Solana bulls charge and trap short-sellers, SOL targets a return to $110

- Solana price was at risk of a significant capitulation move on Monday after testing its final support level.

- Many new short positions were opened near the Sunday and Monday lows.

- A short-squeeze induced rally to retest $110 is very probable.

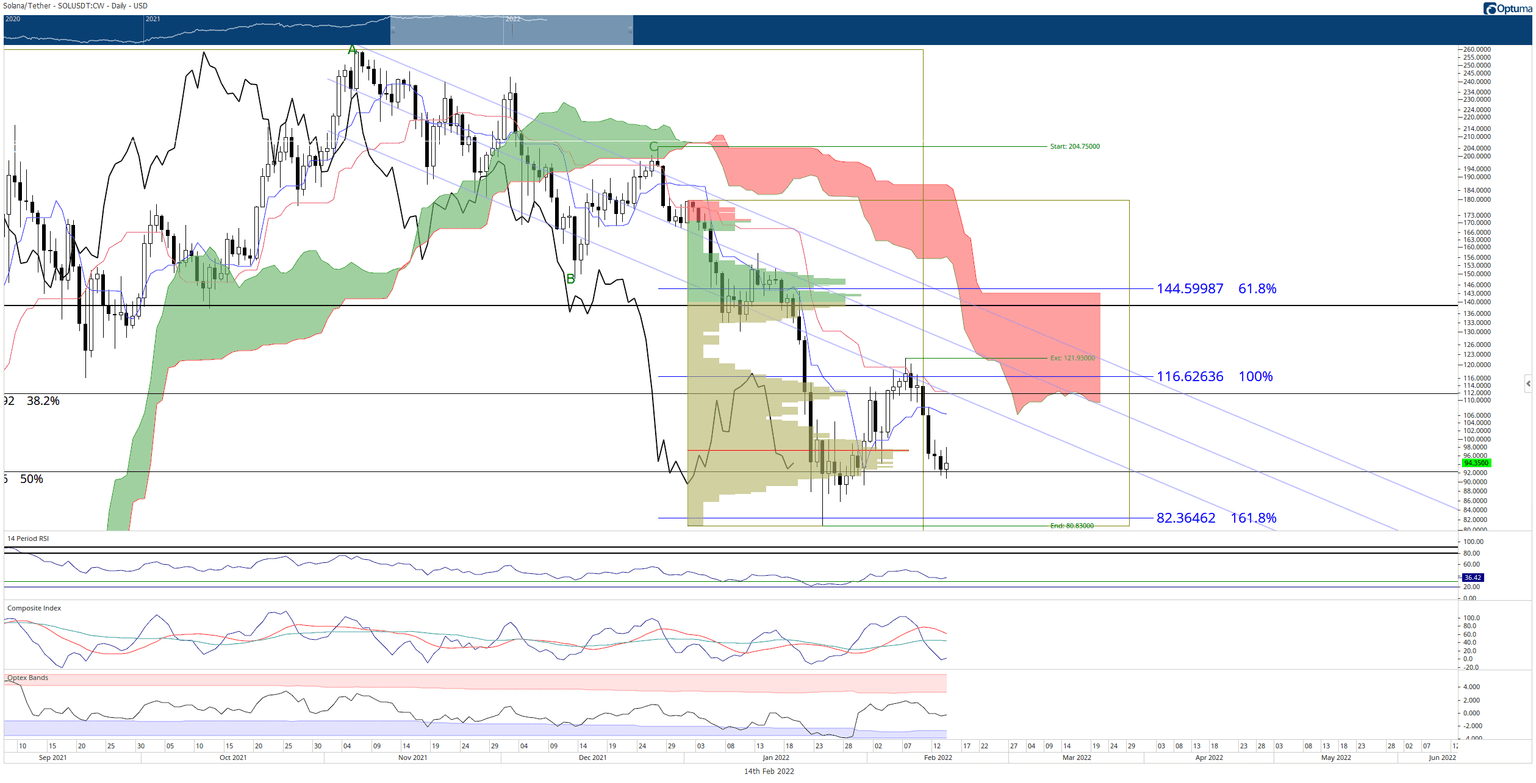

Solana price action has not been kind to buyers of late. The most recent retest of the bottom of a range first traded back in late January 2022 near the $90 is a testament to SOL’s weakness. Additionally, the rejection against the resistance cluster near $115 weighed heavily on any near-term bullish outlook. But another bullish bounce is now in play and could signal an end to the current downtrend.

Solana price developing a bullish engulfing candlestick at swing low, bullish reversal setup developing

Solana price action is attempting to form one of the most sought-after bullish reversal candlestick patterns in technical analysis: the Bullish Engulfing candlestick pattern. While the pattern has some minor variations depending on the market, in general, a Bullish Engulfing candlestick is one where the body of the current candlestick is greater than the body of the previous candle.

However, bulls will need to show confidence and commitment to prevent Solana price from falling further. The $92 price level is the 50% Fibonacci retracement from the all-time high to the strong bar of the swing that began in July 2021. The 50% retracement technically fulfills the necessary corrective move to resume its uptrend – but bulls need to follow through.

SOL/USD Daily Ichimoku Kinko Hyo Chart

If Solana price closes below $90, then the next likely stopping point is the combined support zone of the 200% Fibonacci expansion at $64 and the 61.8% Fibonacci expansion (from the current minor swing) at $68.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.