Trader as a powerful confirmation tool.

Read on as we run down the five Order Flow Trading Strategies you need to try right now!

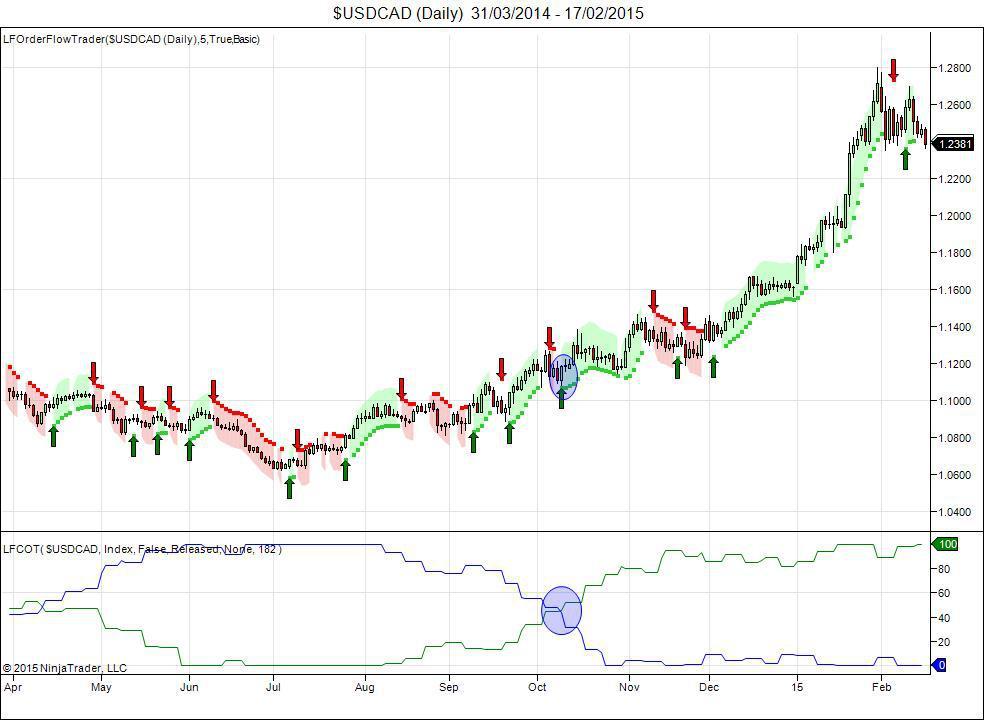

1.ORDER FLOW WITH COT

What Is It?

- Making the absolute most of available market information, this strategy is an incredibly powerful way to trade in line with the big fish in Forex. Our COT indicator automatically pulls the data from the weekly COT report to display the positioning of the main market participants directly on your charts, giving you the broader directional bias of Banks and institutions. Order Flow trader then tracks the flow and volume of their activity to give specific entries in line with their directional bias.

Best Thing About It

- Made over 39,000 pips profit in 2014

- Trades in line with Banks & major institutions

- Clear, easy to read signals

- Only takes small amount of time to check charts for signals

2.MULTI-TIMEFRAME ORDER FLOW

What Is It?

- An incredibly powerful swing trading strategy looking to trade in line with Banks & major institutions on a much broader scale, using higher timeframe OFT signals to signal a trade direction and confluent lower timeframe OFT signals to confirm and execute the trade at a reduced risk and potentially gain entry to much larger moves.

Best Thing About It

- Only need one indicator on your charts

- Generates really high profits through multiple confluent positions

- Trades in line with Banks & major institutions on a longer term basis

- Catches fantastic trends

3.TRIPLE THREAT TRADING (ORDER FLOW WITH COT & PIN BAR)

What Is It?

- A bit of a tweak on our Order Flow & COT strategy, this time we bring the classic Pin Bar candlestick which is an LFX favourite, to act as further confirmation on our trade entry. Geared towards the more conservative trader, this three tier strategy helps to identify prime entries to broad market moves with the security of a multiple filter approach.

Best Thing About It

- Much more conservative, lower trade frequency

- Gains entry to big market moves from really accurate signals

- Uses market information and price action to generate profitable trade entries

- Can use our Pin Bar Indicator to automatically highlight Pin Bars and customize their parameters

4.ORDER FLOW WITH RSI

What Is It?

- Combining the best of the old and the new, this powerful swing trading strategy is incredibly straight forward and easy to follow and uses RSI divergence along with Multi-Timeframe OFT confirmation to highlight fantastic trades. Higher timeframe traders will love the simplicity and effectiveness of this method.

Best Thing About It

- Totally enhances RSI divergence effectiveness

- Works off Daily & H4 timeframes and so plenty of time to monitor setups.

- Can be used on lower timeframes too.

- Gives really tight entries at big reversal points

- Really simple strategy with easy-to-learn process

5.ORDER FLOW WITH CHART PATTERNS

What Is It?

- An extremely effective strategy teaching the trader how to read market structure and use OFT to confirm movements in line with historical market patterns creating powerful trading opportunities with simplicity and ease.

Best Thing About It

- Simple and reliable method

- Works on all timeframes

- Only need basic analysis + OFT

- OFT is a great tool for filtering false breakouts and false moves which are traditional issues with pattern trades

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD struggles near 1.1850, with all eyes on US CPI data

EUR/USD holds losses while keeping its range near 1.1850 in European trading on Friday. A broadly cautious market environment paired with a steady US Dollar undermines the pair ahead of the critical US CPI data. Meanwhile, the Eurozone Q4 GDP second estimate has little to no impact on the Euro.

GBP/USD recovers above 1.3600, awaits US CPI for fresh impetus

GBP/USD recovers some ground above 1.3600 in the European session on Friday, though it lacks bullish conviction. The US Dollar remains supported amid a softer risk tone and ahead of the US consumer inflation figures due later in the NA session on Friday.

Gold remains below $5,000 as US inflation report looms

Gold retreats from the vicinity of the $5,000 psychological mark, though sticks to its modest intraday gains in the European session. Traders now look forward to the release of the US consumer inflation figures for more cues about the Fed policy path. The outlook will play a key role in influencing the near-term US Dollar price dynamics and provide some meaningful impetus to the non-yielding bullion.

US CPI data set to show modest inflation cooling as markets price in a more hawkish Fed

The US Bureau of Labor Statistics will publish January’s Consumer Price Index data on Friday, delayed by the brief and partial United States government shutdown. The report is expected to show that inflationary pressures eased modestly but also remained above the Federal Reserve’s 2% target.

The weekender: When software turns the blade on itself

Autonomous AI does not just threaten trucking companies and call centers. It challenges the cognitive toll booths that legacy software has charged for decades. This is not a forecast. No one truly knows the end state of AI.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.