XRP Price Prediction: Ripple hints at an explosive move

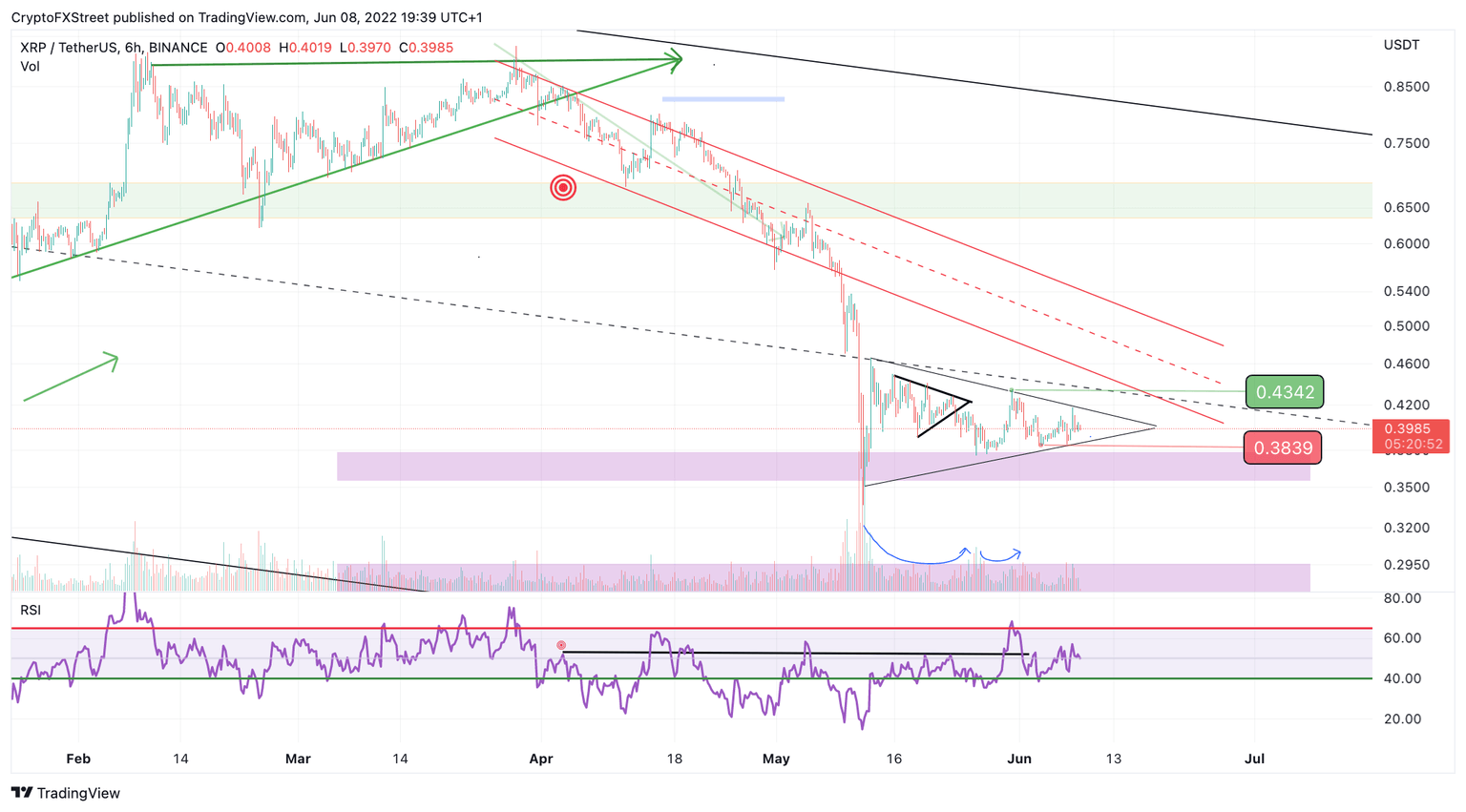

- XRP price coils in triangular fashion which explains the unpredictable price action during May.

- A breach below $0.3839 could trigger a 25% decline to $0.31.

- Invalidation of the bearish thesis is a breach above $0.4342, which could trigger a 25% rally towards $0.51.

XRP price unpredictability over the last few weeks is finally beginning to make sense. A triangle formation is now very apparent and justifies the erratic behavior displayed during the month of May.

XRP price is going to move 25% one way or the other

XRP price is beginning to show transparency as the digital asset has been notoriously challenging to trade during the month of May. The shakeouts, fakeouts, and false breakouts are now being stitched into a narrative that finally makes sense for the XRP community. A newfound triangle surrounds the XRP price. If the technicals are correct, a powerful 25% rally is now on the cards for the Ripple token, but the direction of its choice is still unclear.

XRP price currently trades at $0.4027. If the bears can produce a closing candle below $0.3839, a 25% decline could occur to $0.31. The lack of bullish involvement on the Volume Profile justifies this idea as triangle consolidations usually occur under low volume.

XRP/USDT 6-Hour Chart

The bulls could conquer the triangle, so traders must be aware of the opposite scenario. The bearish thesis will be void if the bulls can produce a closing candle above $0.4342. A 25% rally could occur to the upside landing the XRP price back into the $0.50 zone.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.