Stanley Druckenmiller is considered to be one of the greatest investors of all time. In a career that has spanned decades and even centuries ( he started managing money in the 1970’s) and traded through a variety of financial crises from the Black Monday crash of 1987 to the LTCM blow up in 1997 to the popping of the Internet bubble in 2000’s and the Global Financial Crisis of 2008 without ever recording a losing, although he would be the first to admit that part of that remarkable record is due to the luck of the calendar.

Nevertheless, Druckenmiller possesses one of the most creative and original minds in finance so it’s worth a look to see what he is trading now keeping in mind that part of his long term success is the ability to change his mind on a dime.

In a wide ranging interview with Tony Pasquariello of Goldman Sachs Druckenmiller revealed his best ideas for 2021 showing how he is positioned at the moment.

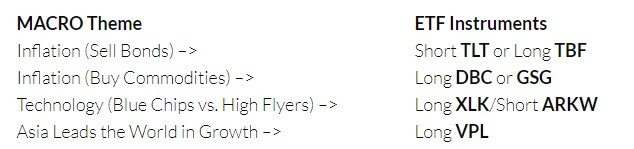

Druckemiller’s central thesis is that the massive fiscal expansion in the budget deficit along with the ultra accommodative policy of the Fed will create inflationary pressures throughout the global economy and his largest macro bet is to be short US bonds at the long end of the curve and long a basket of commodities. Investors who have the ability to trade on margin can easily implement this trade by shorting the TLT ETF which tracks US Treasuries at 20+ year maturity and by getting long either the DBC or the GSG ETFs both of which track a broad basket of commodity prices and are up double digits this year. Investors who cannot trade on margin could consider the TBF EFT which is simply a 1X leveraged inverse long bond ETF that tries to mirror a short position in 20+ year Treasury maturities. If the bonds yield on the 10 year move to the 2.00% – 3.00% range within a year, that position will explode to the upside.

When it comes to equities Drukenmiller proposes two relative strength bets. In the US equity market he believes that higher yields will be toxic to the high flying 40X revenue technology stocks and will be much less problematic for technology blue chips such as AAPL, MSFT, FB and AMZN so one possible way to play the theme is to be long the high technology XLF ETF while being short ARKW (ARK Next Generation Internet ETF) which holds many of the high flyers.

Finally, Druckenmiller is very bullish Asia versus North America and Europe and is heavily invested across all major Asian equities bourses and currencies. His thesis is that Asia has been able to weather the COVID pandemic far better than Europe or US. The balance sheets of the region of both public and the private sectors are far better than those of the US and the rebound in growth will be stronger as well. Druckenmiller is long all the major stock markets in the region including Korea, China, Taiwan and Hong Kong but retail investors the easiest way to invest in the region is to simply buy the VPL ETF which tracks the broad index of stock in the region and is up strongly this year.

Druckenmiller is a strong proponent of making concentrated bets and then watching the investment carefully. So far this year his sense of market direction has been spot on and his primary view that Treasury yields will rise materially over the next year could pay off big if the macro forces align with his forecast.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD retakes 1.1800 on renewed USD weakness

EUR/USD gains ground after three days of losses, re-attempting 1.1800in the European trading hours on Thursday. The US Dollar sees fresh selling interest across the board, despite hawkish Fed Minutes, as the market mood improves and supports the pair. US Jobless Claims data, Fedspeak and geopolitics remain in focus.

GBP/USD recovers above 1.3500 amid better mood

GBP/USD finds fresh demand and rises back above 1.3500 in the European session on Thursday. Improving risk sentiment and renewed US Dollar weakness are helping the pair recover ground ahead of mid-tier US data releases and Fedspeak.

Gold clings to gains above $5,000 amid safe-haven flows and Fed rate cut bets

Gold sticks to modest intraday gains, above the $5,000 psychological mark, through the first half of the European session, though it lacks bullish conviction amid mixed cues. The third round of US-mediated negotiations between Ukraine and Russia concluded in Geneva on Wednesday without any major breakthrough.

Injective token surges over 13% following the approval of the mainnet upgrade proposal

Injective price rallies over 13% on Thursday after the network confirmed the approval of its IIP-619 proposal. The green light for the mainnet upgrade has boosted traders’ sentiment, as the upgrade aims to scale Injective’s real-time Ethereum Virtual Machine architecture and enhance its capabilities to support next-generation payments. The technical outlook suggests further gains if INJ breaks above key resistance.

Hawkish Fed minutes and a market finding its footing

It was green across the board for US Stock market indexes at the close on Wednesday, with most S&P 500 names ending higher, adding 38 points (0.6%) to 6,881 overall. At the GICS sector level, energy led gains, followed by technology and consumer discretionary, while utilities and real estate posted the largest losses.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.