Solana price eyes new all-time highs before taking a breather

- Solana price sees bulls targeting $219.75 and making new all-time highs.

- With RSI indicating overbought, it could be time for SOL to take a breather before the next move up.

- Expect the monthly R1 pivot to offer resistance, then possibly support, before R2 comes into focus at $272.17.

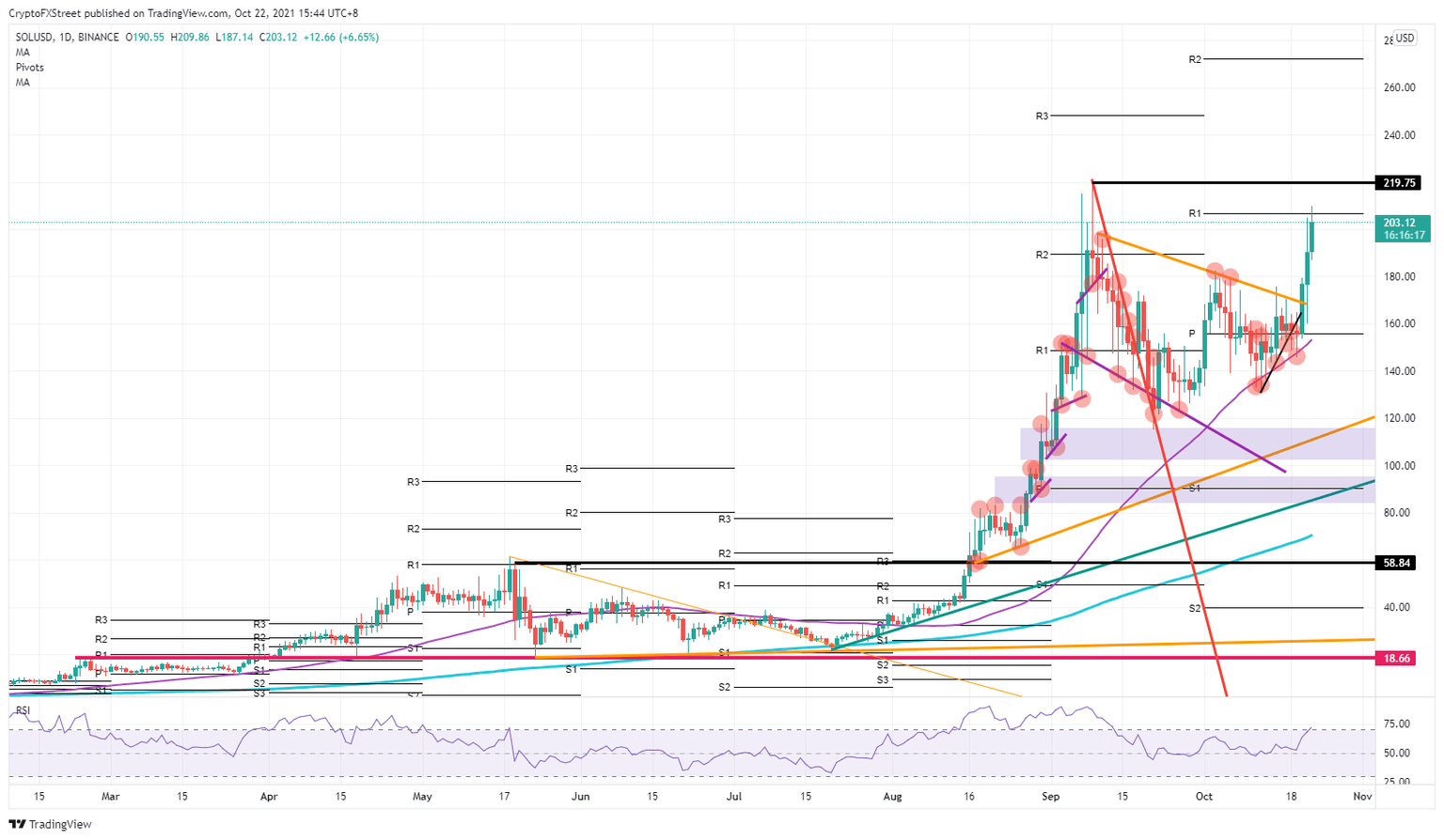

Solana (SOL) price has successfully broken out of the descending top line that was keeping SOL price trapped below $200. The breakout rally began at the level of the 50-day Simple Moving Average (SMA), a level which has provided support on several previous occasions. Today, SOL price hit the monthly R1 at $206.73 and is now on its way higher to the next target at $219.75.

Solana price to hit $219.75

Bulls were able to break above the monthly pivot on Wednesday, which sparked an acceleration in the rally before hitting the monthly R1 resistance level at $206.73.

The Relative Strength Index (RSI) is in overbought territory indicating SOL may take a short breather before moving higher. Followingthe correction, expect R1 to turn from resistance into support. That support should keep the uptrend in shape and see new buyers joining the rally to move on to the next price target, around $272.17.

SOL/USD daily chart

Both R1 and the all time highs will probably provide SOL price with a double band of support between $206 and $219 which will see bulls both defending this area and using it as entry-level each time SOL price dips back to these levels before rallying further towards the monthly R2, near $272.17.

Should Solana price see bulls not holding the support at the R1 resistance level, expect bears to quickly reverse the rally from this week back to the monthly pivot near $155.87. If global market sentiment turns back to risk-off, expect bears to see bulls fleeing the scene and give them room to break below the 55-day SMA towards $120.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.