Solana price edges closer to 25% breakout

- Solana price is traversing a descending parallel channel, hinting at gains after a bullish breakout.

- Due to the recent mishap, a breakdown of the $152 support floor could trigger a sell-off.

- In a highly bearish case, SOL might drop as low as $108.37.

Solana price has been on a steady downtrend over the past week and shows no signs of slowing down. As SOL approaches a crucial support floor, the buyers and sellers are posed with a make-or-break decision.

Solana price prepares for a bullish breakout

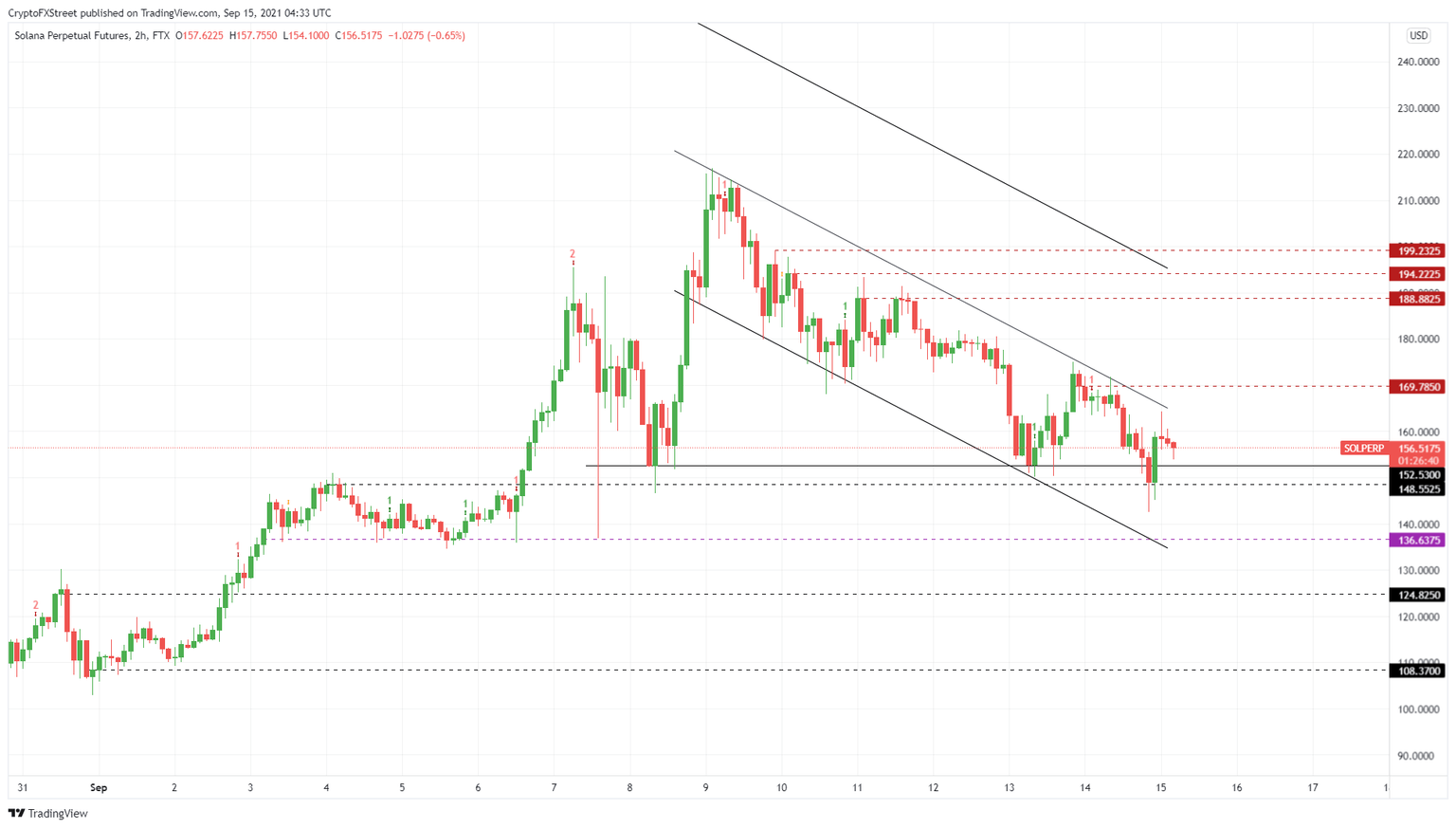

Solana price has dropped roughly 26% to where it currently trades, $156.52. During this descent, SOL has set up four swing highs and three swing lows. Connecting these swing points using trend lines shows the formation of a descending parallel channel.

A decisive close above the upper trend line of the technical formation at $169.79 indicates a bullish breakout. In this case, investors can expect SOL to rally 11% before encountering the $188.88 resistance barrier.

If the buying pressure persists, Solana price is likely to flip this hurdle into a platform. A successful close above $188.88 will put the $194.22 and $199.23 supply barriers in view of the bulls.

Due to massive congesting on its way down, clearing these blockades could exhaust the buying pressure and slow down the uptrend. Therefore, investors should pay close attention to $199.23 or the $200 psychological level.

SOL/USDT 2-hour chart

While descending parallel channels have a higher probability of breaking bullish, the optimistic scenario above makes sense. However, if Solana price fails to keep above the $148.55 support floor, it will form a lower low.

This development will scare investors away as it could indicate the continuation of the downtrend. However, if SOL breaches below the $136.64, it will seal the bullish fate and have a high probability of pushing Solana price to $124.83 or, in a highly bearish case, $108.37.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.