Shiba Inu price offers two reasons why SHIB will rally 15% this week

- Shiba Inu price sees burn rate jump 30,940%.

- SHIB gets support from podcaster David Gokhshtein as a long-term investment.

- Expect these two elements to create a tailwind that lifts SHIB above $01.00001150.

Shiba Inu (SHIB) price is getting some support from two different angles as SHIB gears up for a firm rally higher. The first element comes from podcaster David Gokhshtein, who recently became a big fan of PEPE but nonetheless has commented that SHIB will remain his favored position for the long run. Add to that a burn rate of 30,940% or 2,254,093,318 SHIB tokens being burned, and you get less supply. The lower supply meshes nicely with David Gokhshtein’s sign of approval that might trigger a pickup in demand, resulting in a 15% jump.

Shiba Inu price to fly higher with a boost of confidence

Shiba Inu price sees trading conditions falling in its favor as two elements at work will see SHIB popping higher. Crypto podcaster David Gokhshtein came out with a tweet saying “Looking at the data, people have been swapping their SHIB positions into PEPE. I still like SHIB long term”. The comment came after on-chain analytics revealed a vast amount of swapping into PEPE under fear of missing out.

Shiba Inu burn rate

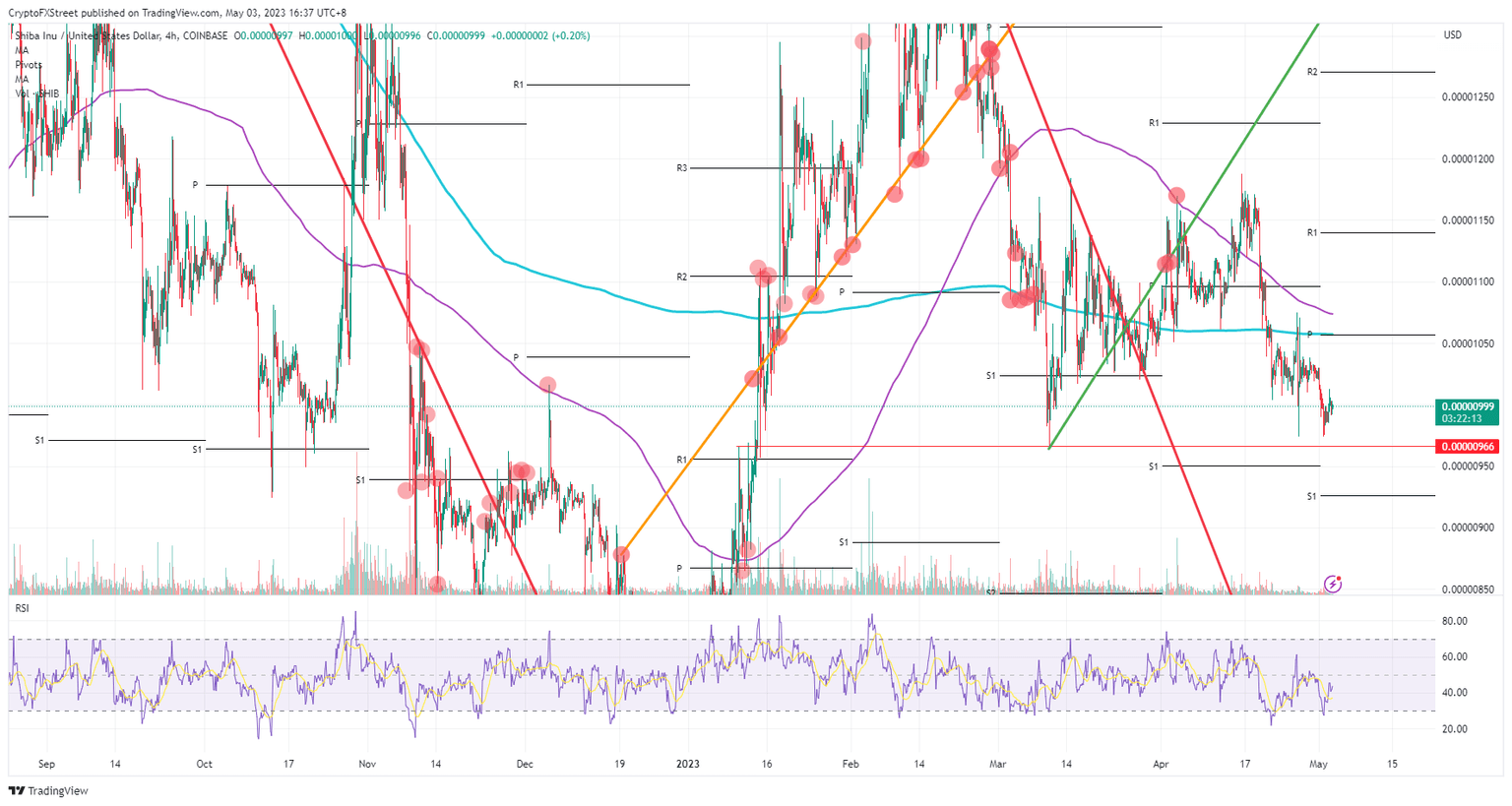

SHIB, meanwhile, has seen the liquidation of over 2 billion tokens in a burn operation, which has drained the liquidity a bit. More demand while liquidity is lower though is always a good recipe for bullish price action, and Shiba Inu price needs to prepare for quite the pop. Once $0.00001050 has been broken and bulls can reclaim ground above the 200-day Simple Moving Average (SMA), it will be an easy street toward $0.00001150 and a break above the monthly R1 for a 15% gain.

SHIB/USD 4H-chart

Risk to the downside comes with the current decline that could squeeze out bulls and drop further. The line in the sand is $0.00000966, which already caught the falling knife back in March. Once that is broken, SHIB is set to tank further and will be heading toward $0.00000850 with instead a 15% loss on the books.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.