XRP Price Prediction: Ripple bulls’ quest to $2 reaches halfway point

- XRP price surged nearly 20%, hitting a resistance level at $1.65.

- A 10% pullback that allows the buyers to recuperate seems likely before the next leg begins.

- Slicing through the supply barrier at $1.76 is crucial for Ripple to achieve $2.

XRP price has seen an explosive rally in the last week of April, and a similar turn of events is set to occur in the first week of May.

XRP price stays on track

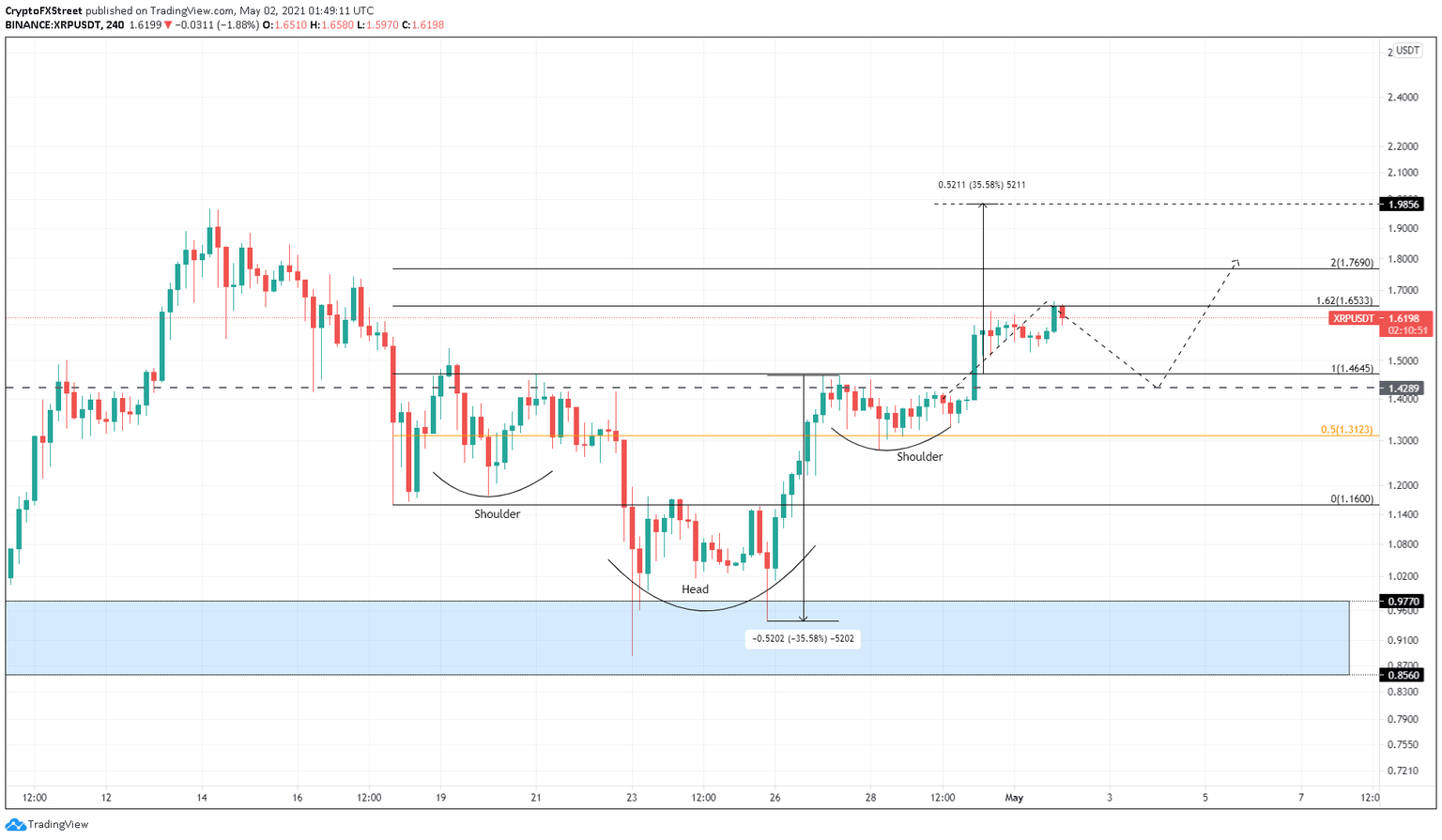

On the 4-hour chart, XRP price shows that it has risen to pre-crash levels. At the time of writing, Ripple is trading at $1.61, indicating its intention of retracing lower after its recent upswing.

The retracement could range from $1.52, a 6% decline from the current price, to $1.42, which denotes a much steeper correction of 11%.

Hence, investors need to pay close attention to this area of interest.

Such a pullback would allow the buyers to accumulate the remittance token at a discount for the next leg, which could extend up to $2.

While the 22% upswing to $2 from the current price is plausible, market participants need to be aware of the supply barrier at $1.76, which could deter this upswing or halt it.

Clearing this resistance level would provide Ripple with a clear path to achieving new yearly highs.

XRP/USDT 4-hour chart

On the flip side, if the pullback extends beyond the 50% Fibonacci retracement level at $1.31, it would invalidate the bullish thesis. In such a condition, the comeback for bulls would be arduous and might result in an 11% correction to $1.16.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.