Why another 60% drop in SHIB price is inevitable

- Shiba Inu price sees investor interest fading as price consolidates far away from $0.00001708.

- SHIB price drifts further to the downside as pressure builds for a new low for 2022.

- Expect to see a correction back to $0.00000507, saying goodbye to $0.00001000.

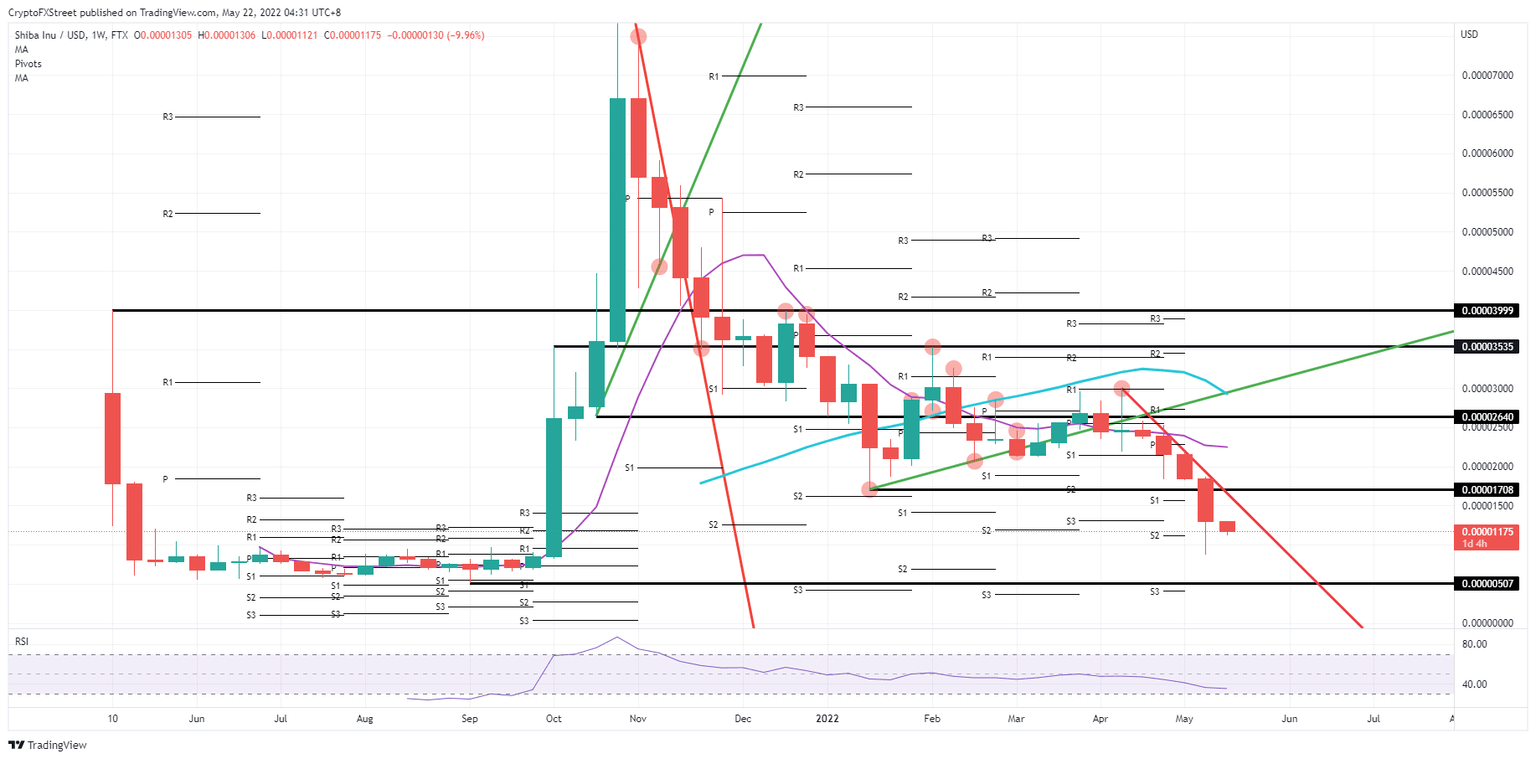

Shiba Inu (SHIB) price is too far gone from the significant pivotal level of $0.00001708 to make a strong comeback for now. Expect to see price action consolidate around current levels, slightly above $0.00001000, before another round of tail risks will come back to bite price action and trigger another drop in value. SHIB price looks set to slip below $0.00001000, trigger a trust crisis amongst investors, and finally settle at $0.00000507, losing another 60%.

SHIB price set to trigger a confidence vote amongst investors

Shiba Inu price is not really falling on the right side of the trade these past few weeks as SHIB is set to close out the week with a fifth consecutive loss. By doing so, investors and traders must start to be fed up with the almost puberal mood swings the cryptocurrency is having and being an outlier when cryptocurrency markets are rallying, and SHIB price being one the few that is bleeding at that exact moment. Expect to see more outflow of capital funds, making the price action less supportive and possibly triggering a falling knife soon.

SHIB price still has the $0.00001000 big figure in its corner, backing price action to consolidate above for now. But the backpack of geopolitical issues and tail risks is growing by the day as more unresolved issues are putting too many question markets around the secured path forward. Expect with that uncertainty and the sometimes unpredictable price moves in SHIB, investors start to lose confidence and could trigger at least another test at the $0.000010000 psychological level. Should that level be breached again, expect to see SHIB price axed in half towards $0.00000507 as investors will be fed up with carrying the loss on their investments and look the other way.

SHIB/USD weekly chart

One element that could ease the weight of the bearish backpack is when those tail risks can be deflated. That would come with some dovish comments from the FED or BOE or if the Ukraine news flows fades further to the background as the situation on the ground stabilises. That could trigger a quick turnaround with SHIB price back to $0.00001500, and bulls pressing against the red descending trend line to create a breakthrough on the descending trend line and touch $0.00001708 before trying to rally towards $0.00002100 and testing the 55-day Simple Moving Average as price cap to the upside;

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.