Terra's LUNA price action takes a step back as the ECB drops the ball

- Terra price action ‘slips in the cake’ of breaking above the 38.2% Fibonacci level.

- LUNA price action concedes against the dollar, with that last one slowly coming back stronger after a short hiatus.

- ECB's Lagarde unveils no new surprises, helping dollar recover – a negative for cryptos.

Terra (LUNA) price action drops back to the first level of support as price action starts to wobble, with a little bit of dollar strength coming back into markets as the euro dips back below parity following the ECB meeting. With US GDP holding up unexpectedly well, the strong dollar may have weakened a bit, but it has yet to be history.

LUNA price is no match for the dollar bulls

Terra price action, although very distant from the ECB, is seeing repercussions from the rate decision and the press conference. The 75 bps hike was so well communicated that it was highly anticipated, and as it met expectations, a sell-off got underway. Just minutes after that initial communication, US GDP came in at 2.6% from -0.6% QoQ and acted as a kicker. The US itself and the dollar are still outperforming, meaning that the dollar strength is still here to stay especially as there is no evidence of a slowdown yet in the US’s steamrolling economy.

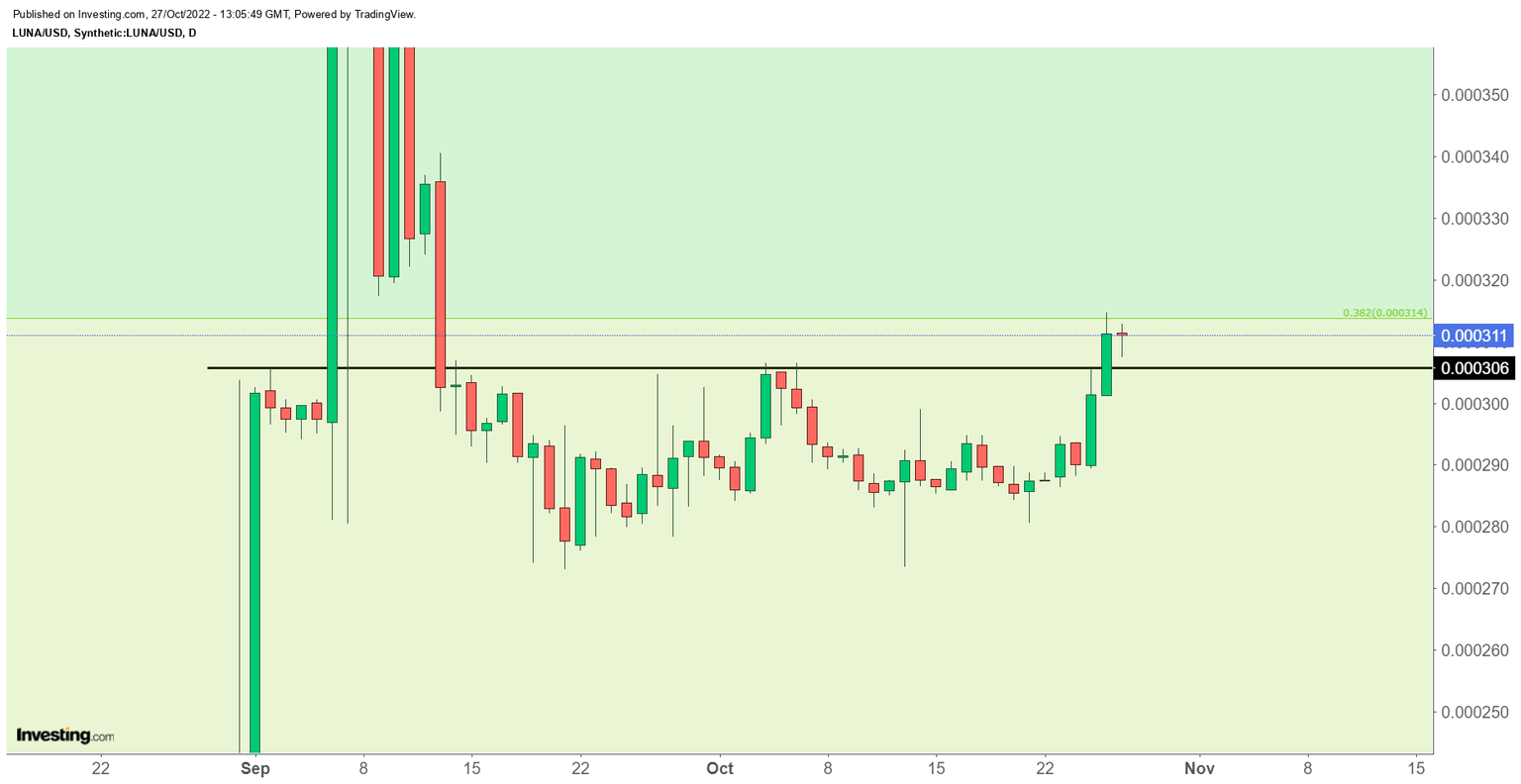

LUNA price action is thus unable to break above the 38.2% Fibonacci level at $0.000314. Instead, a rejection is set to unfold with the dollar pushing back against any up moves and price action looking for support near $0.000306 instead. Expect to see a possible further push to the downside once the US session takes over as the EU session closes, and a possible dip towards $0.000300.

LUNA/USD Daily chart

Of course, the rally on the back of the weaker dollar has been substantial. With the US midterms' an upcoming risk and potentially continued uncertainty around the Fed rate decision, EURUSD could jump higher once the dust settles after the ECB meeting. That would mean that LUNA price action could move higher on the back of renewed dollar weakness. The 38.2% Fibonacci level could then finally get broken, resulting in a rally towards $0.000350.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.