Solana price is on the verge of dipping 30% further by next week

- Solana price has been in a solid rally higher until last week.

- Sellers are dictating price action with a trend line as an essential reference point.

- An early trend line that favored the bulls at the beginning of September is the last support bulls have before sellers go another leg lower in SOL.

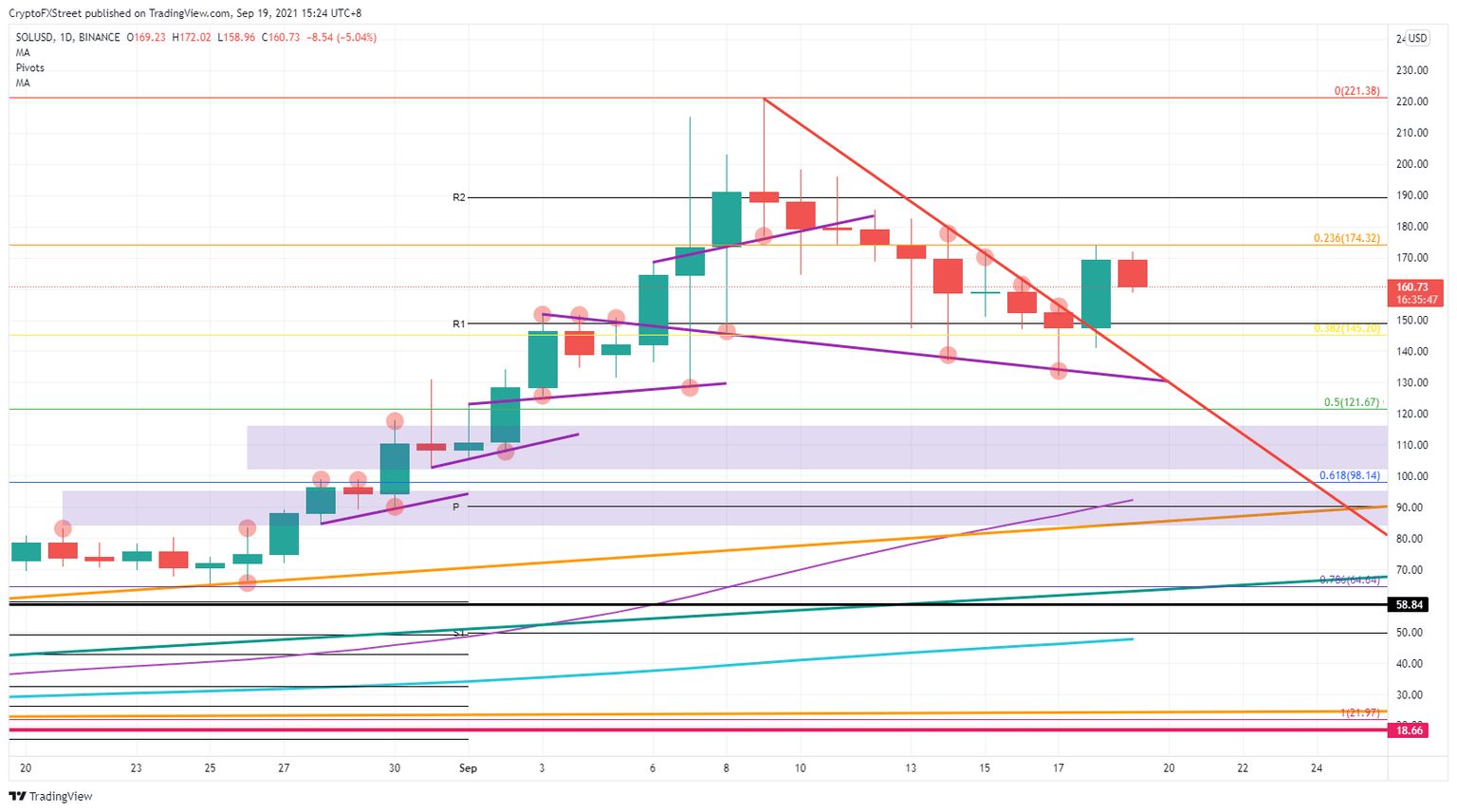

Solana (SOL) was on a tear at the beginning of September. Since the failed attempt on September 9 to keep price action elevated, SOL has been fading and trading lower towards lower support levels that have been broken quite easily each time. Although bulls broke the red descending trend line, a rejection at the 23.6% Fibonacci level spells trouble.

Solana price might open the door to more downside

Solana price had a perfect run at the beginning of September, but price action retreated on September 9 after hitting $221. Sellers overhauled price action as buyers took too much profit and the momentum in favor of the bulls faded. Sellers since then broke a few Fibonacci levels and the monthly R1 resistance levels to the downside.

For now, the purple descending trend line, originating from September 3, is holding the act of the bulls together. But the force from the red descending trend line is starting to squeeze price action in SOL against the purple line, ready for a break lower. With already three confirmed tests to the downside, this purple trend line is undoubtedly a force to be reckoned with.

SOL/USD daily chart

With the squeeze in full effect, expect a lower break as the red trend line will be tested again soon and will be broken back to the downside. Proof can be found in the fact that the descending trend line has been protected already four times by sellers and will have scared each time more buyers out of their positions. The sellers’ next level of interest in profit-taking will be around the 61.8% Fibonacci level at $100. Add the monthly pivot near $90 as an additional factor, and this zone will offer a good entry for a fade-in trade for buyers.

When market sentiment would roll over sooner in favor of some favorable tailwinds for Solana’s price action, watch the break of the 23.6% Fibonacci level at $174. Buyers will emerge on that break, and bulls will kick price action into gear for a rerun towards £221 within a matter of weeks.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.