Solana Price Prediction: A scalpers playground

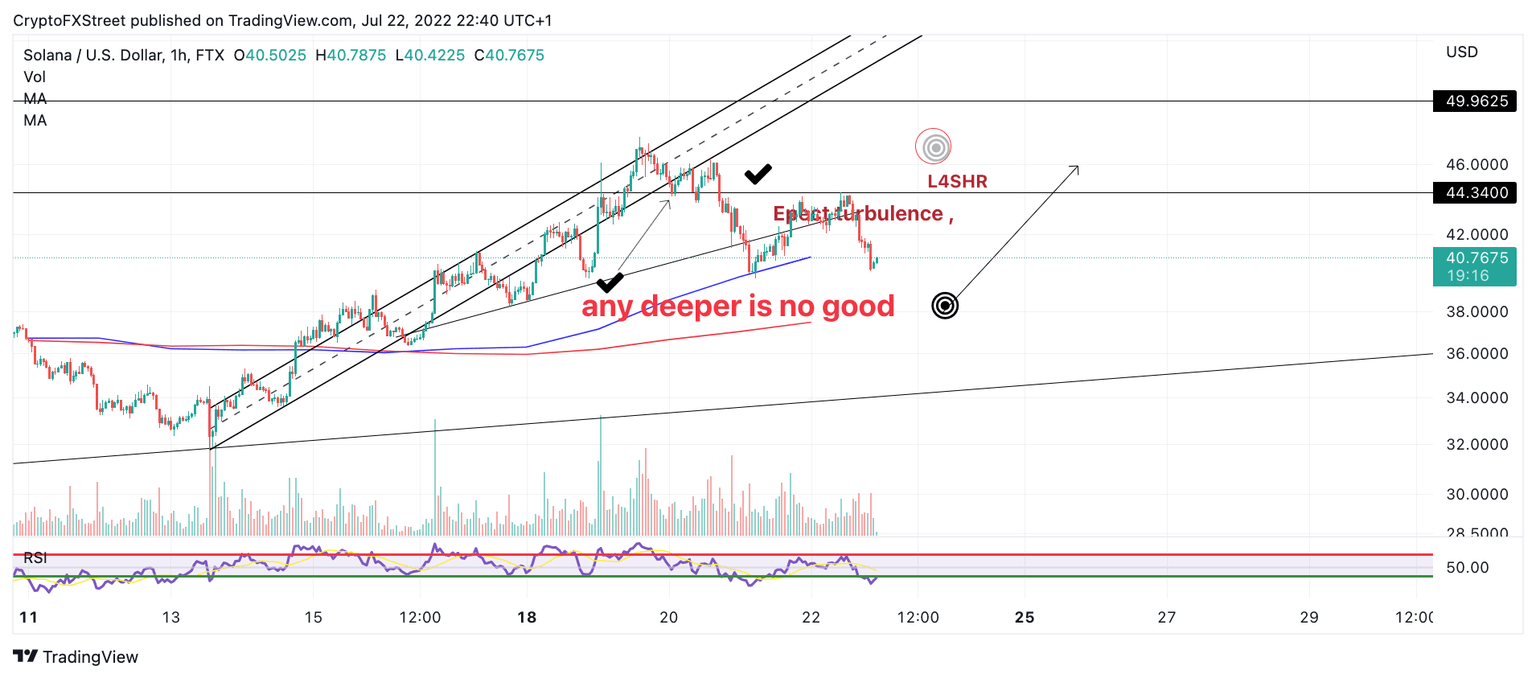

- Solana price has breached an ascending trend channel.

- Solana price falls in free-fall fashion as traders enjoy profits from an earlier bearish forecast.

- Invalidation of the uptrend lines at $33

Solana price has provided two profitable opportunities this week. Defining the third will be the more challenging. Here are the possible scenarios.

Is Solana price A falling knife?

Solana price falls in free-fall fashion as expected from this week’s bearish outlook. Solana price has more wiggle room to fall; However, strong support lies within the $37 region. Traders who missed this week’s opportunities to short the digital asset should remain sidelined for now. Placing an entry to aim for the supportive barrier is ill-advised as a sharp rebound could resolve the free-fall decline.

Solana price at the time of writing trades at $40.65. Traders looking to catch a knife can look for a buy opportunity in the $37 zone with an invalidation level at $33.95. Bullish targets lie once again between $44 and $47 target.

SOL/USDT 1-Hour Chart

Remember that a breach below $33.would prompt more liquidations and deem the entire uptrend void. The bears could then reroute south, targeting swing lows in the $31 zone for up to a 25% decline from the current Solana price.

In the following video, our analysts deep dive into the recent price action of Solana analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.