Zcash gains 12% amid rising interest in ZEC treasury Cypherpunk Technologies

- Zcash is up 12% over the past 24 hours, stretching its weekly gain to nearly 25%.

- The rise follows an increasing social volume in ZEC treasury Cypherpunk Technologies.

- ZEC could rally to $620 if it breaks above the $472-$485 range.

Zcash is leading the crypto market recovery in the early Asian session on Friday, following a 12% jump over the past 24 hours. The move has extended its weekly gain to nearly 25%.

The privacy token's quick recovery aligns with a rise in the social volume of ZEC treasury firm Cypherpunk Technologies (CYPH). According to data from social analytics platform LunarCrush, the company's engagement reached 47.1K, 261% above its daily average.

Cypherpunk Technologies also recently welcomed Zcash cofounder Zooko Wilcox as a strategic advisor. The company raised $58.8 million via a private placement in November and deployed $50 million to acquire 203,775 ZEC.

CYPH closed with a 9.7% gain on Thursday, according to Google Finance data.

The gains in ZEC and related entities mark a notable recovery from a quick dip in the crypto market after the US Federal Reserve (Fed) delivered a hawkish rate cut on Wednesday. Top cryptocurrencies, including Bitcoin, Ethereum and XRP, are also showing signs of a comeback over the past few hours.

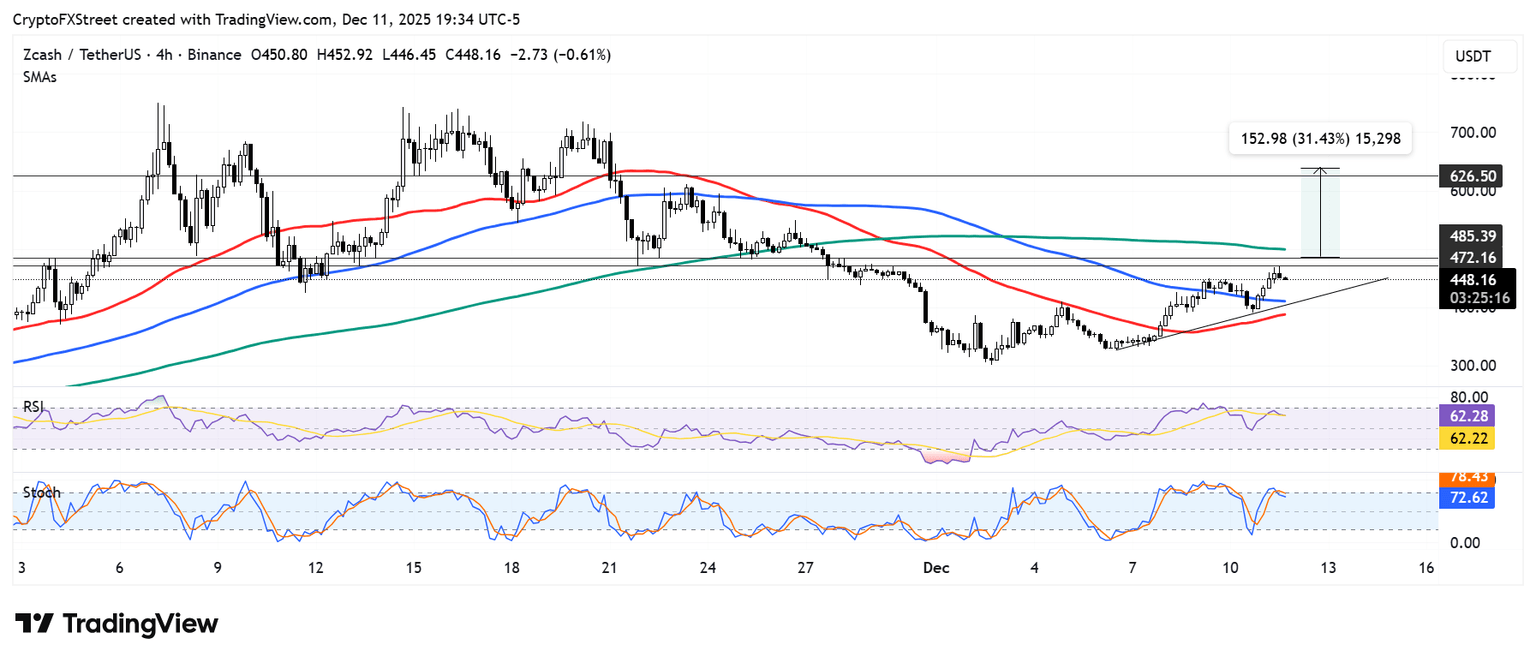

Zcash Price Forecast: ZEC could rally to $620 if it breaks above $485

Zcash saw $8.8 million in liquidations over the past 24 hours, spearheaded by nearly $7 million in short liquidations, per Coinglass data.

ZEC found support at the lower boundary of an ascending triangle but faces resistance near the $472-$485 range. A firm close above the range could push ZEC toward $620, a level obtained by measuring the height of the ascending triangle and projecting it upward from a potential breakout point.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) have retreated from overbought levels, reading 62 and 72, respectively, at the time of publication.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi