VeChain Price Forecast: VET breaks down following multiple sell signals

- VeChain is hanging at the edge of a cliff following a 30% drop from the highs reached in November.

- Continued bearish action under the 50 SMA could see VET retest support at the 50 SMA and 200 SMA.

VeChain has retraced 30% from the highs recently achieved in November. VET appears to have taken a pit stop at $0.013, but it struggles to sustain the uptrend. More declines are likely to come into the picture, mostly if the token fails to close the day above $0.014.

VeChain downtrend hits a temporary pause

VET/USD is holding the ground slightly above the 50 Simple Moving Average. Following the slump from $0.018, buyers seem to have retreated into the sidelines until a breakout is confirmed. Meanwhile, if losses resume under the moving average support, the downtrend could extend first to the 100 SMA and perhaps 200 SMA on the 4-hour chart.

VET/USD 4-hour chart

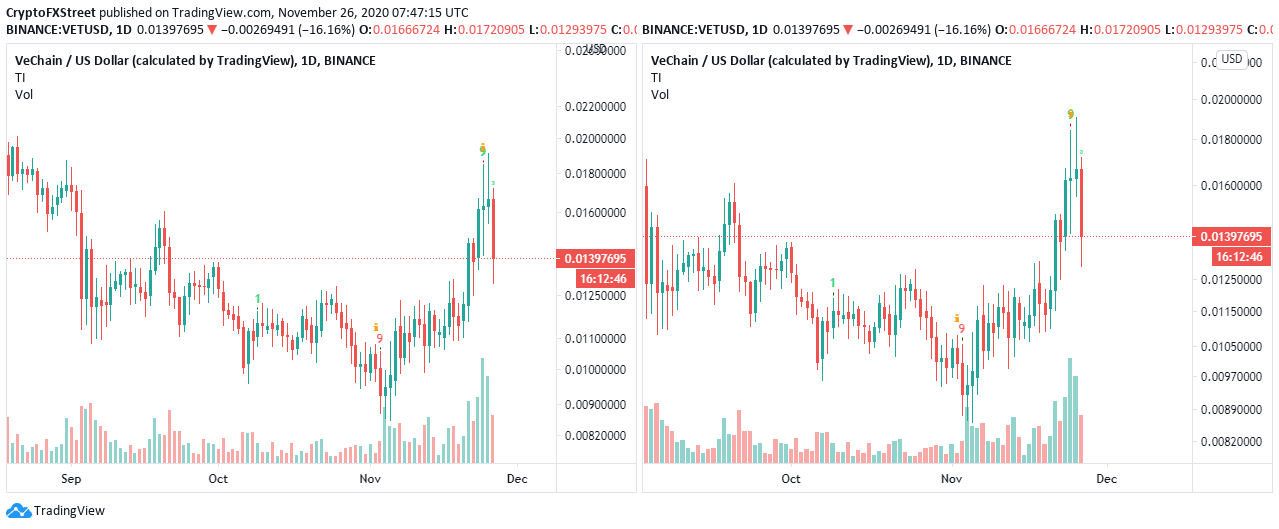

The TD Sequential indicator has presented a couple of sell signals on the 12-hour and the daily charts. The signals formed in green nine candlesticks, which validated the slide from the monthly peak. The price action is likely to occur in one to four daily candlesticks.

VET/USD 12-hour and daily charts

IntoTheBlock's "New Daily Addresses" metric shows a recent decrease in the number of new addresses joining the VeChain network. A fall in the new addresses created on the network is usually a bearish signal. Therefore, VET is likely to maintain the downtrend, mainly because the token's inflow and outflow are negatively affected.

VeChain new addresses chart

It is worth mentioning that VeChain will resume the uptrend if the price closed the day above the 50 SMA on the 4-hour chart. Moreover, trading above $0.014 might give bulls a sense of stability and a chance to plan the next move towards $0.02.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20(5)-637419756167753716.png&w=1536&q=95)

-637419756944829044.png&w=1536&q=95)