Terra's LUNA price is on the wrong side of a technical level at the worst possible time

- Terra price action dropped 2% on Thursday's trading session after bad earnings and a disappointing ECB.

- LUNA Price action currently hangs below a key support level.

- With big tail risks in the coming days and weeks, LUNA is at risk of turning back below $0.000300.

Terra (LUNA) price action was not a match for the stronger dollar that rolled over into the markets on Thursday as investors had to reshuffle their outlook on the back of some major market-moving events. It was not just one, but a slew of catalysts, with first the ECB not meeting traders' expectations, triggering the first round of dollar strength, followed by a meltdown in the Nasdaq as Meta, Amazon and Apple all disappointed. LUNA price action broke vital support and is now trading at the mercy of the Fed and the US midterms in the coming days and weeks.

LUNA price at risk for at least eleven days

Terra price action has dropped more than 2% in just two trading days, with the current one still not over. Although the earnings this evening will not be big enough to change the direction, and what looks like to be a failure at the $0.000306 support level could not come at a worse time. With the midterms on November 8 and the Fed on November 2, LUNA price action is at the mercy of these two main big events upcoming in the next two weeks.

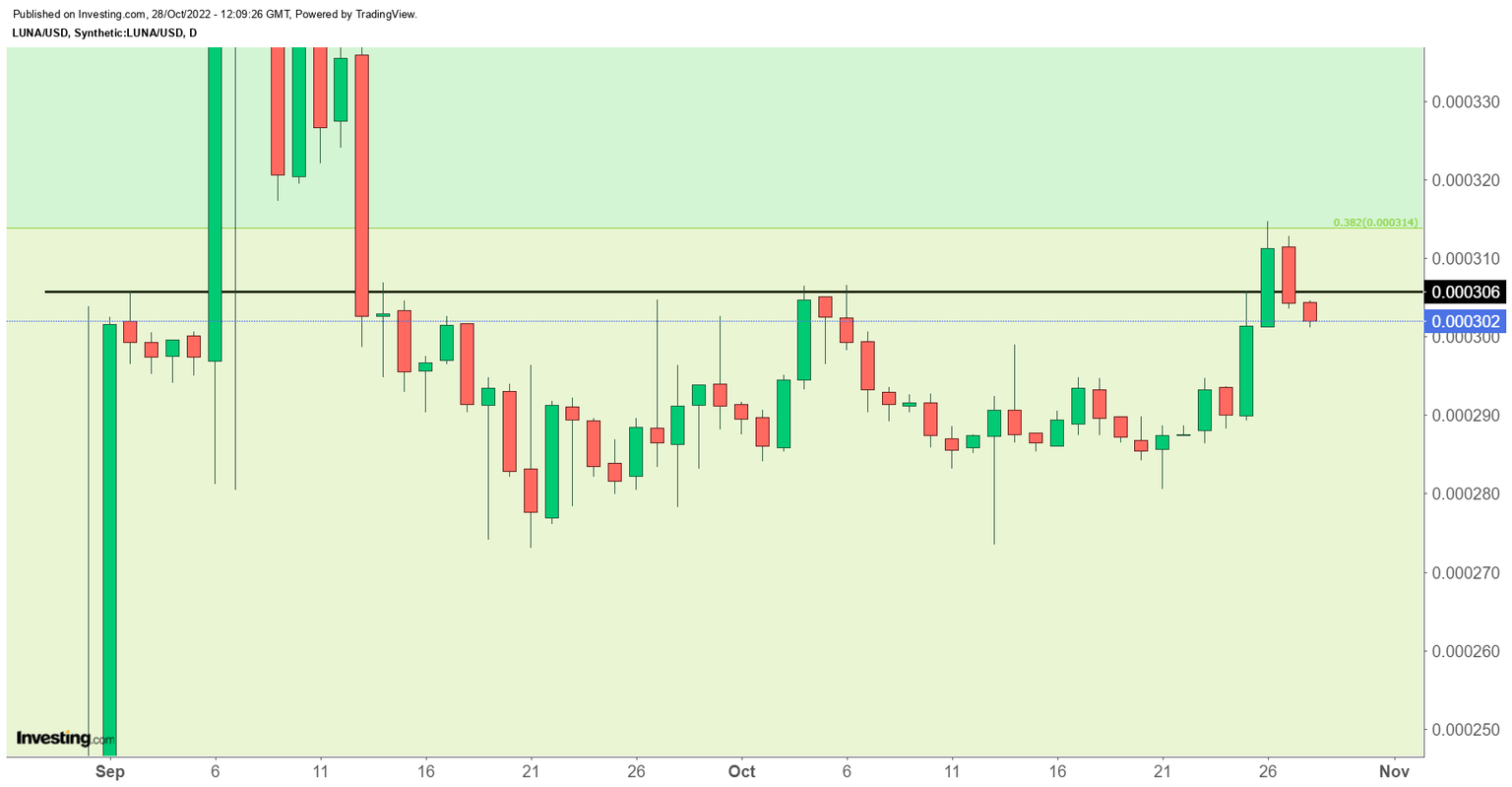

LUNA Price action lacks the support of that $0.000306 handle that originated from the top on September 02. Although not that 100% technically correct, the 38.2% Fibonacci level at $0.000314 triggered a rejection which now caused the breakdown below $0.000306. There is likely more downside to come as the dollar will strengthen in light of these two main events, translated by LUNA price action residing around $0.000290.

LUNA/USD Daily chart

Alternatively, a simple bounce could ensue, as some economic data could still trigger a reversal. The possibility of a goldilocks scenario is still on the table should the Fed signal that it will start slowing down its hikes and pulling off a soft landing instead of a recession. In such a scenario, investors would gladly pick up risk assets and see LUNA price action pop towards $0.000330.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.