This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

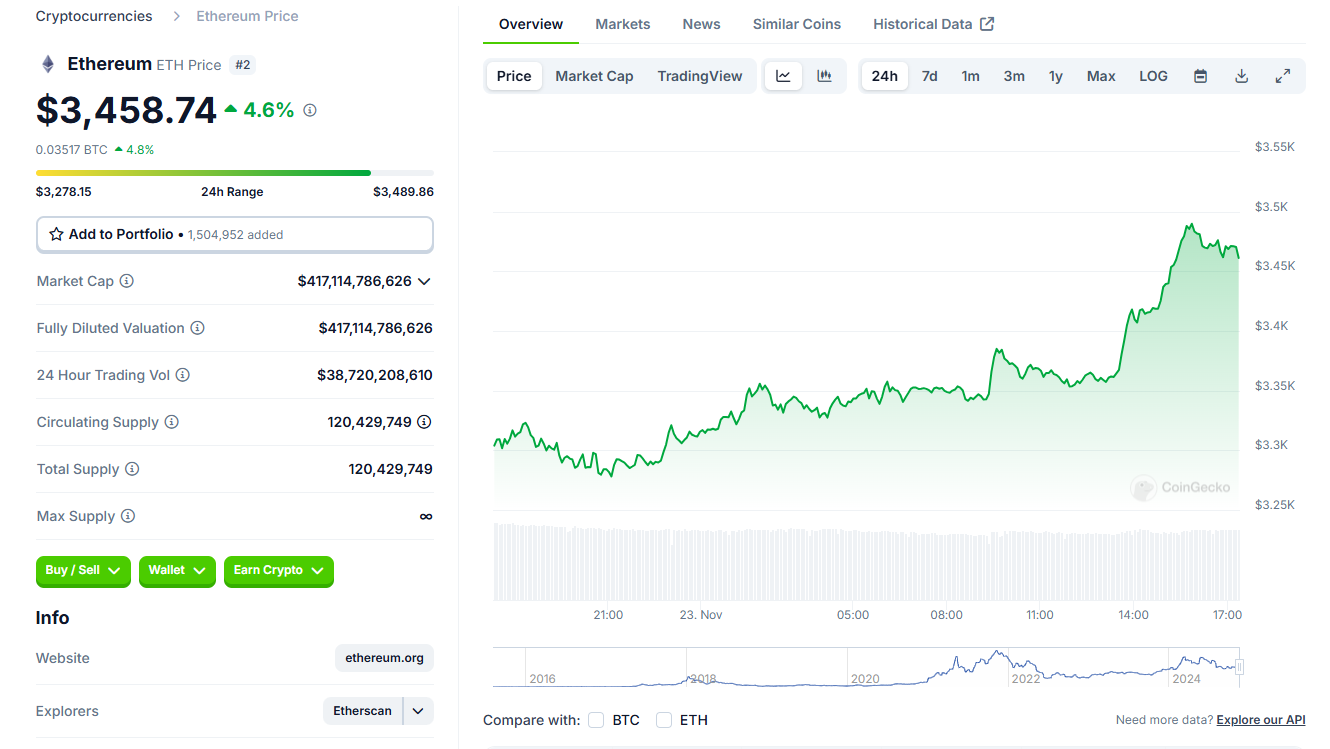

Ethereum (ETH), the world’s second-largest cryptocurrency, has been making headlines again. It has seen a healthy 8% jump in just the past day.

This sudden surge has people talking about its long-term potential, particularly as staking gains traction and decentralized finance (DeFi) continues its impressive growth.

Innovations in the broader ecosystem, including projects like PlutoChain ($PLUTO), are adding even more momentum to the DeFi space.

But could Ethereum really break the $8,000 barrier?

Can Ethereum reach $8,000 with staking and DeFi momentum?

A lot of this conversation around Ethereum’s future stems from the success of its staking mechanism, introduced during the shift to Proof-of-Stake (PoS).

Essentially, staking allows ETH holders to lock their coins to help secure the network and earn rewards in return.

The adoption has been nothing short of remarkable: as of October 2024, nearly 29% of all ETH is staked – up from just under 24% at the start of the year.

That’s a huge chunk of supply taken off the market, which could tighten availability and drive up prices.

At the same time, Ethereum’s smart contract capabilities have fueled the explosion of DeFi platforms.

These decentralized apps are rewriting the rules of finance by letting people lend, borrow, and earn interest without the need for banks.

Major players like Lido Finance, which crossed one million validators earlier this year, are leading the charge.

Meanwhile, the total value locked (TVL) across DeFi protocols has jumped more than 65% in just a few months, showing that users are flocking to the ecosystem.

As of November 23, 2024, Ethereum (ETH) is trading at approximately $3,452.30, reflecting a 4.5% increase over the past 24 hours, according to CoinGecko.

Some analysts are boldly optimistic about the future of Ethereum.

Geoff Kendrick from Standard Chartered predicts ETH could hit $8,000 by the end of the year, citing growing interest from institutional investors and the green light for Ethereum exchange-traded funds (ETFs).

The approval of spot Ether ETFs by the U.S. SEC back in July was a game-changer. Analysts believe these ETFs could pull in $15 billion of fresh investment over the next year and a half, giving Ethereum an undeniable boost.

On the other hand, the SEC’s scrutiny of staking, particularly around whether it might qualify as a security, is causing some uncertainty.

Add to that the unpredictable nature of global markets, and it’s clear the road to $8,000 won’t be a straight shot.

The crypto world is nothing if not volatile, and even the most promising trends can be derailed by external forces like regulations or macroeconomic pressures.

PlutoChain ($PLUTO): Revolutionizing Bitcoin layer-2 technology

PlutoChain ($PLUTO) is a new utility project that wants to change BTC’s involvement in DeFi.

As a groundbreaking Layer-2 blockchain, PlutoChain aims to enhance Bitcoin's ecosystem by introducing smart contracts and DeFi applications directly onto its network.

PlutoChain’s mission is to harness Bitcoin’s unparalleled security while expanding its utility in transformative ways.

A standout feature of the platform is its focus on reducing transaction fees, a critical benefit for users, particularly during times of market volatility.

Furthermore, the platform’s full compatibility with the Ethereum Virtual Machine (EVM) enables developers to migrate Ethereum-based DeFi projects seamlessly onto Bitcoin’s blockchain.

This innovation not only increases Bitcoin’s functionality but also opens new doors for integrating it into the burgeoning DeFi landscape.

Uncompromising security with SolidProof audits

Security is at the core of PlutoChain’s development. The platform has undergone a comprehensive audit conducted by SolidProof to address vulnerabilities in its smart contracts and overall infrastructure.

This dedication to proactive risk management highlights the project’s commitment to protecting its users’ investments.

Regular audits and continuous monitoring guarantee that the platform remains secure and trustworthy in an environment often plagued by scams and security concerns.

Why PlutoChain stands out

PlutoChain’s innovative approach to Layer-2 technology positions it as a project with enormous potential.

By bridging Bitcoin with DeFi, maintaining low fees, and prioritizing security, PlutoChain is set to reshape how Bitcoin is utilized in the broader financial ecosystem.

For those interested in the future of crypto, exploring PlutoChain’s whitepaper or joining its active communities on Twitter, Discord, and Telegram offers valuable insights into its evolving journey.

Visit the links below to learn more about PlutoChain and its unique features:

Official Website: https://plutochain.io

X/Twitter Page: https://x.com/plutochain/

Telegram Channel: https://t.me/PlutoChainAnnouncements/

This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

This article is not financial advice. Cryptocurrencies are risky and unpredictable; do your research. Forward-looking statements involve risks and may not be updated.

Recommended Content

Editors’ Picks

Starknet unveils strkBTC, shielded Bitcoin transactions on Ethereum Layer 2

Starknet, the Ethereum Layer 2 network developed by StarkWare, today announced strkBTC, a wrapped Bitcoin asset that introduces optional shielding while preserving full DeFi composability.

Bitcoin, Ethereum, and Ripple consolidate with short-term cautious bullish bias

Bitcoin, Ethereum and Ripple are consolidating near key technical areas on Friday, showing mild signs of stabilization after recent volatility. BTC holds above $67,000 despite mild losses so far this week, while ETH hovers around $2,000 after a rejection near its upper consolidation boundary.

Ethereum Price Forecast: FG Nexus continues distribution amid signs of returning risk-on sentiment

FG Nexus, once dubbed an Ethereum treasury firm, resumed offloading the top altcoin on Wednesday, distributing 7,550 ETH, according to data from smart money tracker EmberCN.

Top Crypto Gainers: Stable and Decred rally, Pippin approaches record highs

Altcoins, such as Stable, Decred, and Pippin, are extending gains so far this week, defying the risk-averse conditions in the broader cryptocurrency market. Stable and Pippin are near record high levels, while Decred extends its breakout rally above $30.

Crypto Today: Bitcoin, Ethereum, XRP tilt toward breakout on risk-on sentiment

Bitcoin (BTC) kicked off October on a strong note, with the price breaking above $116,000 on Wednesday. Despite a market-wide expectation that September is usually a bearish month for cryptocurrencies, BTC posted gains of 5.31%.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.