Swipe Price Forecast: SXP endures, poised for a 50% rally

- Swipe price reaches price congestion, bulls contemplating a right shoulder.

- SXP has gained 55% from the April 23 low, raising the need for a mini-correction.

- Daily Relative Strength Index (RSI) closed near oversold territory.

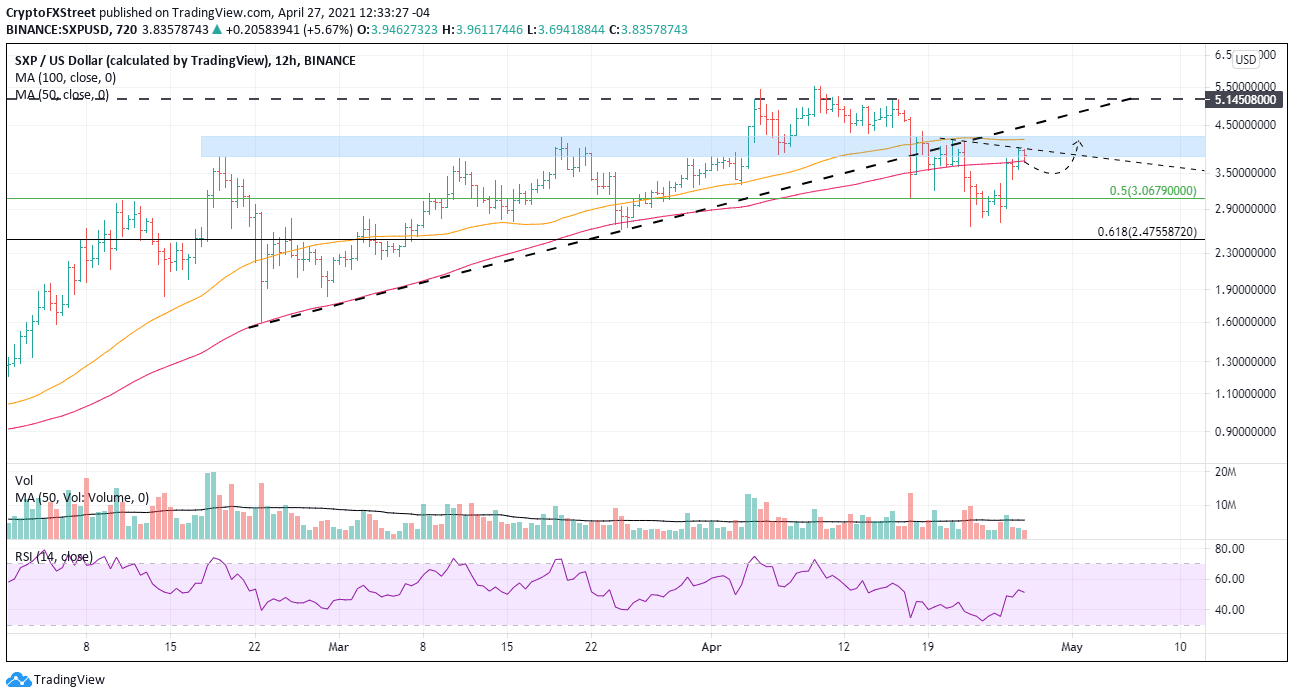

Swipe price has staged a significant comeback and appears ready to form the right shoulder of a head-and-shoulders bottom pattern. The shoulder will unfold at the lower range of price congestion extending back to the February highs. If this pattern continues to be constructive, SXP will be well beyond the all-time high.

Swipe price gain points to FOMO being back in the cryptocurrency market

SXP declined 50% from the April high, meaning that the altcoin needs to gain 100% to regain the price level. Critical to the success of the rebound is the quality of the head-and-shoulders bottom potentially being created on the 12-hour chart, which up to this point has been constructive.

For these next few days, SXP must complete the right shoulder around the 100 twelve-hour simple moving average (SMA) at $3.73 down to $3.50, putting the depth similar to the left shoulder.

The breakout above the neckline will not be an easy feat due to the price congestion and the 50 twelve-hour SMA at $4.18. A break above the congestion puts SXP on a collision course with the meridian trend line beginning at the February low at $4.74, which demonstrated considerable resistance from April 19-22.

If all the resistance is discarded, SXP should test the 2020 high at $5.15 and the all-time high printed in April at $5.52. A decisive advance could take the digital token to the 138.2% Fibonacci extension of the 2020 bear market at $6.89.

SXP/USD 12-hour chart

SXP could decline to the 50% retracement of the 2020-2021 bull market at $3.06 before completing the right shoulder, but any further weakness would put it on the path to test the April low at $2.63 and then the 61.8% retracement of the 2020-2021 bull market at $2.47.

To close, it is interesting to point out that SXP could go on to shape the right shoulder of a head-and-shoulders top pattern. Add a little creativity in the process through pattern projection to keep on the right side of the market.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.