Uniswap price moves according to plan as bullish triangle forecasts 5% uptick

- Uniswap price recovers from a brief uptick and rejection as the end result on Thursday.

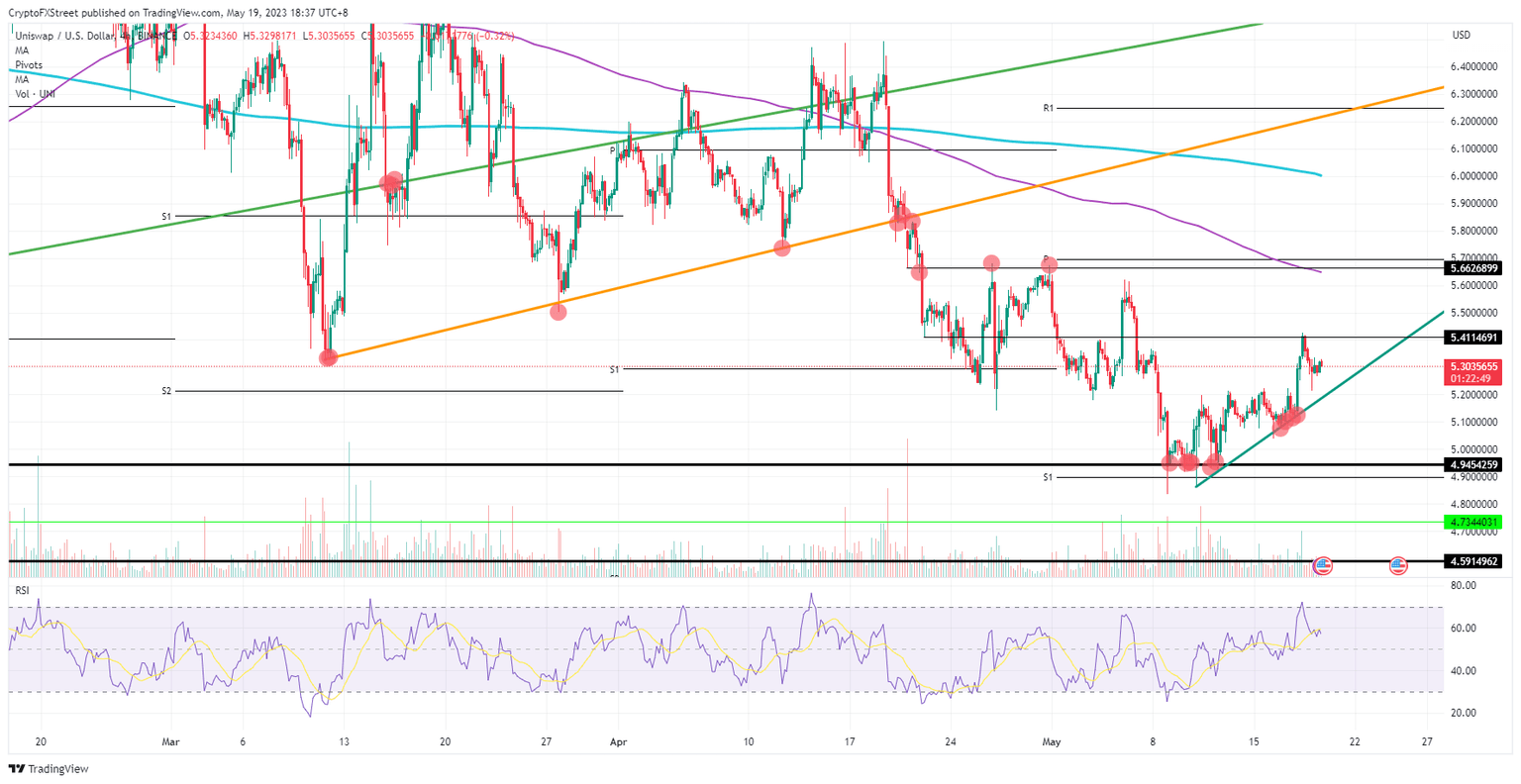

- UNI identifies a bullish triangle with $5.41 as a base.

- Expect a nice 5% return once bulls break out of the triangle and head to $5.70.

Uniswap (UNI) price is a bit of an outlier in terms of patterns against its competitors. Where, for example, Cronos is not showing any tangible signs of a rally, UNI is defining a nice bullish triangle that could bring at least a 5% gain alongside it. With great respect for the ascending trendline, bulls know what to do in order to scoop up those profits.

Uniswap price in a textbook scenario that even children can trade

Uniswap price is primed for some upside potential as UNI shows a clear path higher. Not only is the price action chart showing an important bullish triangle, but the Relative Strength Index (RSI) is confirming that pattern as well. After a test at the topside near $5.41, both the price action and the RSI cooled down without retreating too much.

UNI will see support at the ascending triangle with bulls ready to flock in again for a long position. The next test could be the right one to trigger a break to the upside. Once the breakout is triggered, a firm leg higher to $5.70 would bear another 5% gain for traders to book against the 55-day Simple Moving Average (SMA) as a target.

UNI/USD 4H-chart

Any break of the green ascending trendline would snap that rally and could see it fall substantially lower. That makes sense with the RSI elevated and thus offering more room to the downside with long positions being unwound. It is not impossible to think that UNI could print back below $5, maybe at $4.95, before it finds ample support to halt the correction.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.