VeChain price stabilizes, VET projects 80% gain on the return of FOMO

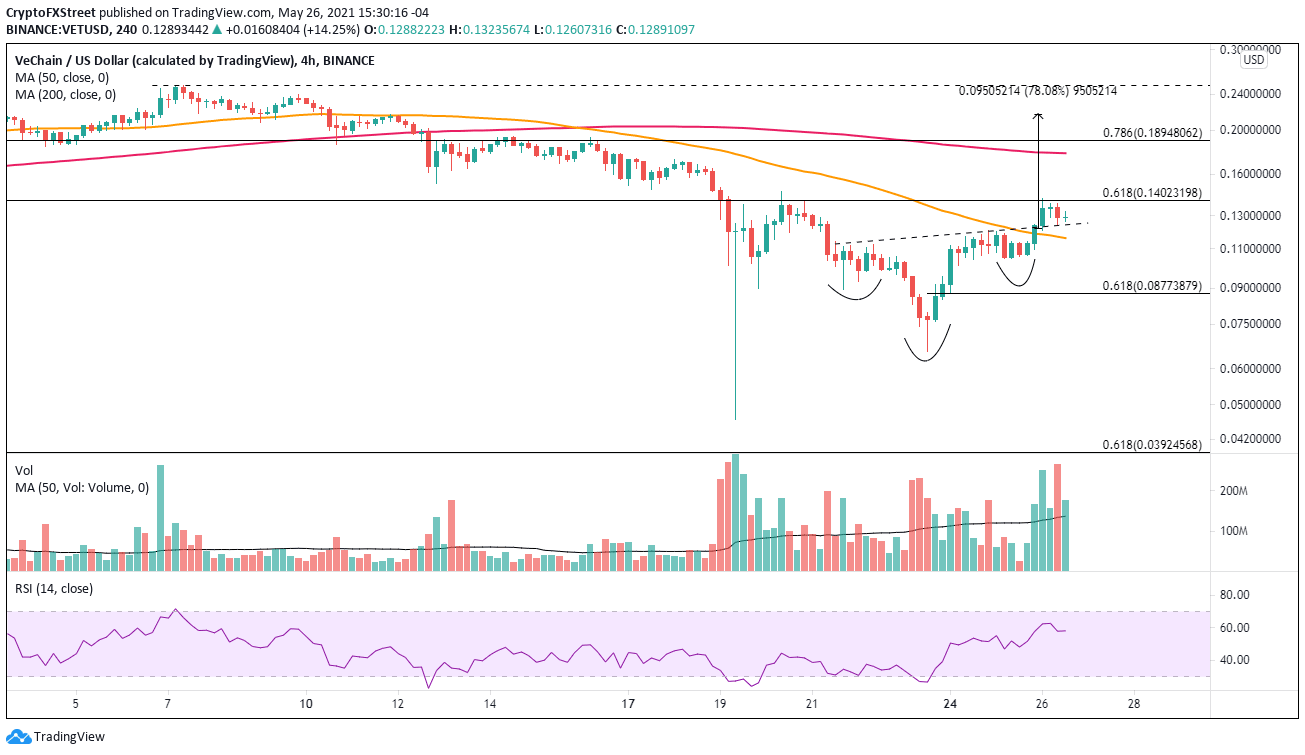

- VeChain price just released from a well-defined inverse head-and-shoulders pattern on the four-hour chart.

- VET is struggling with resistance defined by the 61.8% Fibonacci retracement.

- The fastest-growing network in developing decentralized applications leads crypto market with 250% rebound.

VeChain price just broke out from a bullish formation on the four-chart after a period of intense volatility that was highlighted by a 250% rebound off the May 19 crash lows. The developing breakout is in the early stages, but it is a remarkable turnaround after an 85% decline from the April high.

VeChain price momentum gains traction in a nervous market

Last week, VET was adversely affected by the combination of new Chinese regulations governing cryptocurrencies and a deteriorating outlook for US interest rates. The result was a 51% weekly drop, the most significant weekly decline since prices began in 2018. In fact, VeChain price plummeted over 70% on May 19 before bouncing.

VeChain price has stabilized and responded to the historic sell-off with a 50% gain this week. The gain is nowhere near the largest weekly gains, but it does signify that FOMO is back in VET.

VeChain price has staged a tremendous recovery in just a few sessions, lifting the digital token above the 38.2% and 50% retracement levels of the complete April-May decline. VET is now above the 50 four-hour moving average and is testing the 61.8% retracement at $0.140 after breaking out from an inverse head-and-shoulders pattern earlier today.

If VeChain price overcomes the resistance at the 61.8% retracement, it should not meet any problems until the 200 four-hour moving average at $0.178 and then the 78.6% retracement at $0.189. A high volume breakthrough of these levels will leave VET poised to test the inverse head-and-shoulders measured move target of $0.216, representing a 78% gain from the neckline at the time of breakout.

Additional resistance that could interrupt a VeChain price advance is the May 7 high at $0.260 and then the all-time time at $0.282, printed on April 17.

VET/USD 4-hour chart

The fate of VeChain price will revert to a bearish narrative if it falls below the right shoulder low at $0.104.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.