Solana profit taking to present buying opportunity for SOL at $210

- Solana price experiences profit-taking since making new all-time highs.

- Significant gaps between the candlesticks and certain Ichimoku levels hinted at a mean reversion.

- A retest of the prior resistance zone as support is necessary to help confirm an uptrend.

Solana price action has been a leader in the altcoin space, pushing into new all-time highs and pushing former heavy-hitting market cap cryptocurrencies lower. As a result, profit-taking before the weekend was expected.

Solana price presents a buy-the-dip moment during the weekend trade

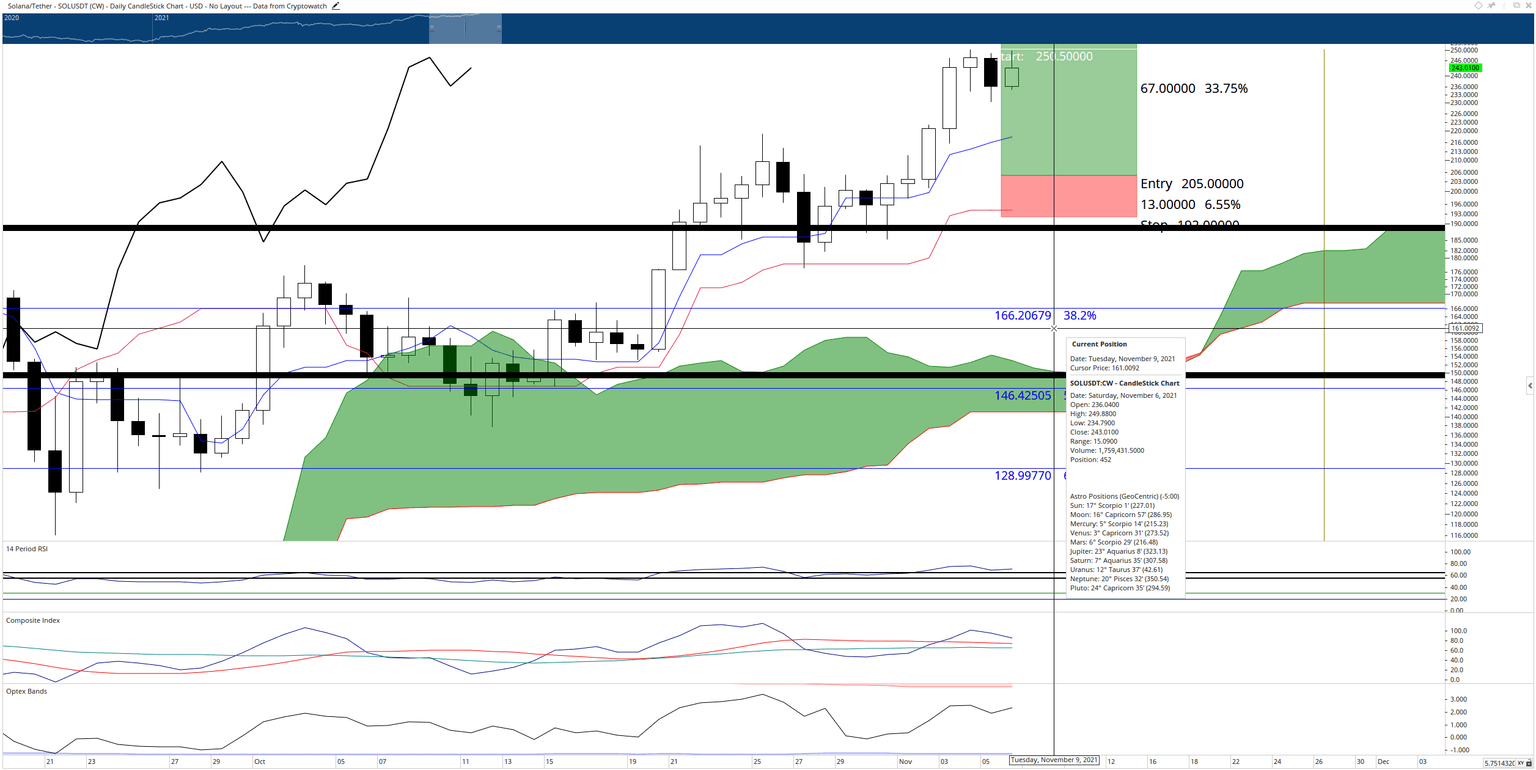

Solana price is likely to give traders who missed the most recent advance a second opportunity to enter. The recent price drop was expected, especially given the significant gaps between the Thursday and Friday candlesticks and the Tenkan-Sen. One anomalous behavior within the Ichimoku Kinko Hyo system is how price action responds to gaps between the candlesticks and the Tenkan-Sen. Gaps are not tolerated for long in Ichimoku, and there is often a return to equilibrium within a few periods.

SOL/USDT Daily Ichimoku Chart

The likely level of near-term support that becomes a buying opportunity for Solana price is the $210 value area. $210 is between the daily Tenkan-Sen and Kijun-Sen and provides enough wiggle room should sellers push price ranges between the two. A hypothetical trade setup would be a buy limit order between $205 and $210 with a stop loss slightly below the Kijun-Sen ($192) and a profit target just above the 161.8% Fibonacci expansion at $266.50.

A signal that a deeper retracement may occur would be any daily close below $200. That would set up conditions for bears to push Solana price to the weekly 50% Fibonacci retracement at $150.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.