VeChain Price Prediction: VET primed for 63% advance

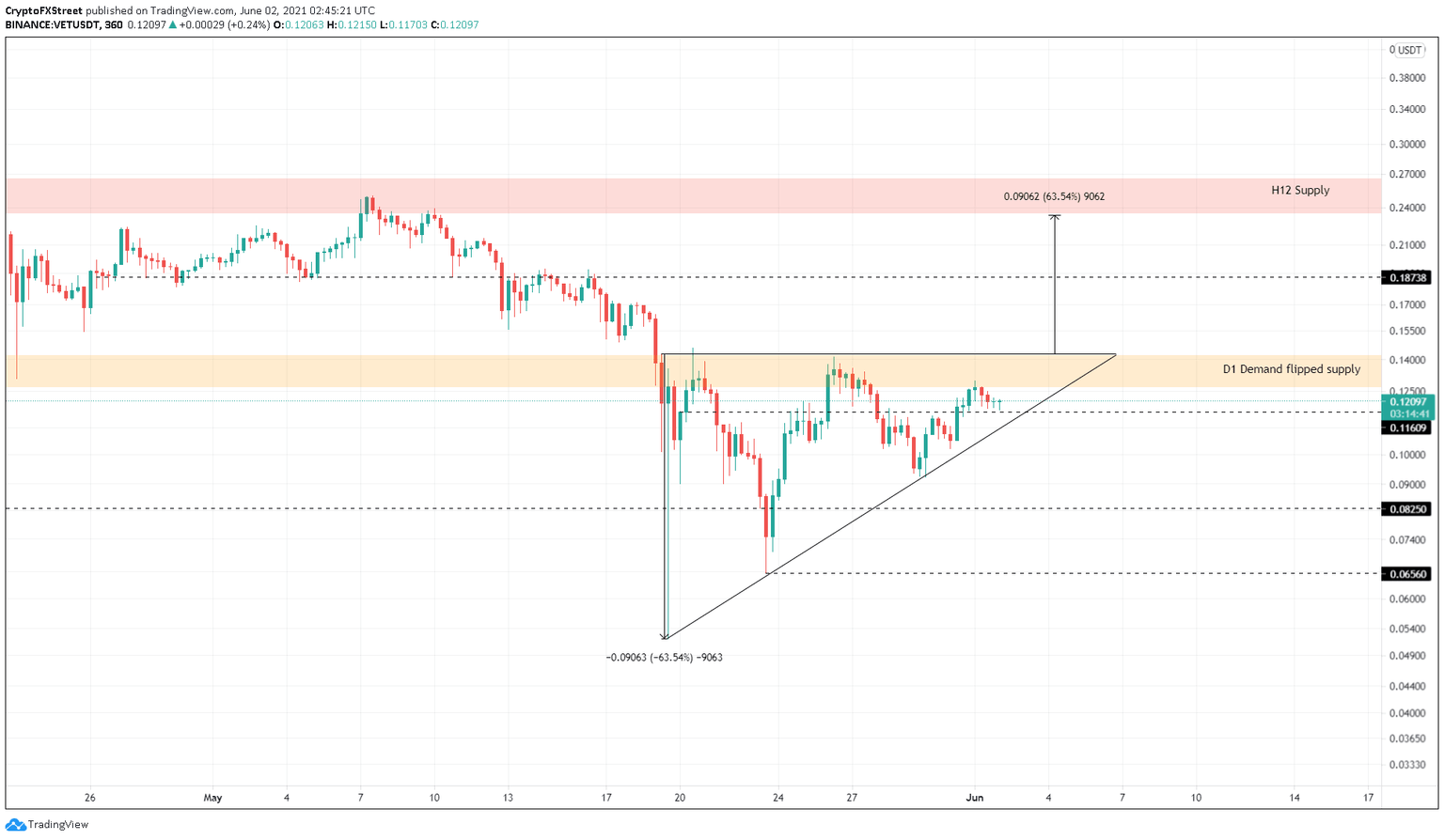

- VeChain price is forming an ascending triangle pattern, hinting at a 63% upswing to $0.235.

- A decisive 6-hour candlestick close above $0.143 will signal a breakout and start of the rally.

- However, a breakdown of the swing low $0.0825 will invalidate the optimistic outlook.

VeChain price is consolidating inside a bullish technical formation that forecasts a massive uptrend. However, a breakdown of a critical support could put a dent in this rally.

VeChain price prepares for blast-off

VeChain price set up roughly three equal highs around $0.143, starting from May 19, while creating multiple higher lows. If these swing points are connected using trend lines, an ascending triangle seems to form.

This technical formation projects a 63% upswing to $0.235, determined by adding the distance between the first swing high and swing low added to the breakout point at $0.143.

Interestingly, the breakout point for VeChain price coincides with the supply zone that stretches from $0.127 to $0.142.

Hence, the bulls need extra oomph to slice through this resistance area and produce a decisive 6-hour candlestick close above $0.143. Such a move would signal a breakout from the bullish formation and the start of an uptrend for VET.

Interestingly, the target at $0.235 coincides with the lower limit of the supply zone that extends up to $0.266.

Investors should also note that the supply level at $0.187 might hinder VET’s uptrend or even halt it. Therefore, the buyers need to clear this level to hit the intended target at $0.235.

VET/USDT 6-hour chart

While things seem to be looking up for VeChin price, market participants should keep a close eye on the support barrier at $0.083. A breakdown of this level will invalidate the bullish thesis and trigger a 20% crash to $0.0656.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.