Why some analysts suggest the Safemoon price is already in a bear market

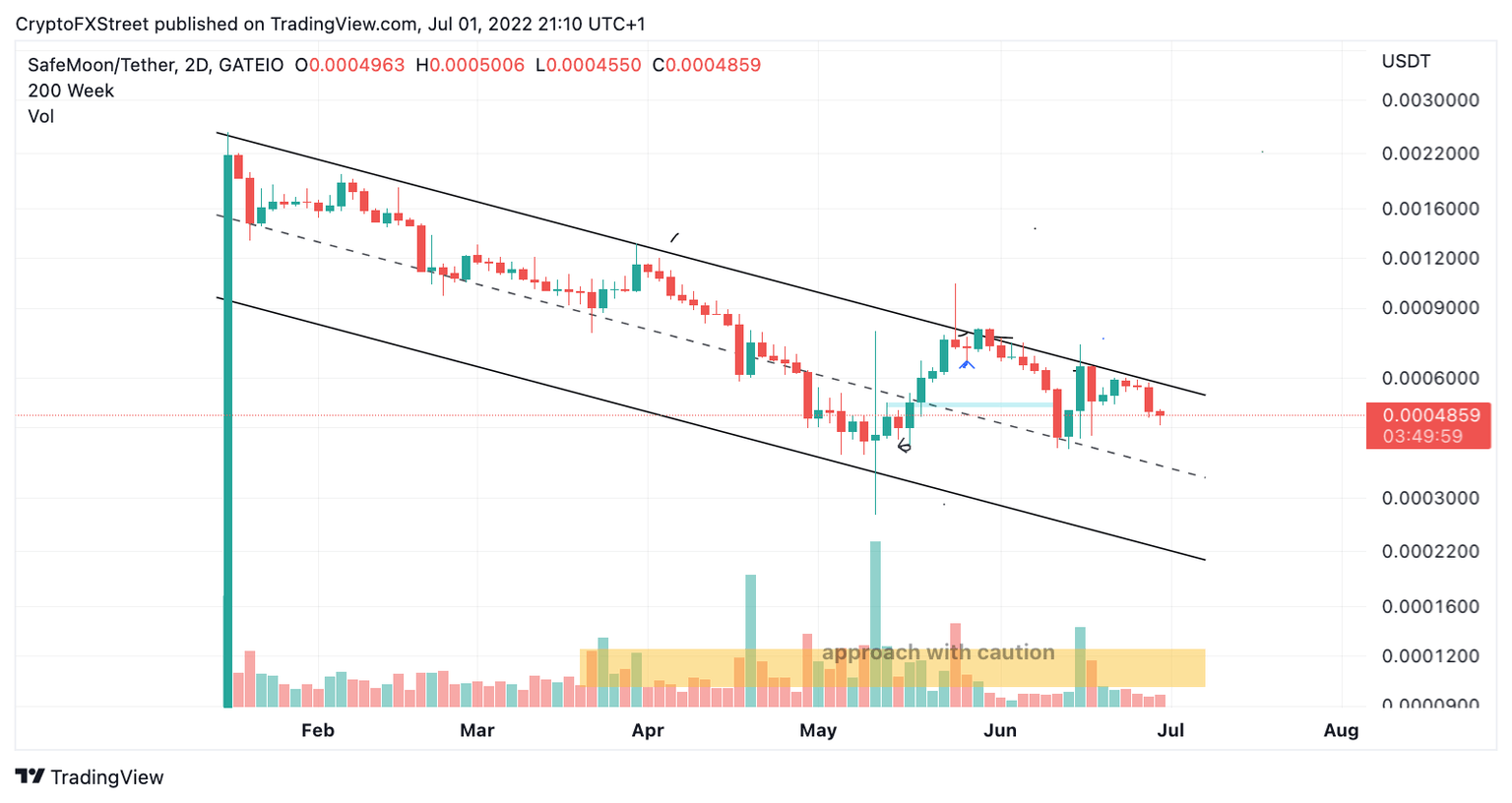

- Safemoon price see’s a rejection beneath a descending parallel channel.

- SFM price has fallen 30% since the last rally in June occurred.

- Invalidation of the downtrend scenario remains a breach above the descending parallel channel currently positioned at $0.0005800.

Safemoon price could endure more sell-offs during July. There are no significant reasons to consider countertrend scalping the digital asset.

Safemoon price spells trouble

Safemoon price continues to bare the brunt of smart money's force in this current crypto market. Since the middle of June, the bears have had complete control of the trend, consistently suppressing the price beneath a descending parallel channel. On July 1, the bears are producing a timid-looking retaliation as the volume profile still shows sparse transactions taking place.

Safemoon price trades at $0.0004923. Traders may recall the significance of the $0.0005200 barrier as it provided early confirmation for the springtime bullrun, propelling Safemoon's price up 100% in less than a week. The same barrier subtly acts as resistance while the bulls attempt to produce a 2-day hammer stick just below it. The bull's inability to breach this barrier can be viewed as early confirmation that the uptrend is over. If market conditions are genuinely bearish, the bears will target the June 18 swing low of $0.0003966 sometime In July.

SFM/USDT 2-Day Chart

Invalidation of the bearish trend is a break above the descending parallel channel currently positioned at $0.0005800. If the bulls can hurdle this barrier level, they may be able to conquer the macro trend and rally as high as $0.0013000, resulting in a 170% increase from the current Safemoon price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.