This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

Over the past 24 hours, Bitcoin forks Bitcoin SV (BSV) and Bitcoin Gold (BTG) have been experiencing significant gains, drawing fresh attention from investors.

These coins have benefited from the enormous volatility in Bitcoin's price, stemming from the false reports that the SEC had approved a BlackRock BTC ETF.

Amid this renewed interest in Bitcoin derivatives, investors are also beginning to seek out novel opportunities to diversify their portfolios – with Bitcoin Minetrix (BTCMTX) emerging as an exciting option in this regard.

BSV price surges 15% as attention turns to Bitcoin forks

BSV, short for Bitcoin Satoshi Vision, has seen a price surge that has piqued the interest of the crypto community.

The coin emerged from a 2018 hard fork of Bitcoin Cash (BCH), aiming to better align with what its creators believed to be the true vision of Bitcoin’s mysterious founder, Satoshi Nakamoto.

Offering a larger block size compared to Bitcoin for faster transactions, BSV has carved out its own space within the market.

However, BSV hasn’t achieved the same success as some other Bitcoin derivatives and currently has a market cap of $761 million – making it the 47th largest cryptocurrency in the world.

Regardless, the BSV price has shot up by over 15% in the past day, driven by the attention surrounding Bitcoin.

At the time of writing, BSV is hovering around the $39.49 level and is approaching a critical resistance zone at $40.00.

BSV hasn’t traded comfortably above this zone since July – yet with the bullish momentum still ongoing, it appears likely that the coin could break this resistance in the near term.

Bitcoin Gold pumps 10% but faces resistance at 200-day EMA

Bitcoin Gold has also been pumping, with its price up over 10% from Monday’s low.

BTG was founded from a desire to democratize the crypto mining landscape, having forked from Bitcoin in October 2017.

Unlike its predecessor, Bitcoin Gold allows for mining via commonly available GPUs and aims to disrupt the concentration of mining power.

However, Bitcoin Gold's reputation took a severe hit in 2018 after it was the target of a 51% hashing attack – something that continues to affect its reputation to this day.

While it has faced reputational hurdles, BTG's price now trades around $13.47 following yesterday's market volatility.

BTG trading volume is up a whopping 145% in the past 24 hours, with investors eager to get their hands on coins, hoping that price continues rising.

Although the bulls are still in control, BTG's price is fast approaching the 200-day Exponential Moving Average (EMA) on the daily time frame – an indicator that could pose as dynamic resistance as it has done in the past.

New BTC “stake-to-mine” token BTCMTX gains traction & hits $1.6m presale milestone

Amid the renewed interest in Bitcoin forks like BSV and BTG, a new Bitcoin derivative called Bitcoin Minetrix (BTCMTX) has emerged as an exciting opportunity for crypto investors.

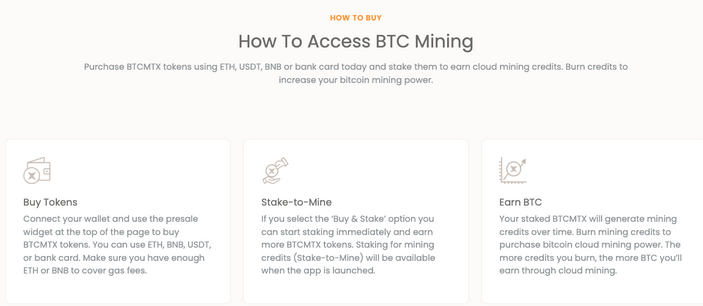

Unlike older forks, Bitcoin Minetrix isn't a clone of Bitcoin's blockchain but instead aims to disrupt cloud mining by introducing a novel "Stake-to-Mine" model.

By staking BTCMTX tokens, users can earn mining credits and tap into the project’s hashrate, allowing everyday investors to get exposure to Bitcoin mining returns.

Also, stakers can earn additional BTCMTX rewards, with yields of 361% per year on offer.

These elements have helped Bitcoin Minetrix’s ongoing presale generate tremendous traction, raising over $1.6 million in under four weeks.

Investors can buy BTCMTX tokens through this presale for just $0.0111 – although this price is only available in Stage 2.

The buzz around Bitcoin Minetrix has spread onto social media, with the project’s official X (formerly Twitter) account now boasting an audience of almost 3,000 people.

Prominent figures in the influencer community are also taking note, like Joe Parys, who stated that BTCMTX has “big potential” once it makes its open market debut.

With innovative features and a clear vision for the future, Bitcoin Minetrix seems poised for success, much like the other top BTC derivatives amid the ongoing market momentum.

Visit Bitcoin Minetrix Presale

This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

ETF News provides quality insights in the form of financial guides and video tutorials on buying and investing in stocks. We compare the top providers and provide detailed insight into their product offerings. We do not advise or recommend any provider but want to enable our readers to make informed decisions and trade on their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss for your capital. Up to 67 % of retail investor accounts lose money trading with the brokers compared on this website. Please make sure you fully understand the risks and seek independent advice. By continuing to use this website, you agree to our Privacy Policy.

Recommended Content

Editors’ Picks

Crypto market outlook for 2026

Year 2025 was volatile, as crypto often is. Among positive catalysts were favourable regulatory changes in the U.S., rise of Digital Asset Treasuries (DAT), adoption of AI and tokenization of Real-World-Assets (RWA).

Sberbank issues Russia's first corporate loan backed by Bitcoin

Russia's largest bank Sberbank launched the country's first Bitcoin-backed corporate loan to miner Intelion Data. The pilot deal uses cryptocurrency as collateral through Sberbank's proprietary Rutoken custody solution.

Bitcoin recovers to $87,000 as retail optimism offsets steady ETF outflows

Bitcoin (BTC) trades above $88,000 at press time on Tuesday, following a rejection at $90,000 the previous day. Institutional support remains mixed amid steady outflow from US spot BTC Exchange Traded Funds (ETFs) and Strategy Inc.’s acquisition of 1,229 BTC last week.

Traders split over whether lighter’s LIT clears $3 billion FDV after launch

Lighter’s LIT token has not yet begun open trading, but the market has already drawn a sharp line around its valuation after Tuesday's airdrop.

Crypto Today: Bitcoin, Ethereum, XRP tilt toward breakout on risk-on sentiment

Bitcoin (BTC) kicked off October on a strong note, with the price breaking above $116,000 on Wednesday. Despite a market-wide expectation that September is usually a bearish month for cryptocurrencies, BTC posted gains of 5.31%.

Bitcoin: Fed delivers, yet fails to impress BTC traders

Bitcoin (BTC) continues de trade within the recent consolidation phase, hovering around $92,000 at the time of writing on Friday, as investors digest the Federal Reserve’s (Fed) cautious December rate cut and its implications for risk assets.