I’m Markus Heitkoetter and I’ve been an active trader for over 20 years. I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails. They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically. Real money…real trades.

If you are wondering whether you should trade or not, I will give you three reasons why you should trade.

Reason Number One: You Can’t Save Your Way To Financial Freedom

I hear outlandish claims all the time from people claiming you can save your way to financial freedom, but it simply doesn’t work this way.

There are even some people who say that if you stop buying coffee every day you can save enough to become a millionaire.

Now, let me be honest, this is complete BS, I will prove it to you. I did the math, and I used a calculator from Dinkytown, which is a savings calculator.

Now let’s look at the numbers.

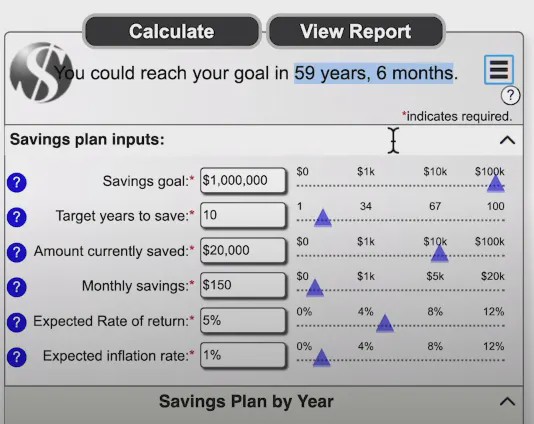

Say your goal is to have a million dollars in your savings account, you have 10 years to reach this goal, and right now you have already saved $20,000.

How long would it actually take to grow your savings of $20,000 to a million dollars if you stopped buying coffee every day?

How much does a latte cost, $5 maybe? Well if you stopped buying coffee for 30 days, you would save about $150 a month.

Let’s assume that we get an expected rate of return if you’re putting it into a savings account, as this is what some of these people suggest that you do.

They will tell you to just put it in a savings account or in an index fund. You’ll be earning what maybe 5%?

I hate to break it to you, but with a savings of $150 a month, earning 5% interest, it will take you 59 years to save up to a million dollars.

59 years and 6 months to be exact.

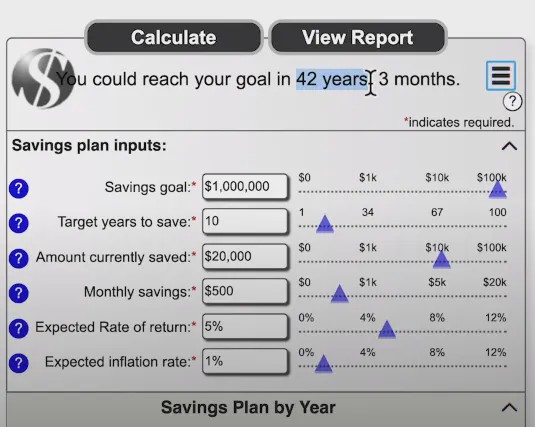

Let's go a step further and say that, in addition to giving up buying coffee every day, you also stop going out, and can then save $500 a month.

Good news. If you saved $500 instead of only $150 a month, it would take you ONLY 42 years to get to your goal of a million dollars.

Look, I don’t know about you, but I don’t have that much time.

At my age, I don’t have 42 years, and most people that I talk to, and teach how to trade don’t have 42 years either.

So this is why, as you can see, you can’t save your way to financial freedom.

You must find a way to make more money and trading is a perfect way to do this. Now let’s move on, and talk about reason number two.

Reason Number Two: Trading Is The Ultimate Playing Field

Trading is absolutely the ultimate playing field, which is really exciting to me. What do I mean by “ultimate playing field?”

This means that when you’re trading, it absolutely doesn’t matter who you are.

It doesn’t matter whether you’re young or old, a man or a woman, or if you’re white, back, grown, green or pink — you get the idea right?

It doesn’t matter whether you’re a math genius, or you need a calculator to add two numbers together as I do. Those that know me, know I use a calculator for everything.

It doesn’t matter whether you’re a Ph.D. or whether you dropped out of high school.

This is why trading is the ultimate equal opportunity. When trading there is no discrimination. And you see everywhere else there is discrimination.

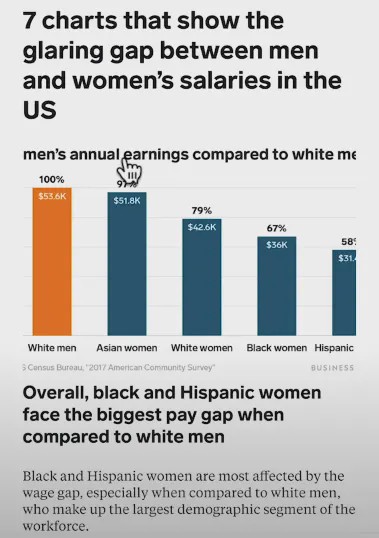

I found an article on Business Insider, that I want to refer to briefly, but I was shocked to see this.

So this is women’s annual earnings compared to white men.

According to this, Asian women only earn 97% compared to white men, white women earn 79%, black women 67%, and 58% for Hispanic women.

I’m not trying to get too political here, I just want to illustrate that we already know that in all areas of life, there is discrimination.

Not when trading, however. Keep this in mind.

When trading it’s not men versus women, or young versus old, or black versus white. When trading it’s the educated versus the uneducated.

The ones that win are the ones that have a system, the right tools, and the right mindset. These are the ones trading against the gamblers.

So trading is the ultimate playing field and this is why I love it.

Now before I started, you may have thought my top reasons were probably things like:

You can trade anywhere, you can do it anytime, and you will have a lot of free time and money.

Yes, all of these are good reasons, but I wanted to give you my top three reasons why I think that you should trade.

Reason Number Three: Trading Can Make You Money & Money Buys Happiness

I’m a firm believer that money CAN buy happiness.

Now, I know that this is controversial because people say, “Money can’t buy you happiness.” Based on my experience, they are wrong.

I will prove it to you. If you’re an avid reader of this blog, a subscriber to my YouTube channel, or are a member of Rockwell Trading, you know I’m always about the facts.

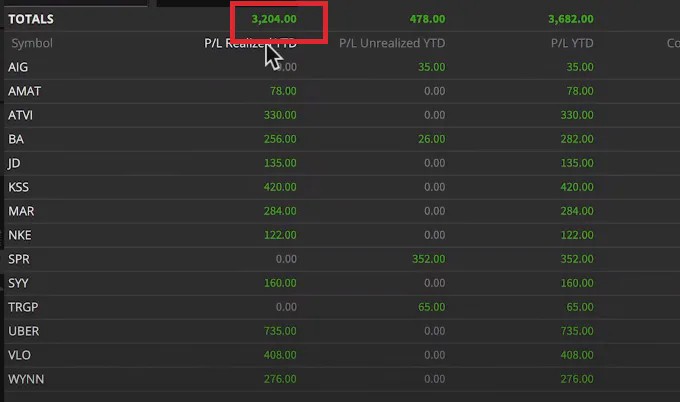

I have multiple trading accounts, and recently I was trading a small account live here on my YouTube channel using a trading strategy called The Wheel.

Many of you are already trading this strategy as well.

On this account up to this point, I have made $3,204, in a month. Even though this isn’t my main account, and is one of my smaller ones, $3,200 is not too bad.

Let me prove to you how money can buy happiness.

Let me ask you, do know somebody who is in a tough spot right now with everything that we have going on in the world?

Do you know someone who got laid off and couldn’t pay their rent? Someone who got sick and couldn’t afford to buy the needed medication?

What about somebody whose car broke down, and didn’t have money to fix it making transportation difficult?

So so let me ask you this. What if you could have given them $3,204? Do you think that this could have changed that person’s life?

Making $3,000 for me is nice, but it doesn’t change my life. But maybe you know somebody whose life we can change with this.

Very recently, I decided to give away that month’s worth of profits to a few people in need.

I had our members and viewers nominate someone they knew, who was currently having a tough time.

We received so many applications, and I reviewed the (heart-wrenching) submissions.

I picked the two candidates who I felt could use it the most, and I split the profits from this trading account and sent them a check.

It helped them out a great deal, and it meant the world to them.

So for me, this was very solid proof that money CAN buy happiness, and can change your life for the better.

I believe we have a responsibility to make more money to help not just ourselves, but others.

Money buys happiness and this is why I will keep doing it.

I’m doing this information out there because I want you to succeed. I want you to make money to give back.

There are so many people in need that you could help. Here is an example of one of the nominations for the recipient of the trading profits we gave away.

This nominee is a single mother of four children. Her son had a needed surgery a while back and she got stuck with a $9,000 bill. She’s getting garnished for this by taking $150 from each of her paychecks. She’s a nursing assistant and doesn’t receive all that much.

She wasn’t one of the recipients that I chose as the final two, but I decided to send her the money that she needed anyway.

Now doesn’t have to worry about her paychecks getting garnished for a whole year.

Here is an email that I received over the weekend, and it’s from a man named Robert, and it read,

“Markus, thank you for being you, brother! Could go into a long story about how ironic it is that I’ve been a Rockwell member for almost four years and finally started applying your trading rules in August of 2020, and had one of my best months ever.

But that’s not what this is all about. I would like to donate an additional $300 to whoever you decide to give the money to. I feel very blessed and just want to pay it forward. Let me know the best method to get the money to you. Thanks for your persistence and all you do.”

Why I’m showing you this e-mail? This is exactly what happens when we start making money together.

I know that people are probably telling you,

“You can’t make money with trading.”

Well, you know what? Prove them wrong. You can make money with trading. Is it easy? No, because you need three things:

You need the right strategy, the right tools, and the right mindset.

Together we can make a difference

Money buys happiness.

I believe we have a moral obligation to make as much money as we possibly can to be like Robert. I know that many of you are already donating. I mean, you have told me in these emails and I’m so, so proud of you for what you’re doing already.

Together we can make a difference. This is what this blog is all about, and this is what this message is all about.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

Gold plunges on sudden US Dollar demand

Gold drops markedly on Thursday, challenging the $4,900 mark per troy ounce following a firm bounce in the US Dollar and amid a steep sell-off on Wall Street, with losses led by the tech and housing sectors.

EUR/USD turns negative near 1.1850

EUR/USD has given up its earlier intraday gains on Thursday and is now struggling to hold above the 1.1850 area. The US Dollar is finding renewed support from a pick-up in risk aversion, while fresh market chatter suggesting Russia could be considering a return to the US Dollar system is also lending the Greenback an extra boost.

GBP/USD change course, nears 1.3600

GBP/USD gives away its daily gains and recedes toward the low-1.3600s on Thursday. Indeed, Cable now struggles to regain some upside traction on the back of the sudden bout of buying interest in the Greenback. In the meantime, investors continue to assess a string of underwhelming UK data releases released earlier in the day.

LayerZero Price Forecast: ZRO steadies as markets digest Zero blockchain announcement

LayerZero (ZRO) trades above $2.00 at press time on Thursday, holding steady after a 17% rebound the previous day, which aligned with the public announcement of the Zero blockchain and Cathie Wood joining the advisory board.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.