Supercore CPI spike could shake interest rate outlook and crypto markets

US Supercore CPI has jumped unexpectedly, raising the risk of prolonged high interest rates and sparking uncertainty for crypto markets.

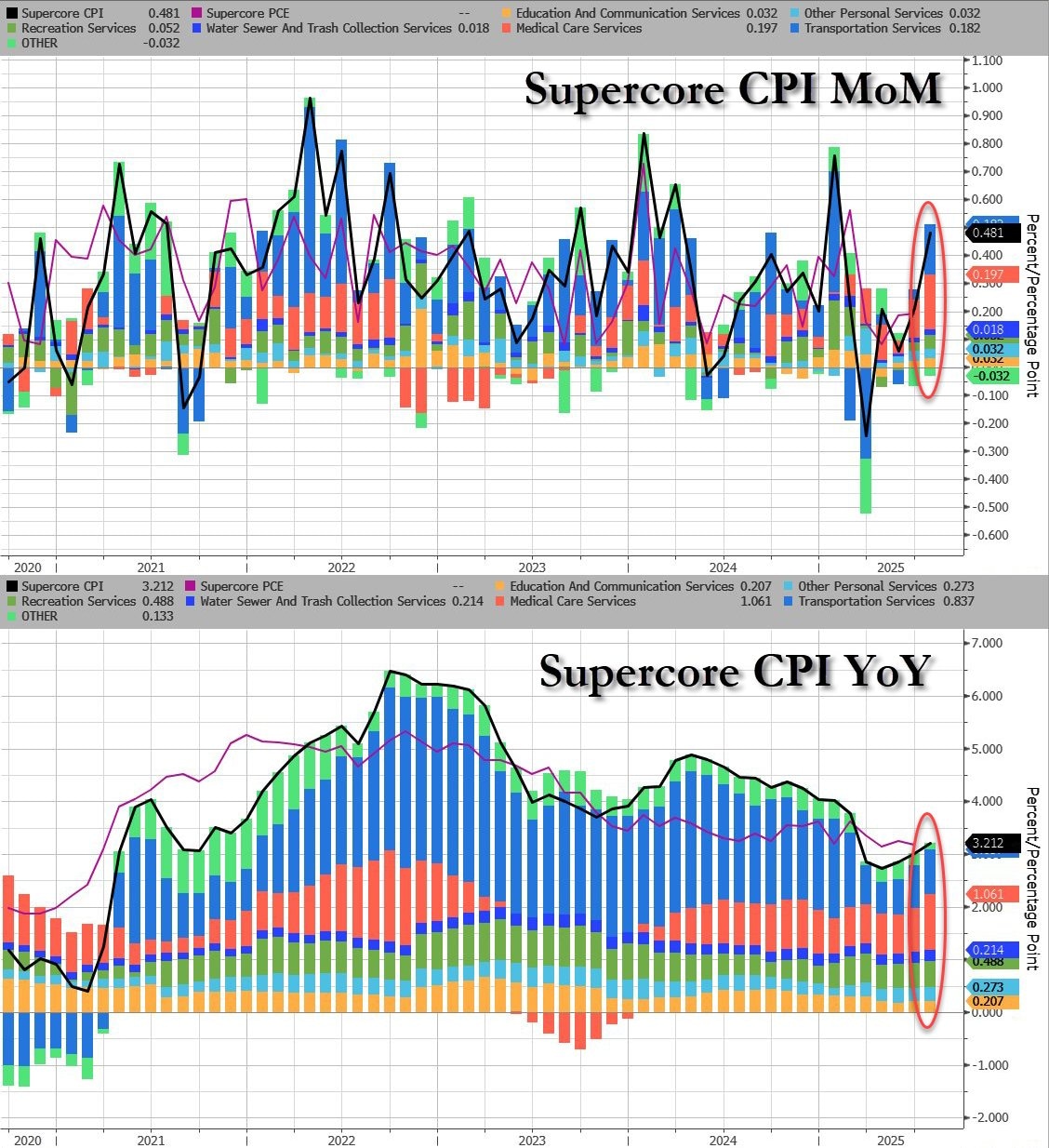

The latest U.S. Supercore CPI data shows a sudden rise in service-sector inflation, with both month-over-month and year-over-year measures jumping higher. Supercore CPI tracks services inflation excluding housing and energy, making it a key metric for the Federal Reserve when assessing underlying price pressures.

This unexpected increase could push the Fed to keep interest rates elevated for longer or even consider further hikes. Higher rates make borrowing more expensive, cool down spending, and typically weigh on risk assets. For crypto markets, persistent inflation and tight monetary policy often translate into short-term volatility and weaker price momentum, as investors shift toward safer, interest-bearing assets.

However, if markets interpret this spike as temporary and the Fed signals patience, crypto could benefit from a softer rate outlook later in the year. The coming months will be critical, as inflation trends will heavily influence both rate expectations and capital flows into digital assets.

Author

Jacob Lazurek

Coinpaprika

In the dynamic world of technology and cryptocurrencies, my career trajectory has been deeply rooted in continuous exploration and effective communication.