This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

The SEC’s pending decision on spot Bitcoin ETFs has the crypto community on edge, with several enormous firms awaiting regulatory approval.

Many believe an approved Bitcoin ETF could propel BTC's price back above $50,000 – yet these ETFs would likely positively impact an array of altcoins and tokens.

One altcoin that some traders believe could benefit is the new presale project Bitcoin Minetrix (BTCMTX), which looks primed for growth once listed on major exchanges later this year.

Bitcoin struggles to maintain momentum under vital $30k level

Bitcoin finds itself in a challenging position right now, trading around the $27,000 mark.

The coin's price has been highly volatile throughout most of 2023 and could not sustain itself above the crucial $30,000 barrier back in July.

Currently, BTC is 60% below November 2021’s all-time high, with various factors contributing to the coin’s downfall.

One of the main factors is persistently high inflation levels, which have led to rising interest rates and a bearish crypto market sentiment.

Additionally, the implosion of some major cryptocurrency firms, such as FTX, has shaken the confidence of the whole ecosystem.

While crypto enthusiasts hope for an end-of-year rebound, many investors remain skeptical.

The Bitcoin sentiment index from Augmento.io is currently sitting at a value of 0.40, veering into bearish territory.

Combine this with the Fed's assertion that high interest rates will likely stay in 2024, and the path forward looks murky for the world's largest cryptocurrency.

Spot BTC ETF approval could reignite bullish sentiment

The potential approval of a spot Bitcoin ETF by the SEC could be a significant catalyst to propel Bitcoin back to the $50,000 milestone.

According to a recent article from CoinDesk, a bipartisan group of lawmakers have urged SEC Chair Gary Gensler to approve outstanding BTC ETF applications "immediately."

This followed a court ruling that the SEC was “arbitrary” in rejecting Grayscale’s ETF application.

Crypto advocates argue that a spot Bitcoin ETF would allow easy access for retail investors while unlocking vast amounts of institutional capital.

As such, while ETF approval may not drive Bitcoin directly to $50,000, it would likely provide a psychological boost and remove the regulatory uncertainty currently hindering the adoption of crypto in the US.

However, as of writing, the SEC remains hesitant – meaning Bitcoin may need to find other catalysts for growth in the interim.

Bitcoin Minetrix seeks to Democratize crypto mining through innovative stake-to-mine model

With Bitcoin’s path forward looking unclear, a revolutionary new crypto project called Bitcoin Minetrix (BTCMTX) is generating buzz.

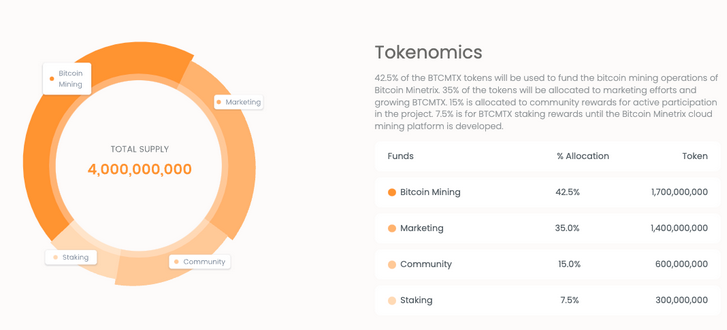

According to the project’s whitepaper, Bitcoin Minetrix seeks to open crypto mining to everyday investors through a "Stake-to-Mine" mechanism.

This mechanism allows users to stake BTCMTX tokens to earn credits, which are redeemable for Bitcoin cloud mining time.

By taking this approach, Bitcoin Minetrix’s team aims to remove the high barriers to entry that currently restrict BTC mining to those with the resources to purchase advanced computing hardware.

With BTCMTX currently available via presale for just $0.011, speculative investors are already scooping up tokens, hoping for explosive growth once it makes its open market debut.

The presale has already raised close to $200,000 – with some crypto influencers believing it has enormous potential going forward.

Looking ahead, the project’s team intends to partner with large mining firms to boost its mining capacity, providing a pathway to additional income for BTCMTX holders, according to the Bitcoin Minetrix website.

Given Bitcoin’s sluggish price action, Bitcoin Minetrix’s low buy-in price, and the massive gains seen by similar Bitcoin-style altcoins recently, it’s possible that BTCMTX could surge to $1 sooner than Bitcoin returns to $50,000.

However, this would require BTCMTX to surge 89,900%, which seems highly ambitious, even for the volatile crypto market.

Regardless, this future looks exceedingly bright for Bitcoin Minetrix - making a crypto worth watching in the final months of 2023.

Visit Bitcoin Minetrix Presale

This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

ETF News provides quality insights in the form of financial guides and video tutorials on buying and investing in stocks. We compare the top providers and provide detailed insight into their product offerings. We do not advise or recommend any provider but want to enable our readers to make informed decisions and trade on their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss for your capital. Up to 67 % of retail investor accounts lose money trading with the brokers compared on this website. Please make sure you fully understand the risks and seek independent advice. By continuing to use this website, you agree to our Privacy Policy.

Recommended Content

Editors’ Picks

Grass 20% bullish breakout defies broader market weakness

Grass (GRASS) is edging up above $0.30 at the time of writing on Monday. The token’s notable 20% intraday surge stands out amid heightened volatility in the broader crypto market.

XRP slides as US-Iran war weakens sentiment

Ripple remains under pressure, trading around $1.35 at the time of writing on Monday. The remittance token extended its down leg to $1.27 on Saturday after the US, in collaboration with Israel, launched attacks on Iran, killing the nation’s Supreme Leader, Ali Khamenei.

Crypto Today: Bitcoin pares losses, Ethereum and XRP drift lower as Middle East conflict pressures risk assets

Bitcoin, Ethereum and Ripple remain on edge as the Israel-US war on Iran risk-off sentiment. The Crypto King trades above $66,000 at the time of writing on Monday, but is struggling to break through the seller congestion around $67,000.

Bitcoin on brink of breakdown amid US-Iran war

Bitcoin (BTC) remains under pressure near the key support level of $65,700. Trading at $66,400 at the time of writing on Monday, a breakdown below this critical level would suggest a deeper correction ahead.

Crypto Today: Bitcoin, Ethereum, XRP tilt toward breakout on risk-on sentiment

Bitcoin (BTC) kicked off October on a strong note, with the price breaking above $116,000 on Wednesday. Despite a market-wide expectation that September is usually a bearish month for cryptocurrencies, BTC posted gains of 5.31%.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.