XRP Price Forecast: XRP could go downhill as network activity plunges

- The number of active addresses in the XRP blockchain has significantly decreased in the past two weeks.

- The digital asset faces a strong resistance level ahead.

- If XRP bulls can hold a significant support point, Ripple could see massive upswing.

XRP had a colossal 44% upswing in the last three days after a significant correction down to $1. Unfortunately, it seems that investors aren’t as interested in XRP anymore, despite SEC fears fading away.

XRP price could see massive rejection

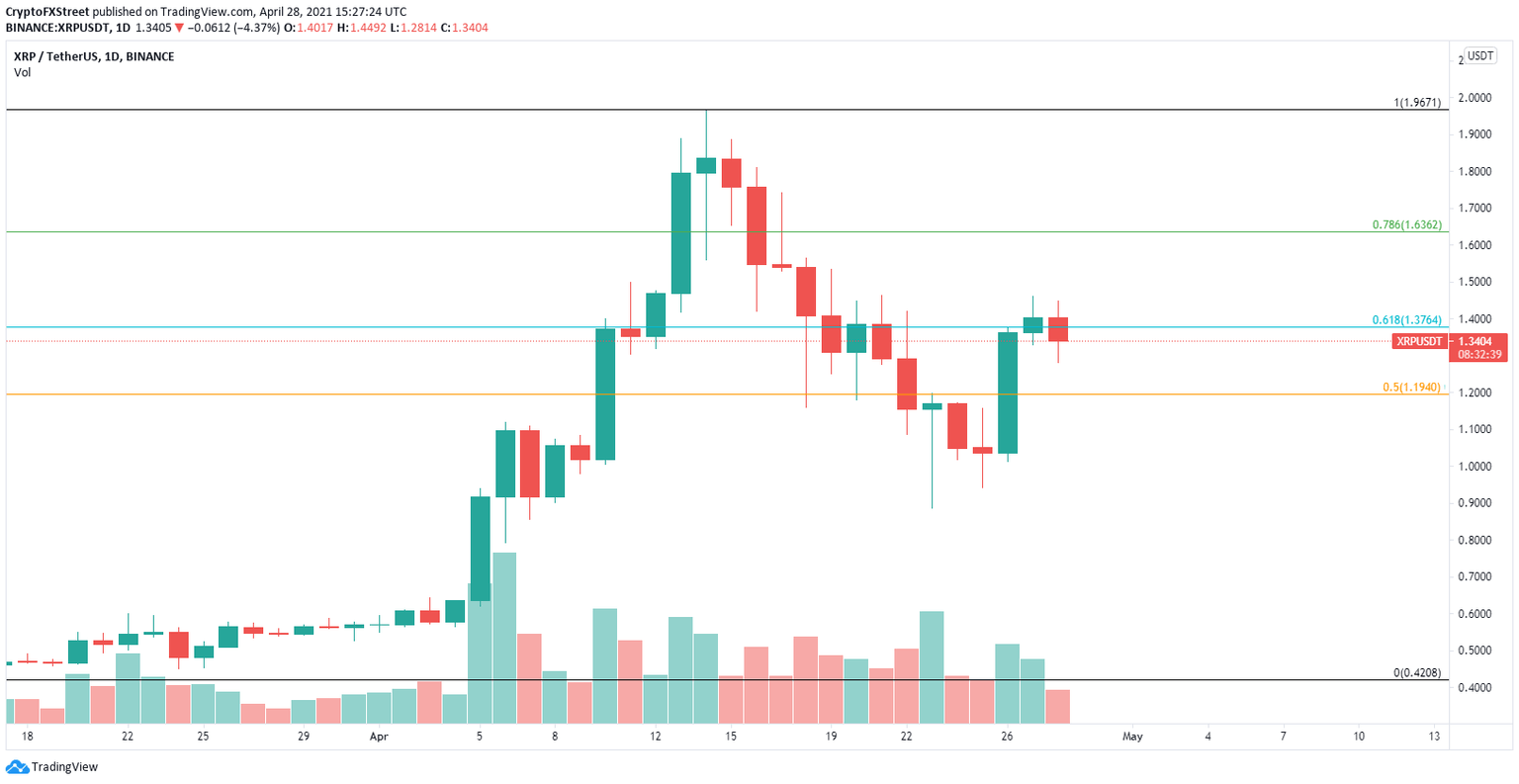

On the daily chart, XRP price got rejected from the 61.8% Fibonacci retracement level at $1.37. This could drive the digital asset down to the 50% Fibonacci level at $1.19.

XRP/USD daily chart

To further add credence to this outlook, we can check that the number of active addresses for XRP has been in a significant downtrend since April 14. This indicates that investors are less and less interested in purchasing or trading with XRP.

XRP Active Addresses chart

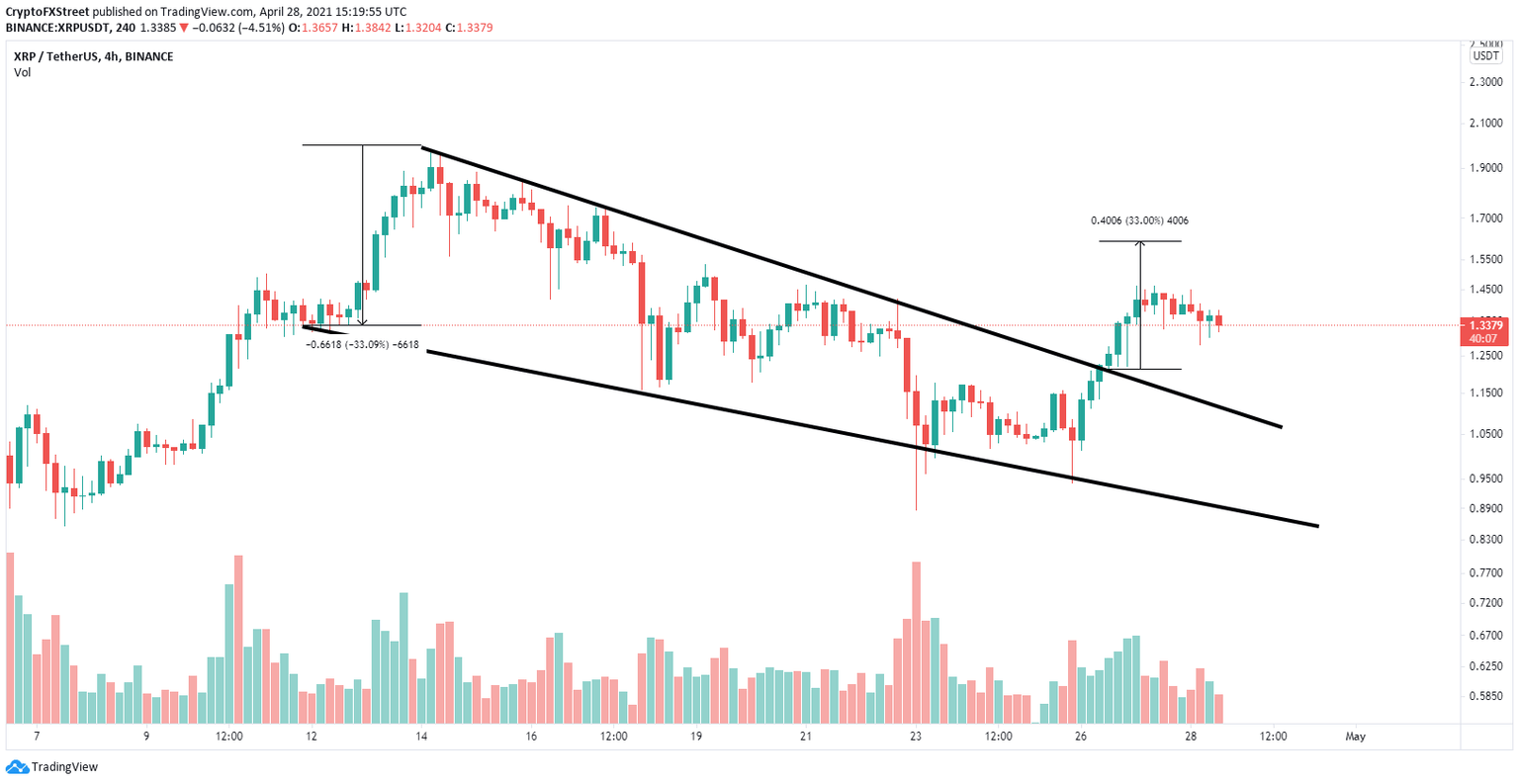

However, on the 4-hour chart, XRP formed a descending wedge pattern which can be drawn by connecting the lower highs and lower lows with two converging trend lines.

XRP/USD 4-hour chart

On April 26, XRP price had a breakout of this pattern but didn’t yet meet the price target of $1.62. As long as XRP bulls hold the previous trend line resistance which is located at $1.11, the price target of $1.62 remains valid.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B19.26.30%2C%252028%2520Apr%2C%25202021%5D-637552206553605070.png&w=1536&q=95)