XRP holds on to $0.75 but failure to hold support could trigger a deeper drop

- XRP price dropped by 15% to hit $0.70 on Wednesday.

- Strong bounce off of the $0.70 price level returned XRP To $0.75.

- Downside risks remain significant.

XRP price faces continued pressure to the downside despite finding some temporary support against the critical $0.75 value area. Directional bias is most definitely weighted to the downside.

XRP price must hold $0.75, or it faces a return to $0.65

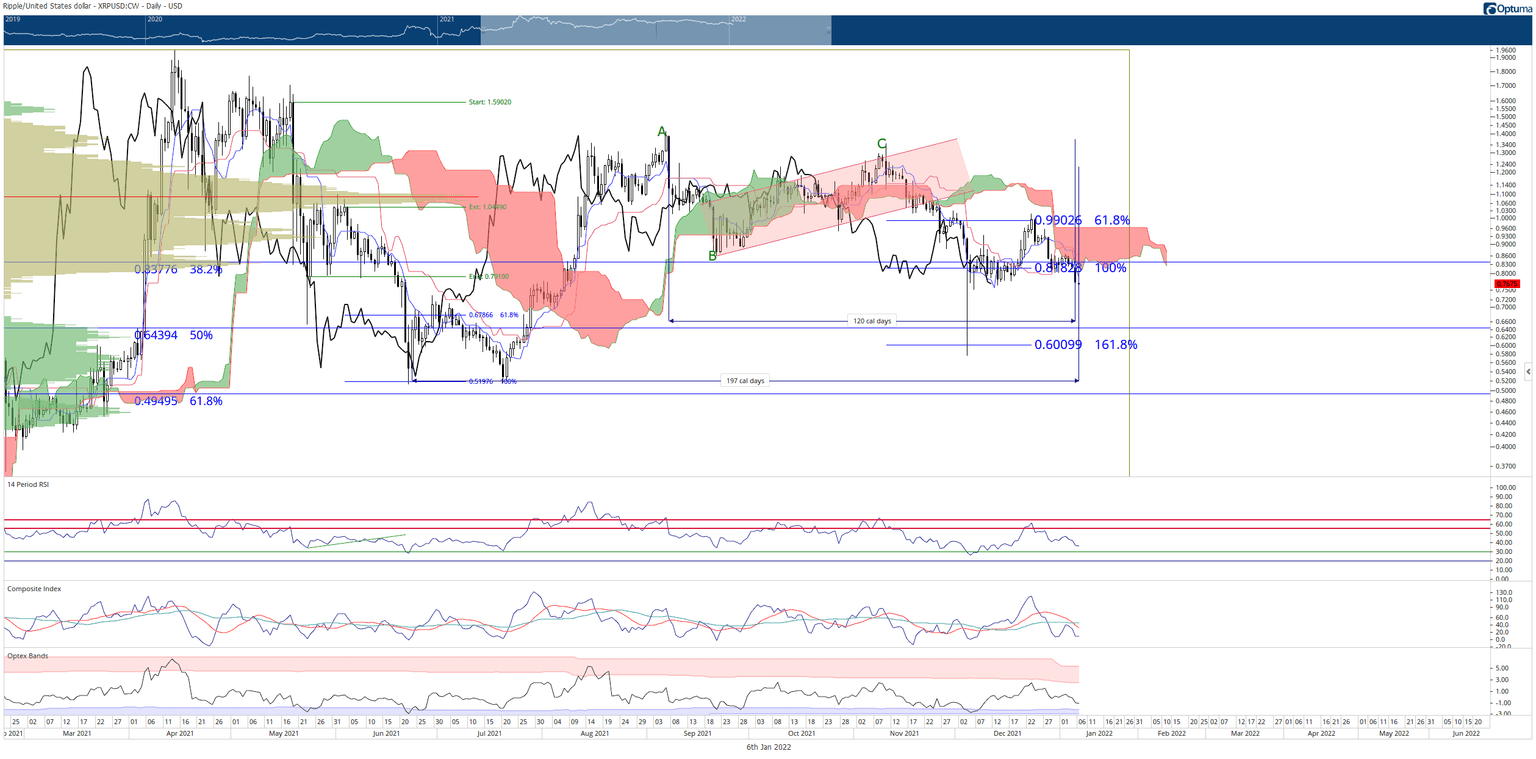

XRP price action returned to a support zone it previously tested back in December. Bulls were able to rally XRP out of the $0.75 zone to the $1.00 but could not maintain those gains. Coincidentally, the significant drop suffered on January 5 was one month from the December 5 flash crash.

XRP remains just above a make-or-break price range. There is little in the form of support between $0.75 and $0.65. The Volume Profile thins out considerably. The following primary price level of support is the 50% Fibonacci retracement at $0.65.

The oscillator values should be a cause of concern for bulls. The Relative Strength Index has a good amount of room to move before it hits the first oversold level in a bear market (30). Likewise, the Optex Bands oscillator is not yet oversold; however, it is getting close. The Composite Index also does not have any significant divergence or extreme range available to hint at a bullish reversal. Nevertheless, all of the listed oscillator conditions favor a further drop for XRP.

XRP/USDT Daily Ichimoku Chart

One factor could trigger a near-immediate bullish reversal, but not based on price action, but time. January 6 is 120-days from the most recent major high found on September 7, 2021. In Gann Analysis, one of Gann’s Cycles of the Inner Year is a 120-day cycle. Gann wrote that the 120-day cycle usually occurs with the trend and should be watched as a countertrend low, especially if a low was found in the 90-day cycle.

Additionally, January 6 is 197 days from June 23 2021, low and falls into the 180-day Cycle of the Inner Year. Significant trend changes or corrective moves often culminate and reverse if a critical high or low is found within the 180-day cycle (the 180-day cycle can extend to 198 days).

Failure by XRP price to establish a clear bullish reversal before January 9 would likely mean XRP will continue to move south.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.