Dogecoin kicks FLOKI and Shiba Inu to the curb with least percentage of holders underwater

- FLOKI and Shiba Inu tokens are struggling to recover with over 80% holders sitting on unrealized losses at the current price level.

- Dogecoin price has started its recovery with a spike in volume of traders that hold DOGE for over a year.

- Shiba-Inu-themed meme coins continue struggling with recent losses as Ethereum Layer 2 and DeFi narrative gathers relevance.

Shiba-Inu-themed meme coins Dogecoin (DOGE), Shiba Inu (SHIB), and Floki (FLOKI) continue to rival for dominance in the crypto ecosystem. Of the three meme coins, Dogecoin has the least percentage of holders that are currently underwater, or sitting on unrealized losses at the current price level.

Also read: PancakeSwap DAO sees 70% of the CAKE holder community favor reduction of inflation, what to expect

Shiba Inu and FLOKI holders sit on unrealized losses as meme coin narrative fades

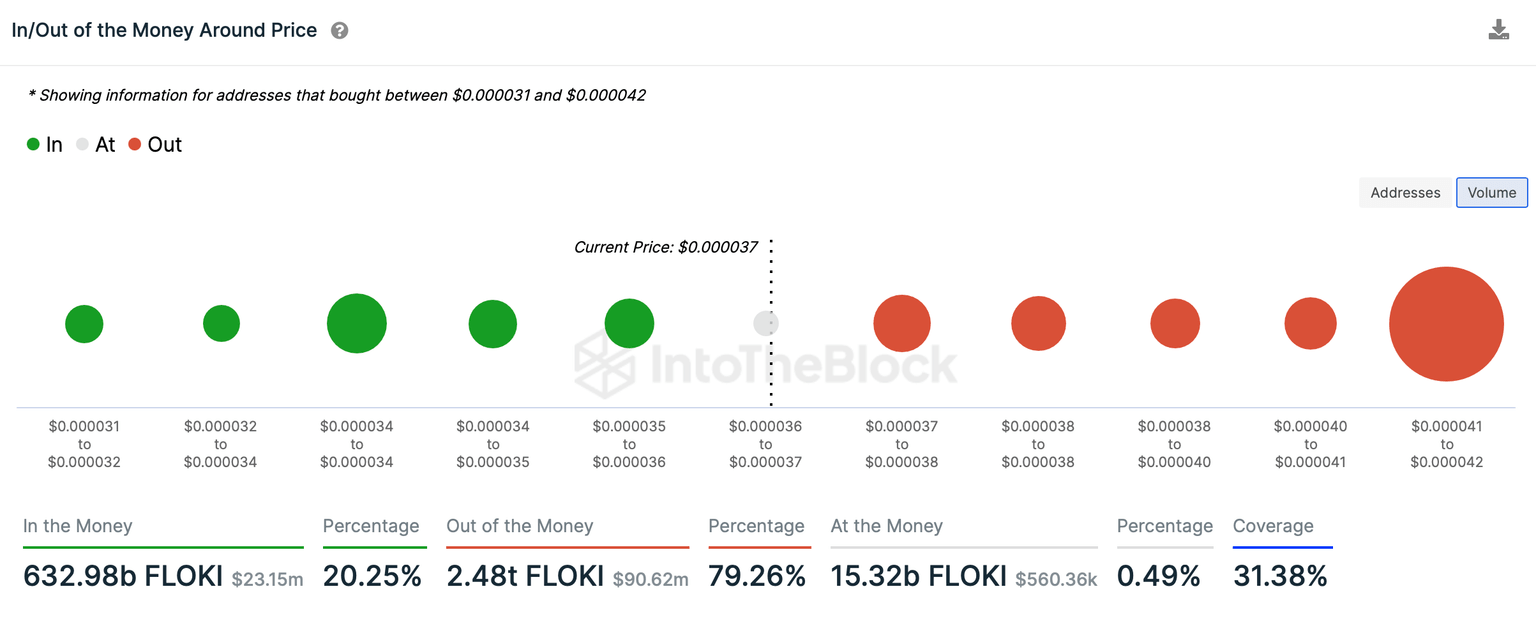

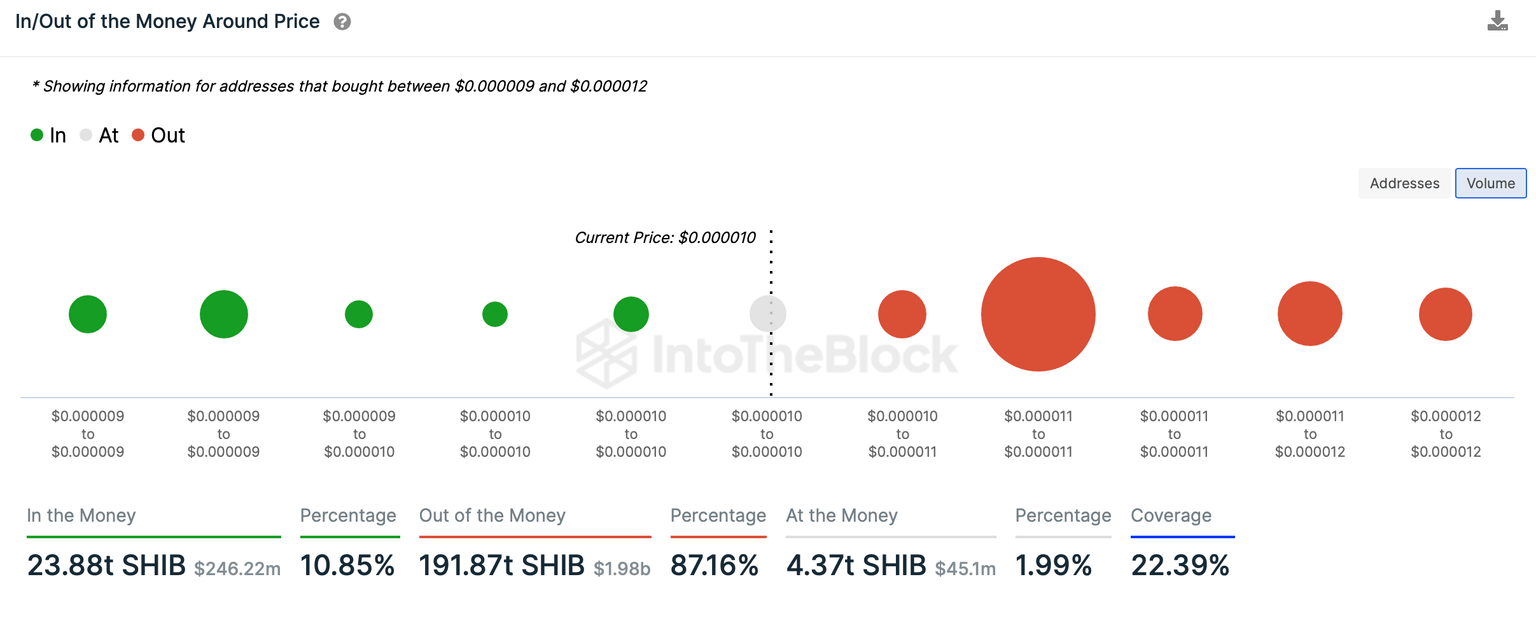

As the meme coin narrative fades, holders of top meme coins Shiba Inu and FLOKI are sitting on unrealized losses. Based on data from crypto intelligence tracker, 79.26% of FLOKI holders and 87.16% of SHIB holders are underwater at the current price level.

If a holder is underwater, it implies that shedding their holdings would result in realization of losses. While this leaves room for recovery in SHIB and FLOKI, since the expected selling pressure would be less on these meme coins, the two assets are struggling to begin their recovery.

SHIB and FLOKI addresses underwater

Interestingly, the largest meme coin by market capitalization started its recovery and 43% holders are underwater at $0.0804, based on data from IntoTheBlock. DOGE has been the dominant meme coin, both in terms of market capitalization and in terms of holder composition.

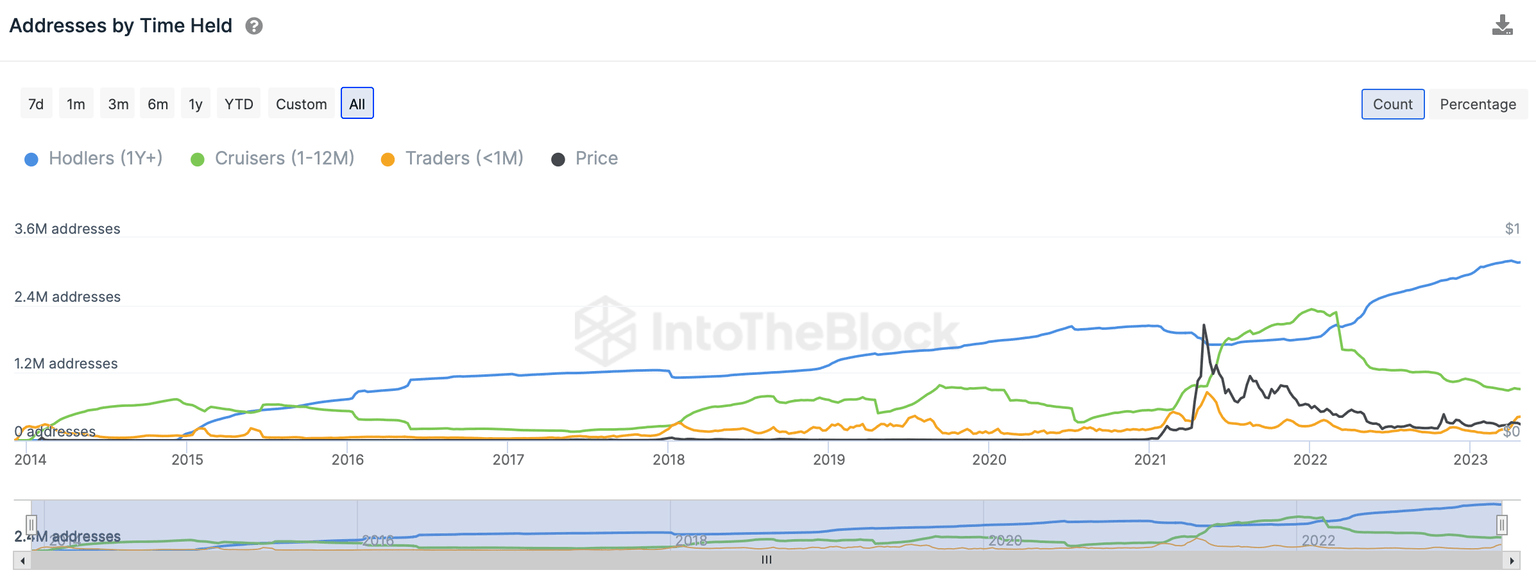

While the meme coin narrative fades, SHIB and FLOKI note a rise in speculators or traders that hold the asset for less than six months. Dogecoin has witnessed a steady rise in the concentration of holders that held DOGE in their portfolio for over a year.

Dogecoin held by long-term investors

Dogecoin addresses by time held chart on IntoTheBlock reveals a massive spike in holders, where DOGE was held by traders for over a year. Other segments of holders, like cruisers that hold DOGE for one to twelve months, have declined sharply.

This shift in composition of addresses holding DOGE fuels a bullish thesis for the asset since there is less likelihood of Dogecoin holdings being shed consistently by long-term investors.

Addresses by time held

The above chart supports DOGE’s recovery and the meme coin’s dominance despite the shifting narratives in the crypto ecosystem.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.