Three reasons why all eyes are on the Cardano price this week

- Cardano price outperformed most cryptocurrencies this week, rallying by 40% since January 1.

- December's monthly high has been liquidated, the mid $0.35 level is the next bullish target zone.

- Invalidation of the bullish trend is a breach below $0.265.

Cardano price has pulled off a surprising rally, outperforming nearly all other cryptocurrencies in the space. The digital token now eyes the 2022 liquidity levels and could yield substantial gains if successful.

Cardano price pulls a crypto 180

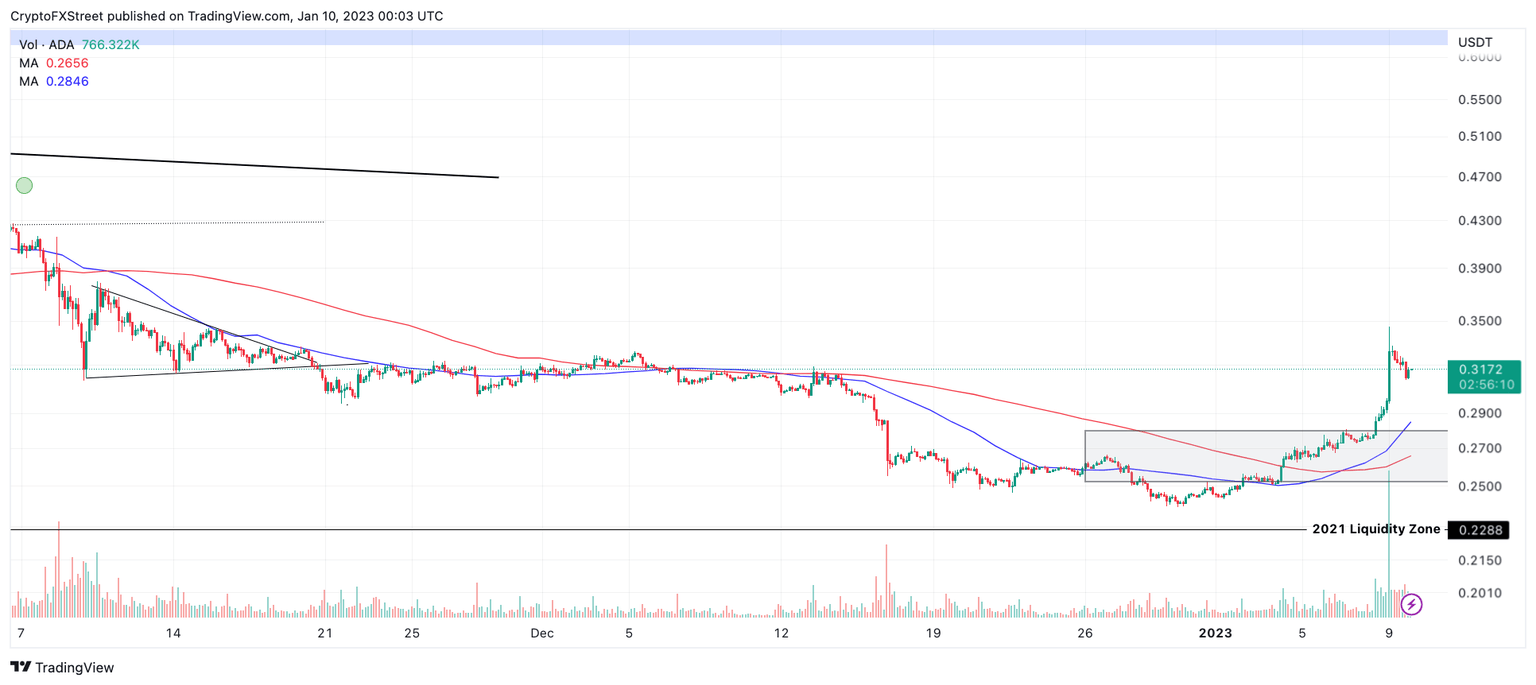

Cardano price is the center of the crypto market's attention during the second trading week of the new year. On January 9, the smart-contract token surged by 40% since its opening at $0.248 on 2023's opening bell. As the days progressed, the trading range has expanded progressively. Consequently, Cardano breached several short-term indicators and previous resistance zones.

Cardano price currently auctions at $0.3170 as the self-proclaimed Ethereum killer token hovers within Deember's broken support zone. Earlier in the week, the bulls breached both the 8-day exponential and 21-day simple moving averages, signaling that the uptrend was genuine. The 15% spike on January 9 broke through the December monthly high of $0.3290, leading to a period of profit-taking consolidation.

ADA/USDT 3-Hour Chart

Considering the scenario that has just unfolded, the bulls have collected several liquidity barriers and opening a long position for more gains is likely to face higher risks. Still, the rally's slope is parabolic, and opening a short position on the digital token would be equally problematic.

If the market is genuinely bullish, then the next target to aim for would be the 50% Fib level of November's trading range at $0.3510, resulting in a 13% increase from ADA's current market value.

On the contrary, if the bulls are already at their wits, the bears could take hold of the current pause in the market and induce a selloff targeting the recently breached moving indicators that remain untested following the recent rally. The 21-day simple moving average is $0.2600 and would reside 15% below Cardano's current price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.