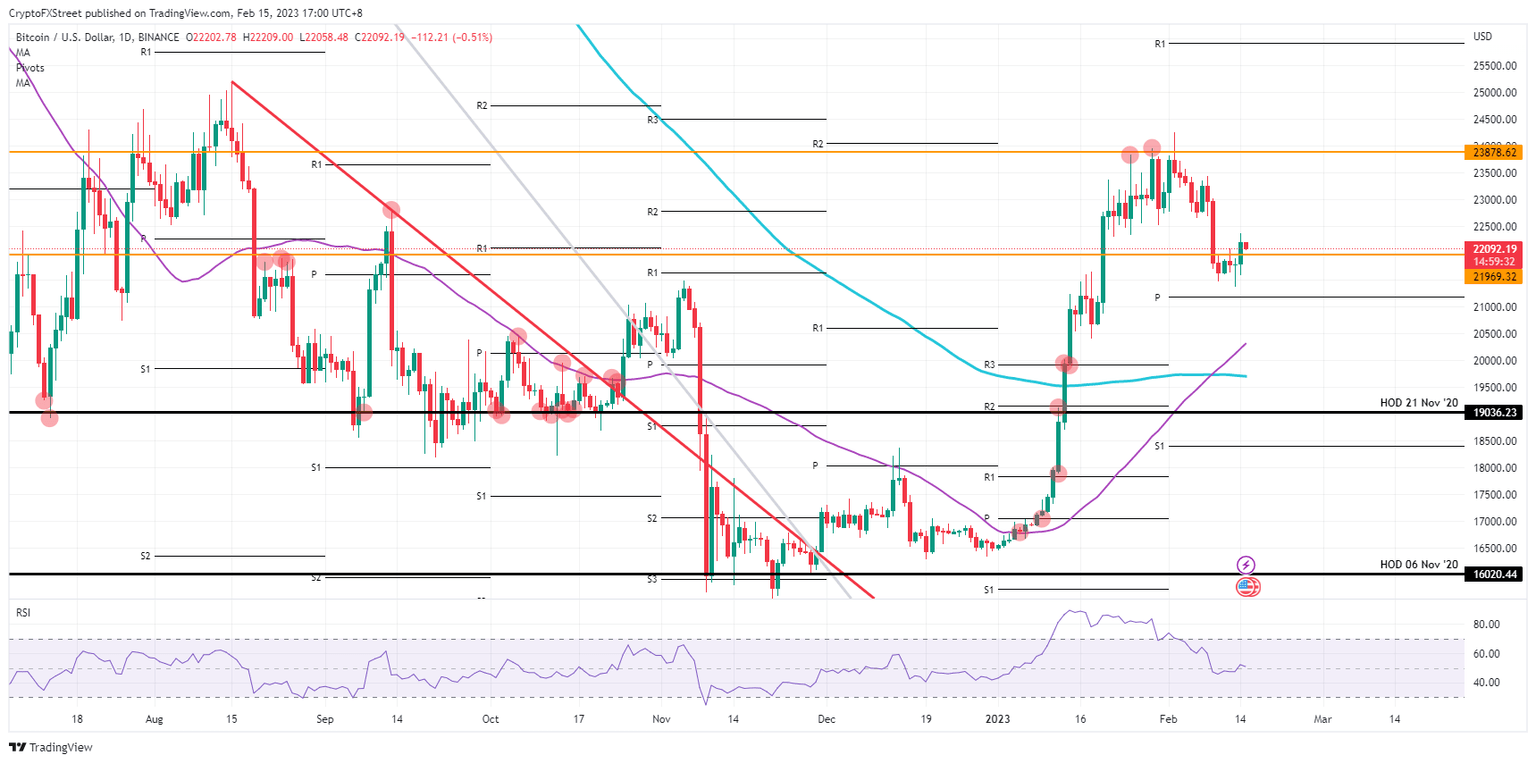

With US CPI behind it, Bitcoin price could thrust higher and tag $23,878

- Bitcoin price jumped nearly 2% on Tuesday after the heavily anticipated US CPI numbers.

- BTC traders will have their work cut out for them as more geopolitical tail risks are left to take into account.

- Expect a drop to $21,969 for support with a higher bounce as $23,878 remains the take-profit level for February.

Bitcoin (BTC) price is showing small signs of a little step back after a very difficult and choppy trading day on Tuesday, where it was only late in the US trading session that bulls were able to claim the upper hand and jack up the price action in Bitcoin. The risk now with the fade is that the more binary tail risks are being taken out one by one and the more difficult geopolitical risks are being left in the tail risks. This means that BTC traders will find it more difficult to price Bitcoin at the correct value should geopolitical pressure in Ukraine or elsewhere in the world hit another high level of alert.

Bitcoin price set to enter a slow burn higher

Bitcoin price saw traders embracing the lower inflation printout from the US on Tuesday. Although the YoY numbers were only marginally lower, traders were focused on the fact that it was a decline. It took bulls quite some time before they could claim victory as trading was very choppy for hours, and it was only late in the US trading session that Bitcoin price could run higher with near 2% gains at the daily close.

BTC is now expected to enter some calm water with a slow grind higher, and only geopolitical elements are left for now in the tail risks. As long as there is no new escalation, expect to see BTC trade higher with a bounce off $21,969 after the fade on Wednesday, with the first $23,000 as the ideal candidate to close out this week. Overall, should geopolitical pressure remain subdued for February, expect $23,878 as profit-taking for February, with 8% gains for bulls who enter the price action at current levels.

BTC/USD daily chart

In European trading hours this Wednesday, the VIX is popping higher while equities are trading sub-zero. This could be a telling sign for the trading session later today as this fade could see a greater sell-off. In case $21,969 breaks to the downside, expect to see further losses on the books, with the monthly pivot at $21,170 as the best candidate to support the price action.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.