XRP develops a rare bullish Japanese candlestick pattern that could return Ripple to $1

- XRP price action develops two consecutive inside-bar daily candlesticks.

- Rare and powerful bullish reversal pattern in development, confirmation still needed.

- Downside risks remain but are likely limited.

XRP price could return to a leadership position in the altcoin market if it can pull off confirmation of one of the most potent and rare Japanese candlestick patterns in existence: the Squeeze Alert.

XRP price positioning for a monster bear trap and short squeeze

XRP price has a very positive number of bullish confluence levels on its daily chart. Between the candlestick chart and its oscillators, XRP could pull off a huge surprise and begin a significant rally. XRP will first need to complete and confirm the bullish Squeeze Alert pattern to pull off a maneuver that could begin a new bull market.

The Squeeze Alert (bullish) is a three-session reversal indicator that forecasts a turn-around and new uptrend. It is a rare pattern and is one of the most compelling bullish reversal indicators in Japanese candlestick analysis. The probability of a bullish reversal from this pattern is exacerbated if the Squeeze Alert develops near a support level.

- The first session is black (traditional bearish Japanese candlestick color, contemporary is red).

- The second session can be white (green) or black (red).

- The second session high is below the first session high.

- The second session low is above the first session low.

- The third session can also be white (green) or black (red).

- The third session high is below the second session high.

- The third session low is above the second session low.

However, while the current structure shows the Squeeze Alert is nearly complete, confirmation can only occur if an undeniable bullish daily candlestick develops within two to three periods after the third session. For example, a Bullish Engulfing candlestick or a bullish Marubozu would most definitely confirm the bullish Squeeze Alert.

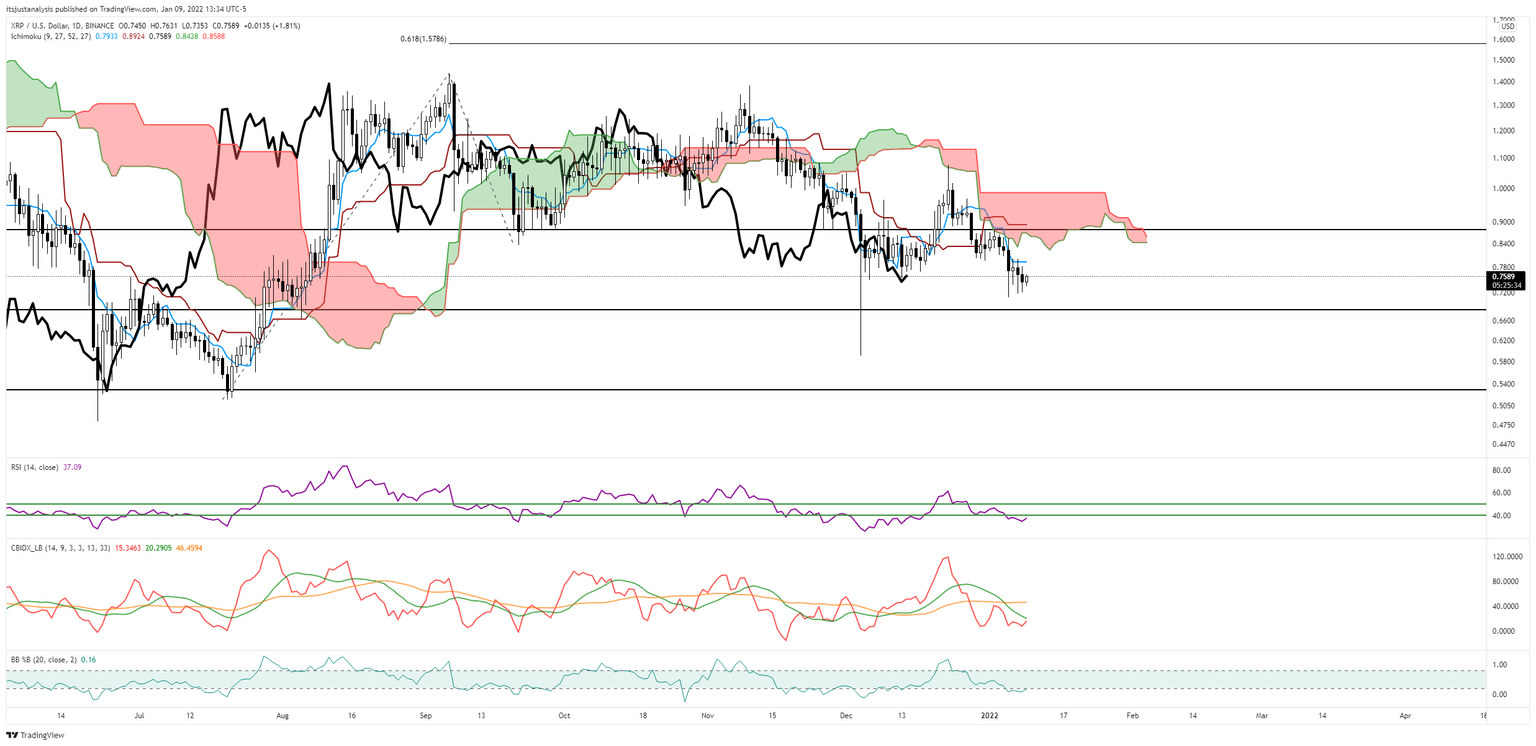

Contributing to the likelihood of a bullish reversal for XRP price is the Composite Index forming support and pushing higher towards a cross above its fast-moving average. At the same time, The %B oscillator is about to cross back above the 0.2 level, giving a strong signal that the recent downside move is likely a massive bear trap.

XRP/USD Daily Ichimoku Chart

Buyers should expect an easy move to rest resistance at $0.90 where the Kijun-Sen, 38.2% Fibonacci retracement, and bottom of the Cloud (Senkou Span A) currently exist. Above that, the next major hurdle is the critical and vital $1.00 level. Ultimately, bulls will need to close and remain above the $1.00 level to pursue any new major uptrend.

The outlook of a bullish reversal will be invalidated if sellers push XRP to a close below the 50% Fibonacci retracement at $0.68. In that scenario, XRP price will likely fall to $0.55 and even deeper to a primary support zone near the $0.36 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.