Ripple Price Prediction: Could rising exchange balance hinder XRP recovery?

- XRP offers bearish signals on short time frames despite steady interest in the derivatives market.

- Investors may be preparing to reduce their exposure as the balance on exchanges grows to 3.41 billion from 3.26 billion XRP in less than two weeks.

- The XRP Ledger's network activity is subdued, with new addresses holding below the 5,000 level.

Ripple (XRP) faces growing downside risks, reflecting falling market sentiment on Friday, as Bitcoin (BTC) slipped below the $108,000 level. Despite steady interest in the token, particularly in the derivatives market, XRP is trading at $2.22, down over 1% at the time of writing.

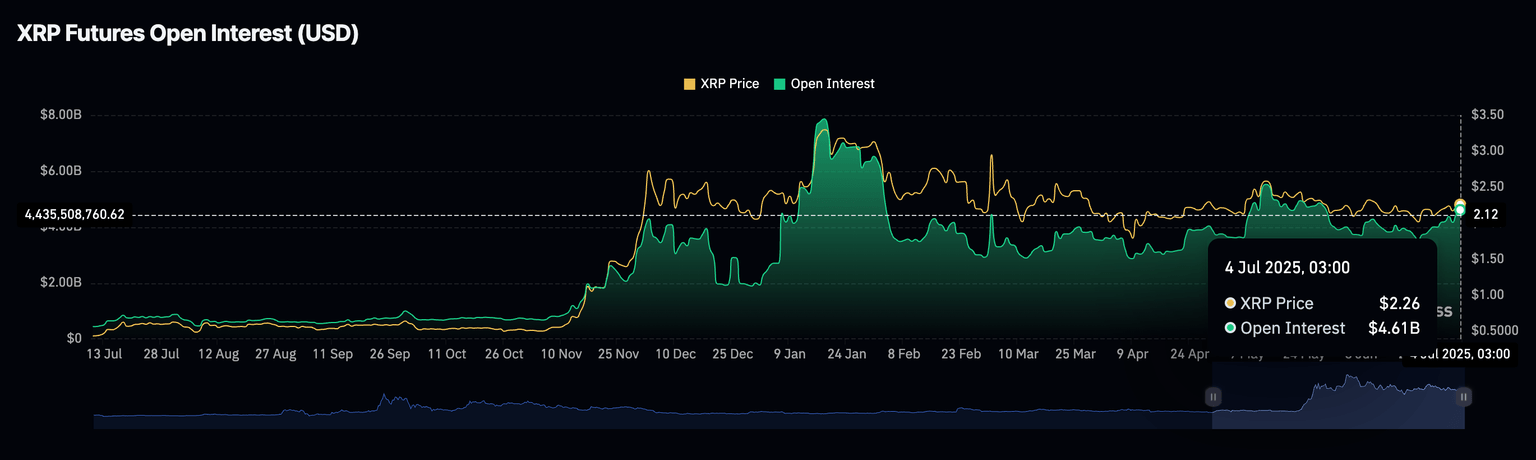

The XRP futures Open Interest (OI) stands at $4.61 billion, following a 23.2% increase from June lows of $3.54 billion. OI refers to the value of all futures and options contracts that have not been settled or closed.

A persistent increase in Open Interest indicates growing risk-on sentiment, while traders bet on future price increases.

XRP futures Open Interest | Source: CoinGlass

XRP exchange balance on the rise as new addresses plunge

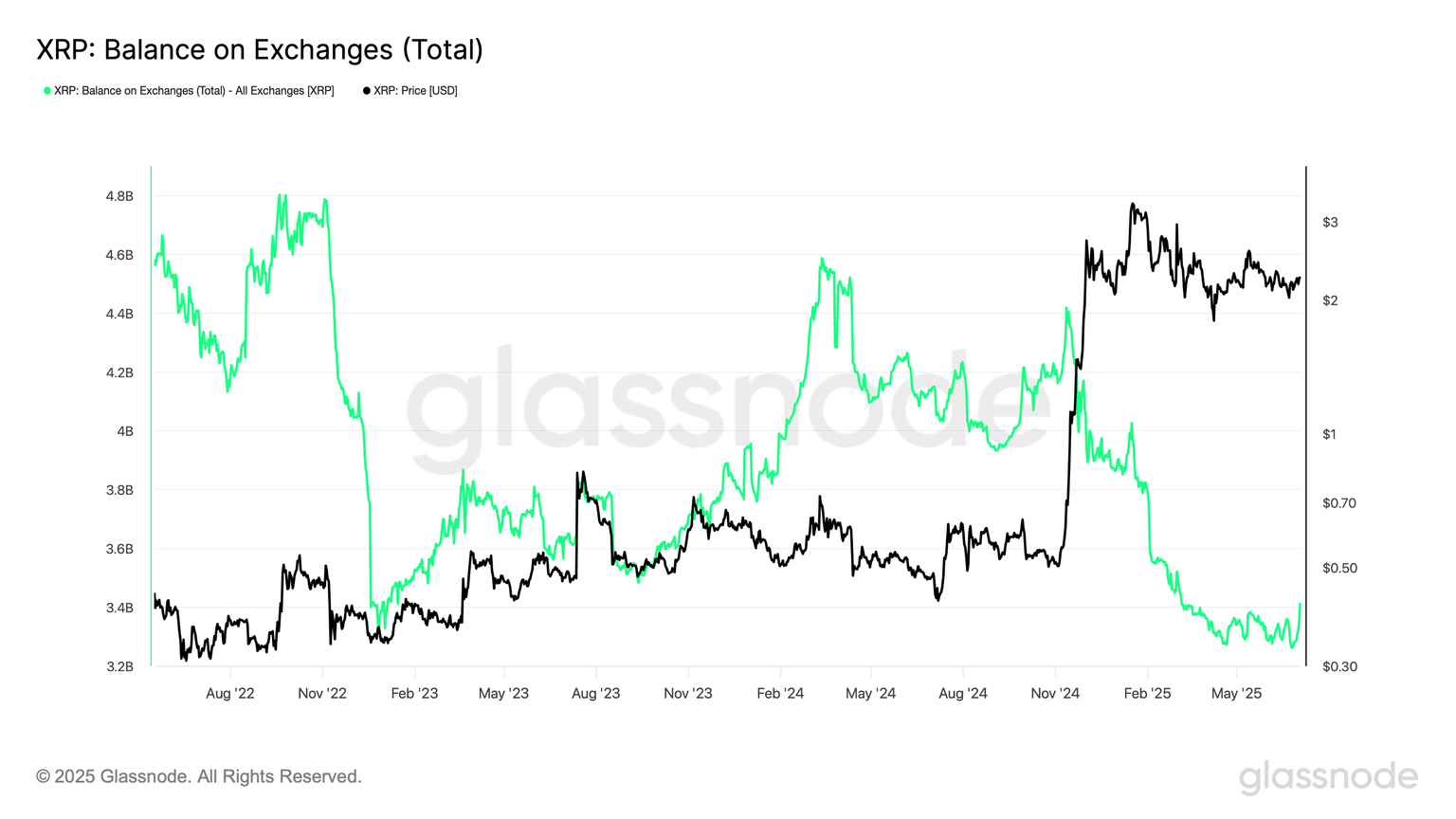

The number of XRP tokens held by exchanges has increased by nearly 4.4% to 3.41 billion from 3.23 billion recorded on June 25. Glassnode data indicate that an increase in exchange balances poses a risk to the price of XRP, as investors are likely to sell when they transfer assets to exchanges.

If the uptrend persists, any recovery could be met by overshadowing selling pressure and dampening price action, making it worth monitoring in the days and weeks ahead.

XRP exchange balance | Source: Glassnode

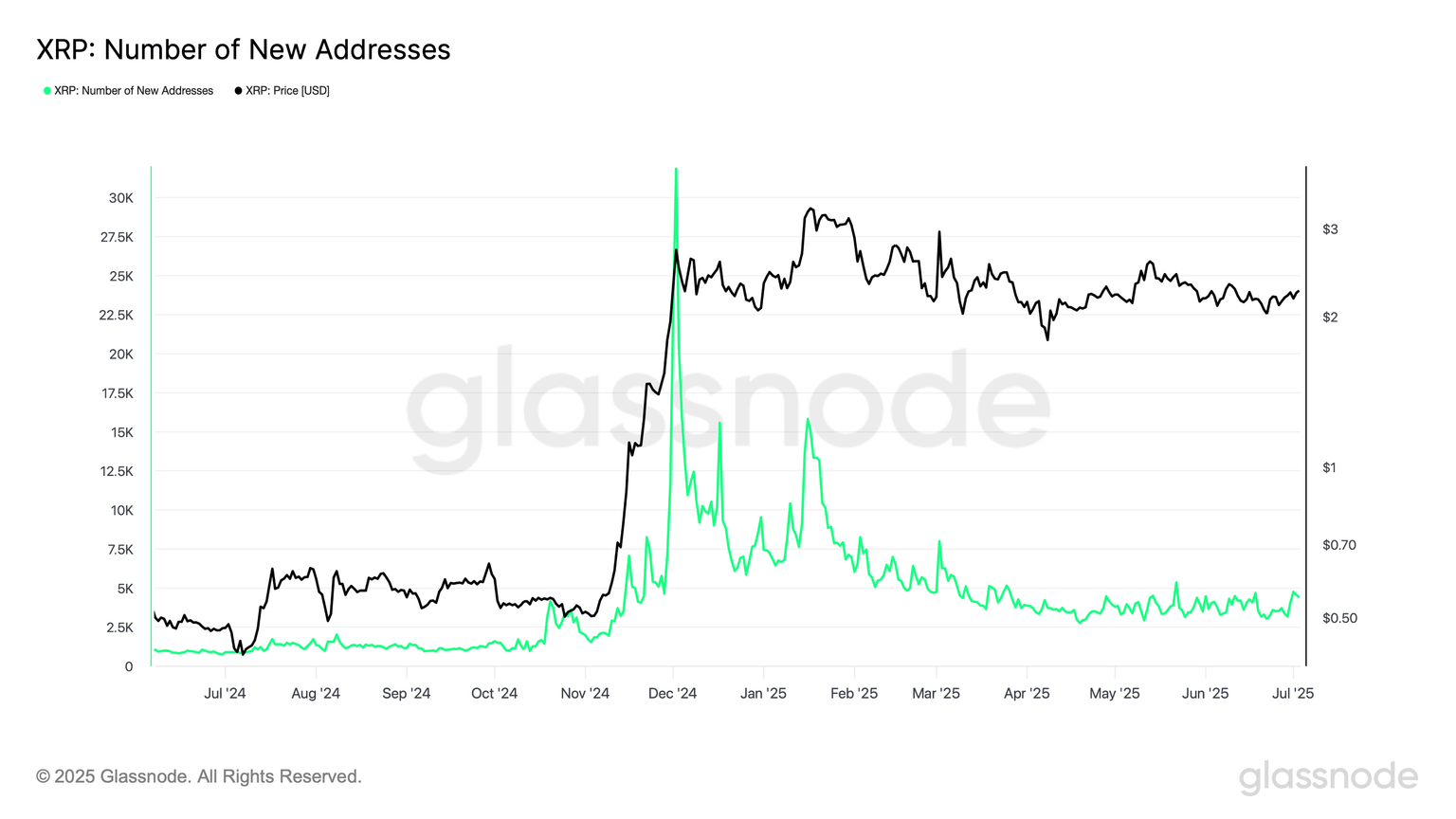

Meanwhile, the number of new addresses on the XRP Ledger (XRPL) has been capped under the 5,000 mark since May 22. The chart below highlights this metric, with newly created addresses standing at 4,389 as of Thursday.

Network activity, which comprises several elements, including active addresses that are transacting on the network and new addresses, often has a direct correlation with the price of XRP.

XRP Active Addresses metric | Source: Glassnode

Amid the spectacular rally in the fourth quarter of 2024 and the first quarter of this year, the number of addresses created on XRPL steadily increased to 31,840 by December 2 while remaining significantly above the current level until mid-March. Such a slump in network growth signals low demand for XRP, which puts downward pressure on the price. Other factors likely to be affected include transaction volume and market sentiment.

However, with interest in XRP remaining steady, particularly in the microenvironment, as evidenced by the uptrend in futures Open Interest, its fundamental outlook has the potential to improve over time.

Ripple's commitment to building the new-age financial system by advancing a regulated bridge between the cryptocurrency industry and traditional finance, utilizing the Ripple Payments platform and its RLUSD stablecoin infrastructure, could boost demand for XRP.

Demand for institutional-grade digital financial systems could bolster market dynamics for XRP, especially if the United States (US) Office of the Comptroller of the Currency (OCC) grants Ripple a national bank charter.

Ripple has also applied for a Federal Reserve (Fed) Master account, which would allow it to hold RLUSD reserves directly with the Fed, increasing trust and security.

Technical outlook: XRP could extend the decline

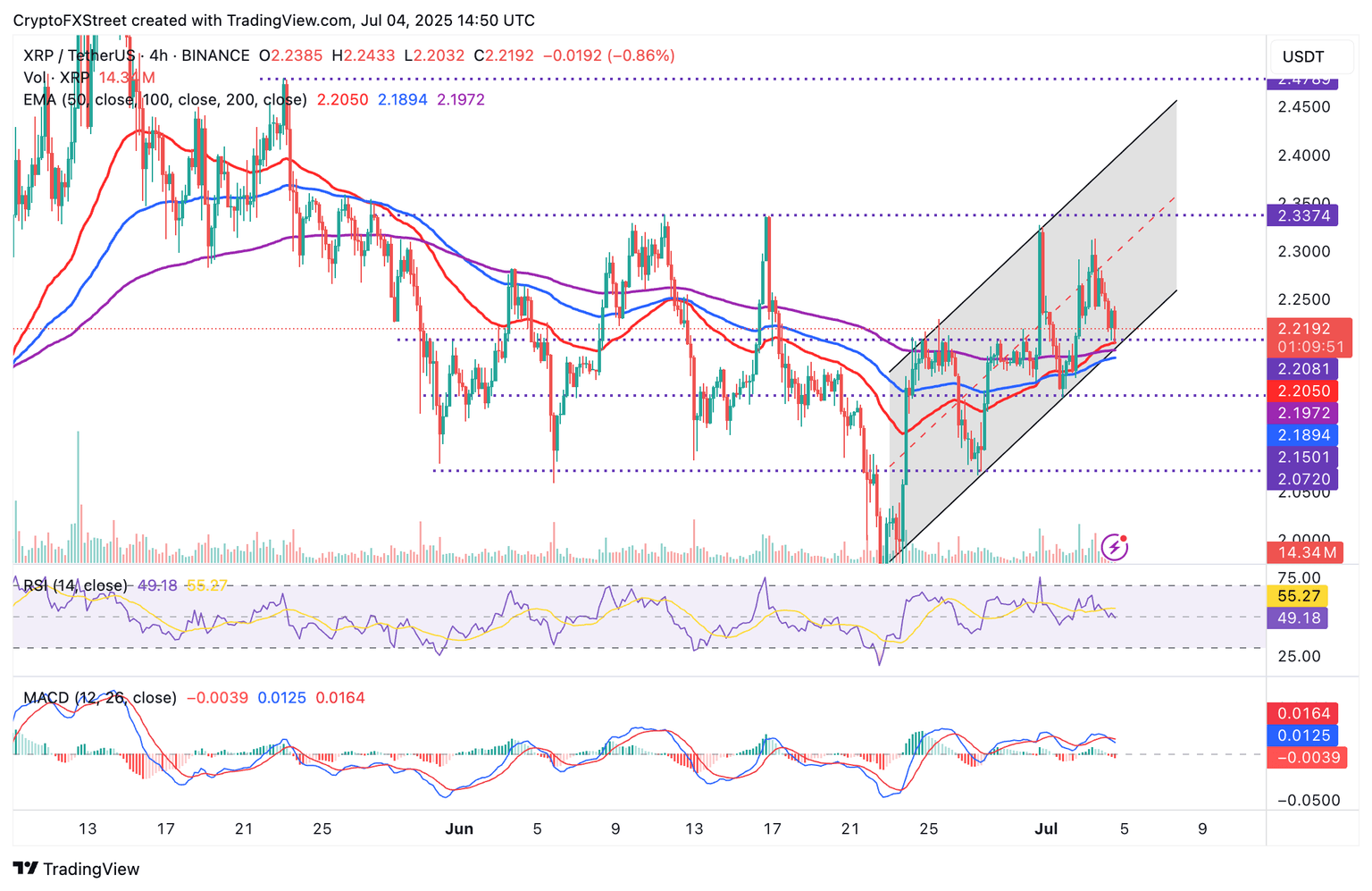

XRP shows signs of extending the intraday pullback into the weekend, underpinned by a sell signal from the Moving Average Convergence Divergence (MACD) on the 4-hour chart below.

Traders will likely reduce exposure as the blue MACD line drops below the red signal line. The red histogram bars below the zero line indicate bearish pressure. At the same time, the Relative Strength Index (RSI) moving downward slightly below the midline indicates that the downtrend could gain momentum.

XRP/USDT daily chart

The 50-period Exponential Moving Average (EMA) at $2.20 is in line to absorb selling pressure. If the price slides beyond this level, the 200-period EMA at $219 and the 100-period EMA at $2.18 could serve as additional short-term support levels. Other key levels traders could prepare for as tentative support include $2.15, tested on Wednesday, and $2.07, last probed on June 27.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren