XRP Price Prediction: Ripple signals 35% breakout

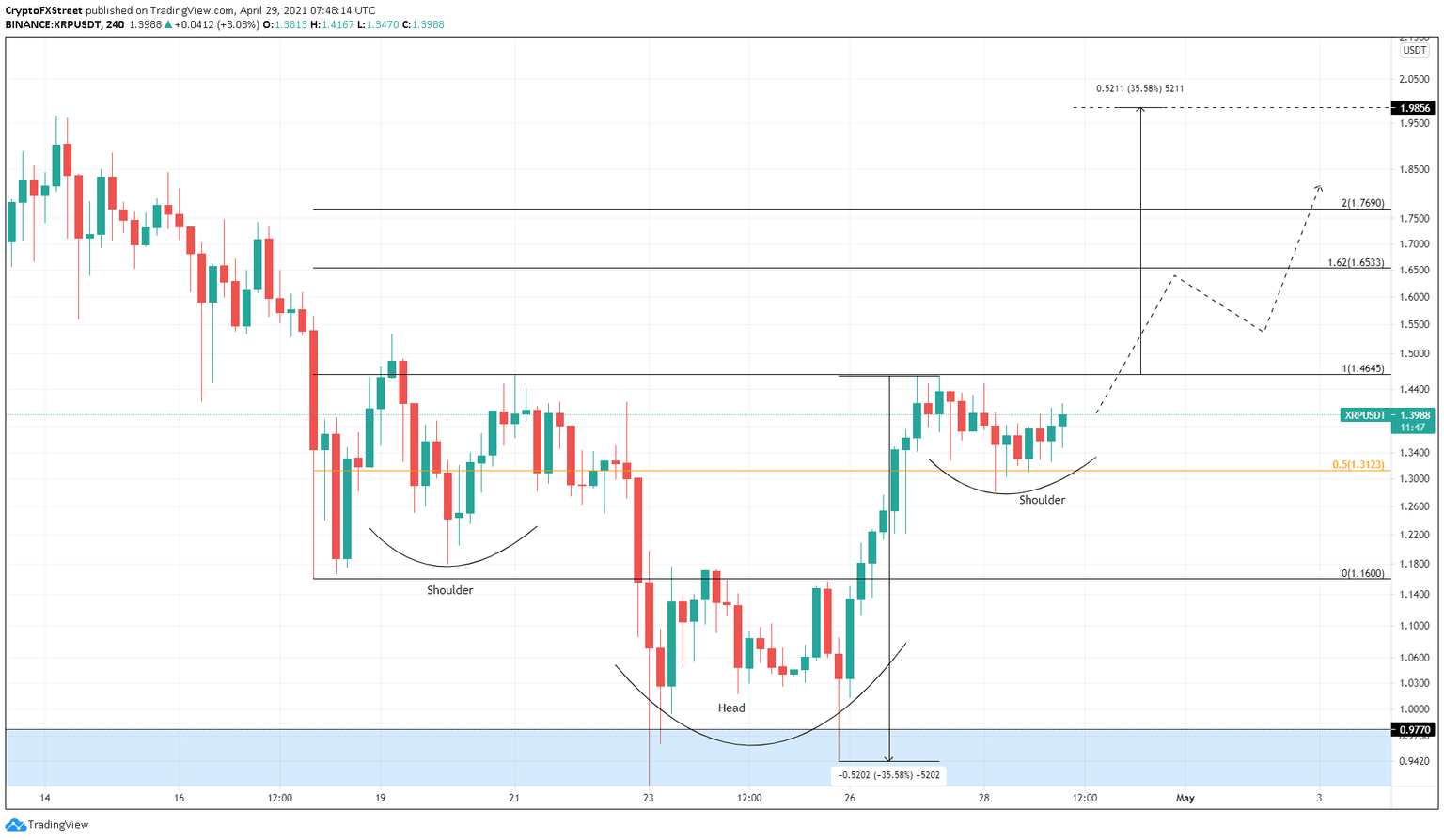

- XRP price shows a potential inverse head-and-shoulders in play, suggesting massive gains on the horizon.

- A decisive close above the neckline at $1.46 projects a 35% upswing to $1.98.

- However, a breakdown of $1.22 will result in a failure of the bullish setup and signals the start of a downtrend.

XRP price is consolidating after a recent swing to the upside and indicates more gains are yet to arrive due to the formation of a potentially bullish setup.

XRP price primed for new yearly highs

On the 4-hour chart, XRP price shows the formation of a potential inverse head-and-shoulders pattern. This technical setup contains three distinctive valleys. The one in the middle is typically deeper than the other two and forms the “head.” The slightly lower valleys of almost equal height create the “shoulders.” Hence, the namesake “head and shoulders.”

Connecting the series of highs of these swing lows reveals a resistance barrier known as a “neckline” at $1.46.

If the buyers produce a decisive close above this point, it would signal a breakout and project a 35% upswing, determined by measuring the distance between the horizontal resistance level and the swing low set up by the central valley. Adding this measure to $1.46 yields a target of $1.98.

While the theoretical target stretches 35%, XRP price may make pit stops at the 162% and the 200% Fibonacci extension levels at $1.65 and $1.76, respectively.

XRP/USDT 4-hour chart

If the sellers overwhelm the bulls, leading to a breakdown of $1.22, it will signal the start of a new downtrend for XRP price.

Under these newly evolved conditions, investors can expect the remittance token to slide 5% to $1.16, where it might find support and a resurgence of buyers.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.