XRP Price Forecast: Large holders offload 460 million tokens as Powell's speech approaches

- Ripple's XRP plunged 6% on Tuesday as large-scale investors downsized their holdings by 460 million XRP.

- The elevated profit levels of its circulating supply could spark a major profit-taking if the market sees a bearish shocker.

- XRP eyes the $2.78 support after declining below the 50-day SMA.

XRP fell 6% on Tuesday as large-scale holders began depleting their holdings amid heightened profit levels. The move comes ahead of Federal Reserve Chair Jerome Powell's speech at Jackson Hole.

XRP whales offload 460 million tokens with sight set on Powell's speech

XRP saw a further decline on Tuesday, plunging by 6% as investors moved to the sidelines ahead of Powell's speech at Jackson Hole on Friday. In the past six days, its price has registered a 13% loss.

The price decline has seen large-scale investors with a balance of 10-100 million XRP tokens trim their holdings by about 460 million XRP over the past week. On the contrary, wallets holding 1-10 million XRP (smaller whales) added 130 million more tokens to their collective balance. This shows mixed expectations among large XRP holders.

Historically, prices often tend to follow the direction of large whales.

%20%5B01-1755648600509-1755648600510.00.16%2C%2020%20Aug%2C%202025%5D.png&w=1536&q=95)

XRP Supply Distribution. Source: Santiment

Meanwhile, more than 93% of XRP's circulating supply has been in profit since mid-July. Despite the recent market decline, holders still maintain an average profit margin above the 90% threshold. Notably, the average profit for the remittance-based token holders hasn't crossed below 80% since its strong uptrend last November following President Trump's election victory.

%20%5B01-1755649897993-1755649897994.01.44%2C%2020%20Aug%2C%202025%5D.png&w=1536&q=95)

XRP Supply in Profit. Source: Santiment

The token has enjoyed tailwinds from the conclusion of Ripple's over four-year battle with the Securities and Exchange Commission (SEC) and positive regulatory developments from President Trump's administration.

However, with the SEC's case against Ripple finally over, and positive crypto regulatory developments priced in, such an extended high percentage of profit levels could stir heavy profit-taking if the market faces a bearish shocker.

With market participants looking toward Jackson Hole on Friday, Powell's speech could prove crucial to how investors with such high profits react.

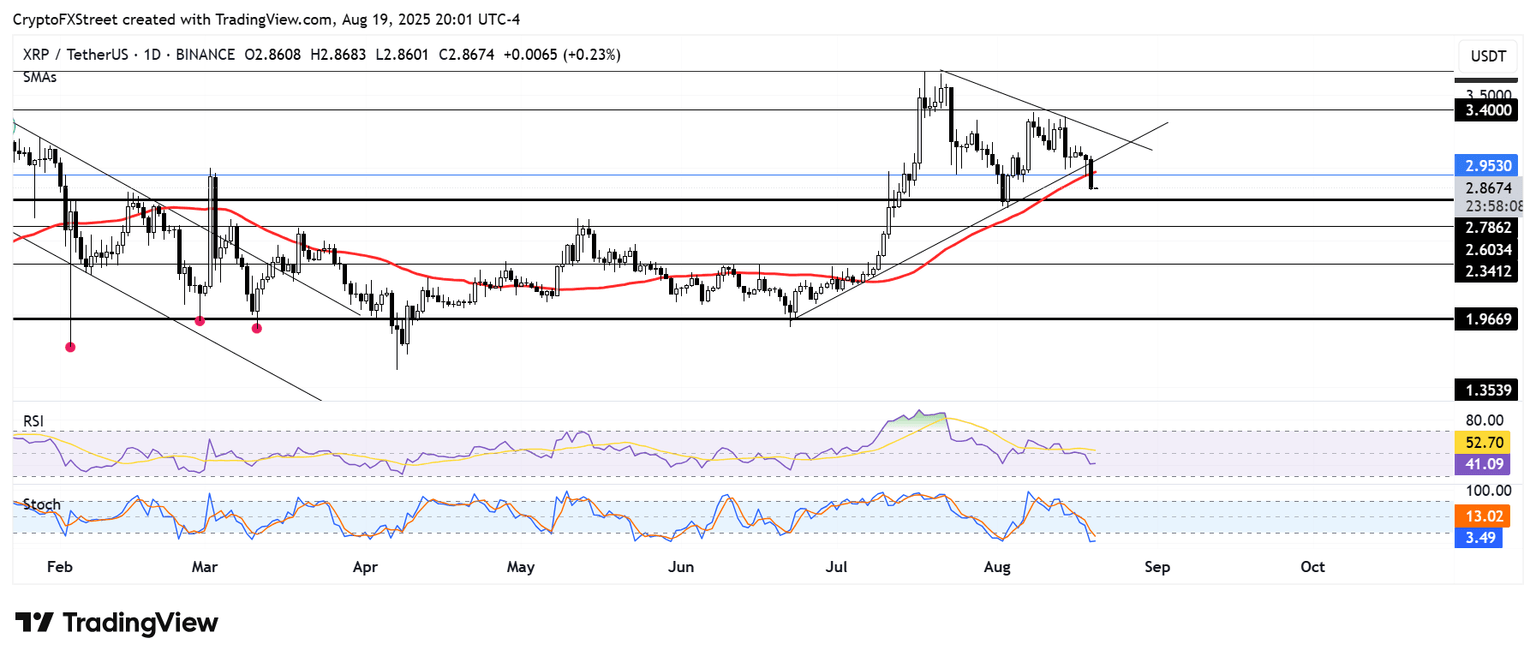

XRP falls below 50-day SMA, eyes $2.78 support

XRP declined below several key support levels over the past 24 hours. The token moved below the lower boundary of a symmetrical triangle pattern, the $2.95 level, and the 50-day Simple Moving Average (SMA).

A failure to recover the 50-day SMA could push XRP to the support at $2.78. Further down, the $2.6 level could help cushion losses if the price decline stretches.

XRP/USDT daily chart

The Relative Strength Index (RSI) has declined below its neutral level, indicating a dominant bearish momentum. Meanwhile, the Stochastic Oscillator (Stoch) has entered the oversold region, implying sustained bearish pressure but with higher chances of a pullback.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi