Streaming services meets blockchain: VAB token analysis

In the past few years, the number of people turning to the internet for the news, entertainment, and education has boosted. Its consumers are increasingly eager to cut the cord and adopt new ways of devouring content. As more TV viewers cut cable, many businesses are turning to Subscription Video on Demand (SVOD) to make revenue. Over-the-top (OTT) video consumption is consistently developing, Allied Market predicted that the online streaming market will be worth $332.52 billion by 2025. Businesses are hopping on this trend to build brand awareness and provide value to their audience.

SVOD is a booming industry that gives an ability to its audience to pay for only the content that they want. It is a major reason why audiences are turning away from cable and other traditional providers. Moreover, it provides publishers a direct line of revenue from consumers without third-party interference. For example, excluding collaboration with advertisers. It has the added benefit of relieving the audience from annoying ads.

In order to follow the latest trends, streaming services are looking for the opportunity to integrate their tokens.

Today we will pay attention to VAB tokens produced by Vabble.

But first, let’s learn more about this streaming service. Launched in 2015, this platform was designed for corporate film production houses, artists, their audience, and cryptocurrency enthusiasts. The platform is supplied with blockchain technology and it aims to capture the target audience starting from 16.

It is important to notice that 46% subscribe to two or more OTT services (most average 3.4 subscriptions). As stated by OpenX, it is a 130% increase since 2014.

The platform has not only SVOD services but also community features you would see on YouTube as well as the interactivity of video calls to consume media together and even the ability to order takeaway via the Co-watching option.

Utilizing VAB token

The company plans to integrate its token into the streaming ecosystem. They will issue rewards paid in VAB to users once subscriptions are paid every month. The audience will pay per quarter of content watched, directly to the publisher.

In addition, the platform offers its users voting with VAB tokens, giving them the power to choose content that will appear on Vabble and invest in productions for profit share and exclusive NFts.

VAB token in numbers

This token will be listed on Uniswap. Take a look at these details about VAB below:

- Initial market cap: $1 079 800

- Circulating supply: 67 487 500

- Max supply: 1 456 250 000

- Initial liquidity: $480 000

VAB tokenomics

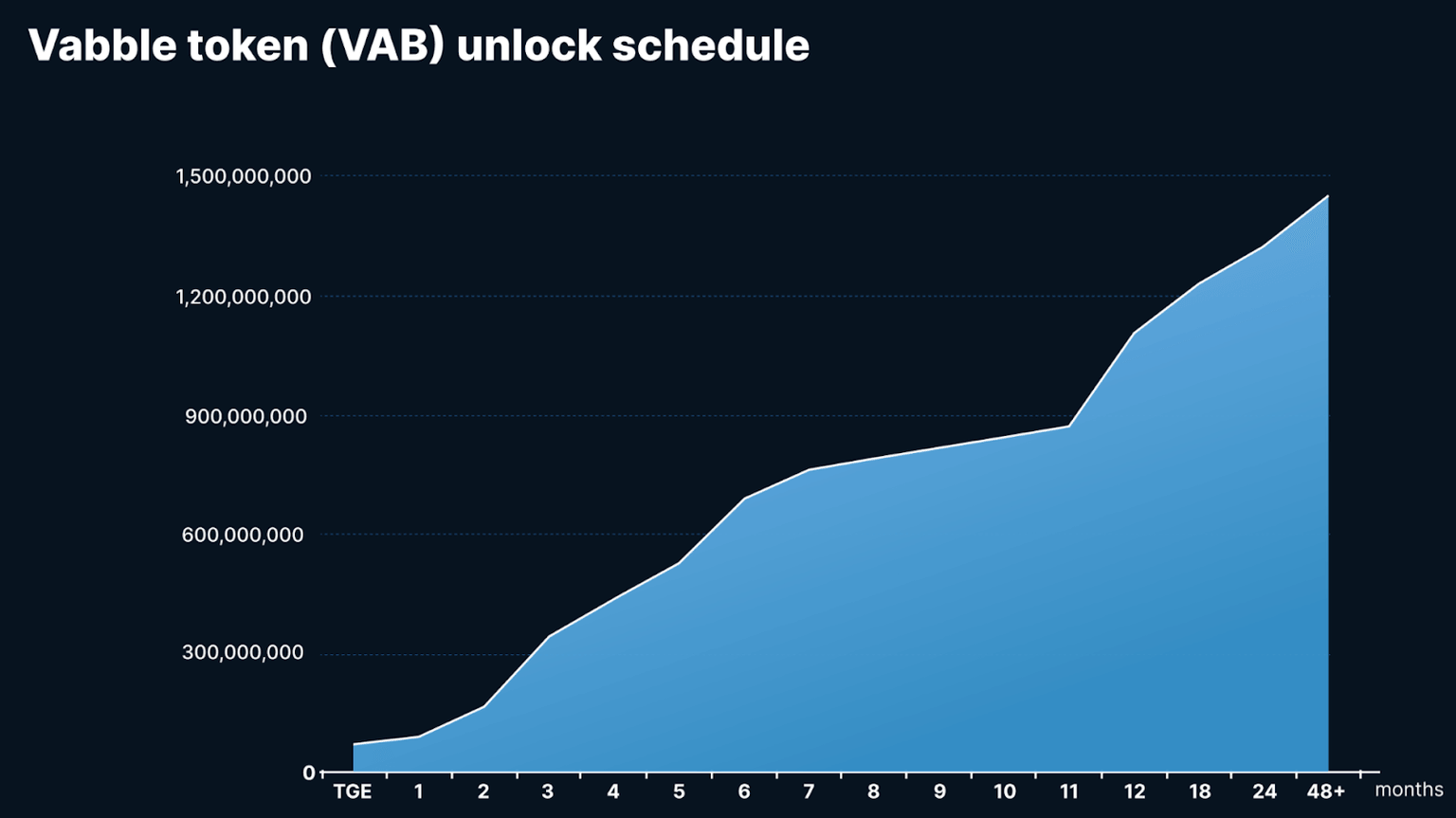

According to the information, published by Vabble, it will take 48 months for all tokens to circulate on the open market.

Seed, Private and Public sale participants are going to only receive small percentages of their allocations over months after the Token Generation Event. The Vabble team will receive 25% one year after this event.

Vabble initial seed round was held on Tuesday, April 20, 2021. It was sold out in a matter of hours, and its goal was reached.

A Beta version of the platform will be launched and available to its consumers in Q3 2021, and soon VAB token will be integrated into the platform.

Author

Vladislav Pivnev

ICODA Agency

Vladislav Pivnev is the CEO of ICODA Agency. Born in Minsk, lives in Moscow. He has been practicing marketing since 2010. In the cryptocurrency segment since 2017. He believes in the prospects for the development of cryptocurrencies.