Why Dogecoin price can make a u-turn to $0.15

- Dogecoin price is yet again under siege by the stronger US dollar.

- DOGE price is set to tank another 10% before a 50% rally will kick in.

- Expect to see DOGE price soaring near $0.15 by Friday.

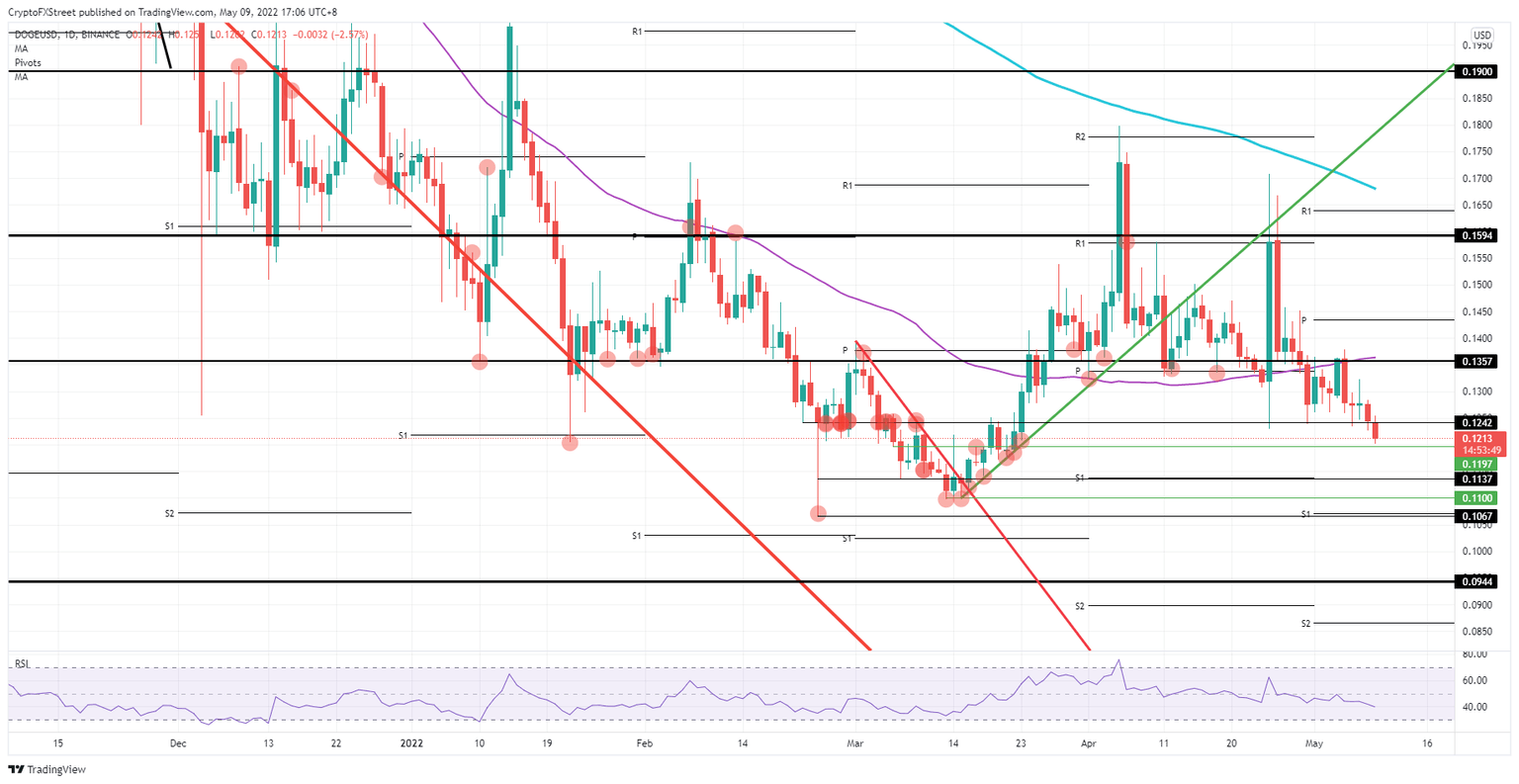

Dogecoin (DOGE) price is yet again under pressure from the stronger US dollar, but all-in-all losses are relatively contained. It looks like it is a matter of finding a floor in DOGE price that could spark a rally with Dogecoin price soaring back to $0.15. That would mean bulls are piercing through the 55-day Simple Moving Average (SMA) and possibly shedding this downturn for 2022, making 50% gains in just one week.

DOGE price set to soar 50% within the week

Dogecoin price is set to tank by roughly 10%, with investors on edge that the Federal Reserve might be too late and too slow to contain the rising inflation in the US. That risk threatens the stock market and, in its turn, creates headwinds for cryptocurrencies as investors refrain from investing in high-risk, high-growth assets. With that muted investment mood, cryptocurrencies are taking a step back as buy-side demand in DOGE price fades further.

Nevertheless, DOGE price might see a turnaround around $0.1100 or $0.1067 which will, once tested, have dragged the Relative Strength Index (RSI) towards the oversold area. By seeing this, bears will start to cash in on their gains and see an automatic increase in buy-side demand as bears need to buy Dogecoin to materialize the gains. Once this move happens, bulls will use the momentum to ramp up prices and trigger panic amongst bears that will see their gains melting as snow before the sun, triggering an even more significant demand for Dogecoin, translating into an exponential rally up to $0.1594 for a test of this key resistance.

DOGE/USD daily chart

The risk at hand is that the US dollar strength is persistent, and with more and more banks calling for parity in EUR/USD, the pressure from the greenback could further weigh on DOGE price. A break below $0.1067 could see a test at $0.1000 and even breakthrough it towards $0.0944. That would mean a 22% devaluation against where DOGE price is currently trading.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.