Ethereum Price Forecast: Vitalik Buterin outlines growth roadmap, says EF is entering period of 'mild austerity'

Ethereum price today: $2,690

- Vitalik Buterin says he will personally take on responsibilities to help scale Ethereum while ensuring it does not compromise core values.

- The Ethereum co-founder has withdrawn about $44.7 million in ETH to support growth on the chain with a focus on projects with genuine utility.

- ETH could find support at the 200-week EMA after losing the $2,880 level.

Ethereum (ETH) co-founder Vitalik Buterin has withdrawn 16,384 ETH worth approximately $44.7 million as the Ethereum Foundation implements a more fiscally disciplined approach to network development. The strategic shift aims to balance ambitious technical goals with long-term sustainability.

In a detailed post on X, Buterin explained the foundation is entering a phase of mild austerity "in order to be able to simultaneously meet two goals: Deliver on an aggressive roadmap that ensures Ethereum's status as a performant and scalable world computer that does not compromise on" resilience and decentralization, while ensuring the foundation's long-term sustainability.

The Ethereum co-founder announced he will personally take on development responsibilities that might otherwise require dedicated foundation resources. The withdrawn ETH will be deployed gradually over several years to support open-source infrastructure across finance, communications, governance, and privacy-preserving technologies.

Rather than pursuing an "Ethereum everywhere" strategy, Buterin emphasized building for users who genuinely need blockchain capabilities. "In a world where for many the usual mindset is to participate in a race to become a big and strong bully, otherwise the existing big and strong bullies will eat you first, our path represents a necessary alternative," he explained, positioning Ethereum as infrastructure for autonomy and security.

This transition occurs as Ether trades around $2,710, marking a six-month low and significantly below its October peak of approximately $4,831. Despite market headwinds, network activity has surged following December's Fusaka upgrade, with daily active addresses and transaction counts reaching record highs.

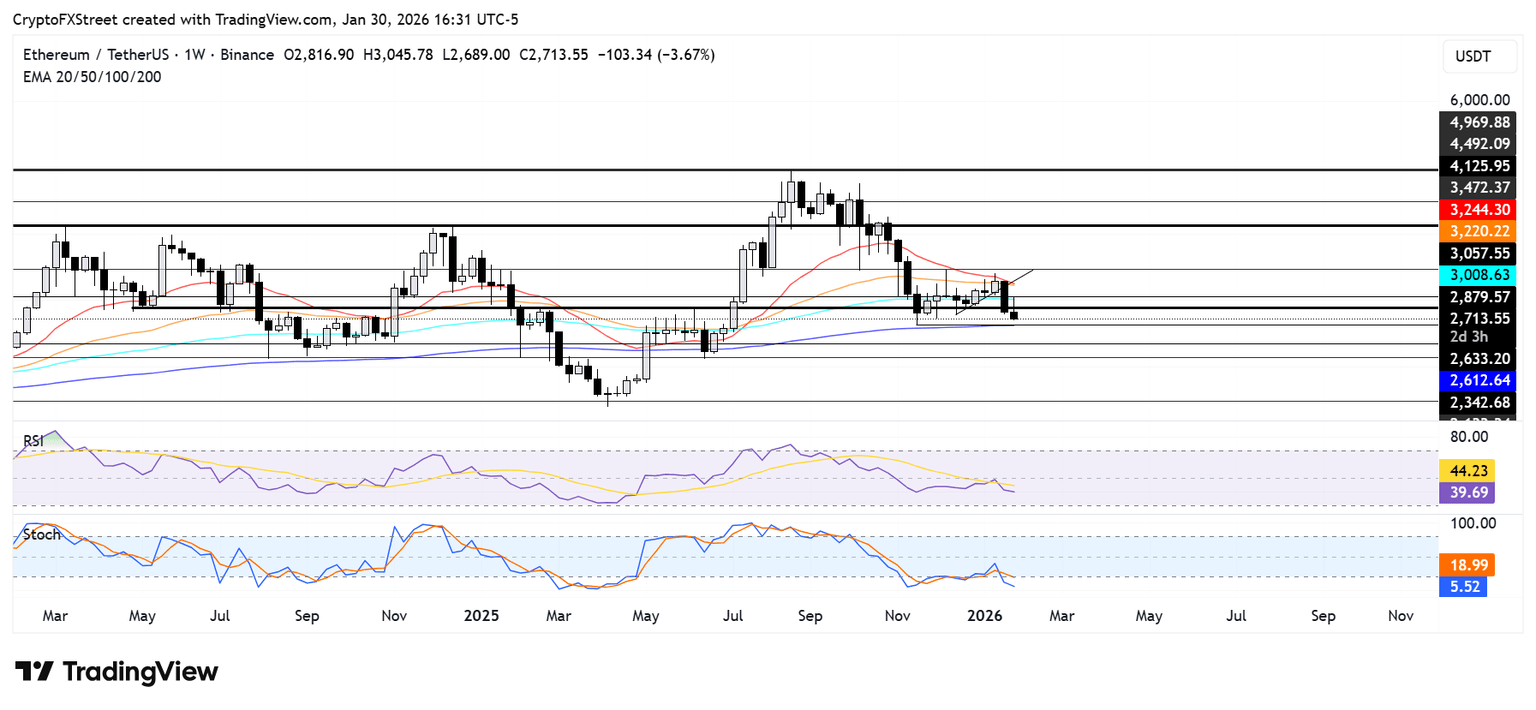

Ethereum Price Forecast: ETH could find support at 200-week EMA

Ethereum has seen $281.3 million in liquidations over the past 24 hours, led by $261 million in long liquidations, according to Coinglass data.

ETH is approaching the $2,630 support level after seeing a rejection at the $3,060 resistance near the 100-week Exponential Moving Average (EMA). The $2,630 support level is strengthened by the 200-week EMA, which bulls defended in June and November last year.

A decline below $2,630 could push ETH to $2,340. On the upside, ETH has to rise above all its key weekly EMAs to resume an uptrend.

The Relative Strength Index (RSI) is below its neutral level while the Stochastic Oscillator (Stoch) is in oversold territory. Sustained oversold conditions in the Stoch could lead to a reversal.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi